Stock Market Trend, There’s More To Consider Than Just The Fed!

Stock-Markets / Stock Markets 2013 May 25, 2013 - 04:24 PM GMTBy: Sy_Harding

Fed Chairman Bernanke spooked investors with his testimony before Congress on Wednesday by indicating that the Fed could begin to withdraw the punch bowl of stimulus as soon as at one of its next monthly FOMC meetings.

Fed Chairman Bernanke spooked investors with his testimony before Congress on Wednesday by indicating that the Fed could begin to withdraw the punch bowl of stimulus as soon as at one of its next monthly FOMC meetings.

What? The Fed might abandon investors? Might remove the ‘Bernanke put’ and let market forces return to normal? That’s not fair! Since the economic recovery and bull market in stocks began in 2009 we’ve been guaranteed the full force of central bank stimulus to keep them going, with the Fed even rushing in with more stimulus, QE2, Operation Twist, QE3, each of the last three summers when the economy and markets faltered.

The Fed’s intentions to keep the good times going no matter how much artificial support it had to provide was so obvious that this time even as the economy is stumbling again, investors aren’t worried, and the market keeps hitting new highs. Bernanke helped spark May’s additional spike up with his assurance when the market was faltering in April that the Fed would increase its current bond-buying stimulus program if necessary.

Sell in May and Go Away? Forget about it.

And now, just four weeks later Bernanke is saying for the first time in five years that the Fed is perhaps ready to cut back on the stimulus?

No wonder markets are reacting with less certainty than a few days ago.

The truth is that investors can probably relax as far as the Fed is concerned. Bernanke is likely just trying to talk some of the irrational exuberance out of the market to prevent a threatening bubble from forming. The Fed won’t begin the process of reversing its stimulus efforts until the economy shows more signs of being able to stand on its own. And instead, the economy is still slowing in a stumble similar to those in each of the last three summers.

However, even before Bernanke’s troubling testimony on Wednesday there were problems for the market that were being glossed over by the confidence that the Fed had the market’s back no matter what.

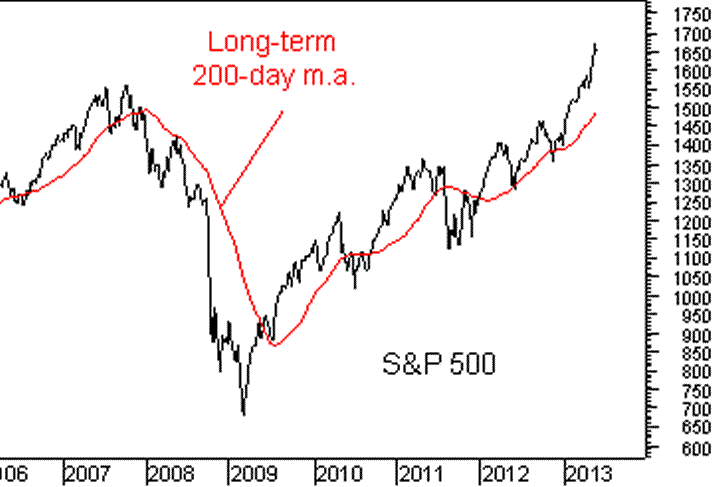

The most obvious problem is the very overbought condition of the S&P 500 above its long-term 200-day (40-week) moving average, more stretched or over-extended than at any of the rally tops of the last 7 years, and even the major market top in 2007. Just a normal pullback to retest the support at the moving average again would be a 10% decline that would wipe out the market’s entire gain for the year so far.

Investors are not concerned. That can be seen in the quick response of immediately buying the dip, and very high levels of bullishness and euphoria in investor sentiment measurements.

But that is another potential problem for the market. Investor sentiment is known as a ‘contrary indicator’. Sentiment is always very bullish at market tops and very bearish at market bottoms. But is it at an extreme that marks a potential top? There’s no way to know as there is no magic number. Markets have topped out with sentiment even lower than current levels of euphoria. But at other times it has also reached even higher levels before rallies ended. All we can know is that it is now warning of higher risk.

And then there is the potential warning from the activity of corporate insiders, considered to be well placed in the hierarchy of ‘smart money’. Insiders are reported to be selling heavily. But they have been selling heavily for several months. And while heavy insider selling, like extreme levels of investor bullishness, is considered to be a warning sign, it is only a warning sign of higher risk. It is not a sell signal, as it can continue for quite some time before a rally ends.

Sell signals are triggered when momentum and money-flow indicators reverse significantly and important support levels are broken. The problem is that with the market so unusually overbought above its 200-day m.a., even a normal pullback to retest the support at the m.a. again would wipe out most of the gains the market has made so far this year.

With investor and media sentiment so bullish the popular wisdom is not to worry, stay fully invested and add to positions on the dip.

But I’m just saying. There’s a time for confidence and greed, and a time for caution.

With that overbought technical condition, high level of investor bullishness and greed, insiders selling and cautious, and now uncle Ben not looking quite as willing to keep the free money flowing, investors need to weight the evidence that it’s a time for caution.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.