The Truth About Central Bank Gold Buying

Commodities / Gold and Silver 2013 May 27, 2013 - 03:49 PM GMTBy: EWI

Dear Trader,

Dear Trader,

Volatile price action is a surprise to most investors most of the time.

That's definitely true of precious metals in the past 30 days. But, the real story is far bigger than just one month. In fact, gold and silver have seen declines of more than 30% and 50%, respectively, since 2011. Now that's news!

If you invest in precious metals, you owe it to yourself to read this brand-new report, Bob Prechter's Big 5 Gold Warnings for Bulls and Bears, from Elliott Wave International.

Inside the new report, you'll learn the truth about:

Inside the new report, you'll learn the truth about:

1) Central Bank Buying

2) Fed Inflating

3) The "Crisis Hedge" Argument

4) The "Gold is Cheap" Argument

5) The Conviction that Post-Peak Lows were Support

Excerpt:

1) Central-Bank Buying

An article published on April 19 quoted a report issued by one of the world’s most famous money managers. It reads, “We believe that ongoing central bank purchases and strong gold demand from China and India will help support the gold price in the near term.” At Elliott Wave International, we have used the very same fact of central bank interest in gold to come to precisely the opposite conclusion. In September 2011, the month of the all-time high in gold, EWT made this observation:

Last November, the president of the World Bank opined that governments should reconsider the role of gold in their monetary systems. Governments thrive on counterfeiting money and hiding that fact. The notion of paying respect to gold, in this context, is a radical idea, indicating how deeply the bullish consensus on gold has influenced people’s thinking. Gold’s downturn is either already in place or really close.

As recently as two months ago, reports of aggressive central-bank purchases of gold throughout 2012 sparked assurances that such activity would force gold prices higher. As gold hovered enticingly around $1600/oz., the February 20 issue of EWT pushed our converse point of view even harder:

After a major top and during the first decline of a bear market, novices buy heavily in what they think is just a pullback in an ongoing bull market. It has just been reported that central banks bought more gold in 2012 than in any year for nearly half a century. No doubt they believed that the setback in gold after its high of 2011 was a pullback to buy. They sold all the way up and finally bought. Central bankers are not good traders. They have been making policy mistakes of historic proportion for five years. This is just another one of them.

It is premature to say our logic proved out, but so far it seems that central banks have once again shown that they are not good market timers, and it seems that investors have once again shown that they overvalue both central-bank power and the external-impact theory of financial price movement.

Continue reading in the FREE Report ...

Thank you for reading,

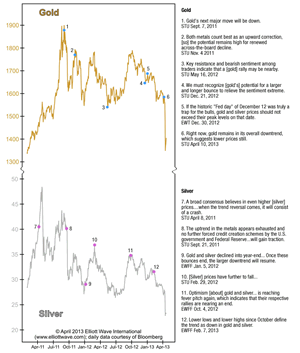

P.S. If you follow the link above, you'll see a stunning chart of some of EWI's gold and silver forecasts over the past three years. When a market's wave patterns are clear, as they are now in gold and silver, it is a remarkable sight. See the chart now.

About the Publisher, Elliott Wave InternationalFounded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.