What Japan's "Lehman Brothers" Moment Means to You

Stock-Markets / Japanese Stock Market May 30, 2013 - 12:33 PM GMTBy: Money_Morning

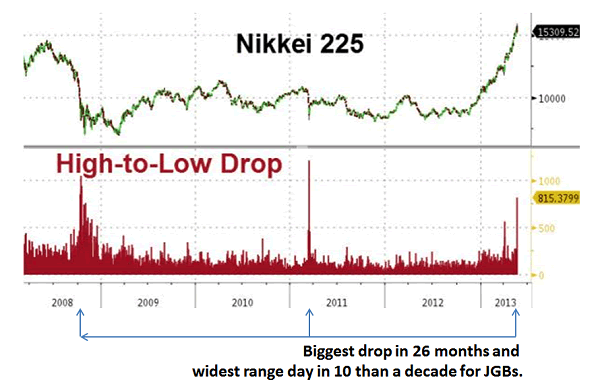

Keith Fitz-Gerald writes: Japanese markets suffered an elevator shaft-like failure late last week, dropping 7.32% in the single largest decline since the horrific March 2011 earthquake and tsunami. Global markets followed suit but recovered.

Keith Fitz-Gerald writes: Japanese markets suffered an elevator shaft-like failure late last week, dropping 7.32% in the single largest decline since the horrific March 2011 earthquake and tsunami. Global markets followed suit but recovered.

This is the third-largest economy on the planet in the fastest-growing region in the world.

Ostensibly, a drop in Chinese PMI that fueled global slowdown fears was what the talking heads agreed was the reason.

They were wrong.

In reality, there were three other real factors.

And every investor needs to know what actually happened:

1) Benchmark 10-Year Japanese Government Bonds topped 1% for the first time in a year

As was the case with gold a few weeks back, this bond event pushed "value at risk" metrics or VaR beyond normal limits.

Typically Japanese traders could have simply purchased offsetting hedges like options or other derivatives, but their greed glands have been in consumption mode for so long that there was no additional cash to do so. They were, for lack of a better term, fully invested and fully margined.

Remember a while back when I told you that traders would sell equities if they had to bring VaR models in line? This is exactly what happened.

Having already sold substantial portions of their gold a little over a month ago, Japanese traders began selling equities as hard and fast as they could to compensate for six sigma volatility in Japanese government bonds. Again.

And, for the second time in weeks, traders effectively walked away from the bid -- nobody wanted to buy. So prices that had begun to slide accelerated to end the day down a staggering 1,143.28 points, or 7.32%, as America slept.

2) Japanese traders are the first to put together the implications of Bernanke's comments

Bernanke made comments via written testimony to Congress May 22 from the Fed's April 30 - May 1 meeting suggesting that the end of stimulus may not be far away.

What's interesting to me about this is that very few people here in the United States lasered in on the meat of his recent observations - namely that when the Bank of Japan is finished with its stimulus, the BOJ's balance sheet will be three times larger than the Fed's balance sheet compared to GDP.

But Japanese traders sure did. I know, because I received several calls from panicked Japanese bond trading colleagues in the middle of the night wanting to know if they had interpreted Bernanke's comments correctly from English to Japanese.

In practical terms, what the Bank of Japan is planning to do is like expanding the Fed's ledgers to $12 trillion - expensive, fraught with risk and almost completely un-repayable except by default.

So they began taking profits in addition to burning off the risk premium needed to bring VaR in line. That all but guaranteed that momentum was firmly to the downside all day in Tokyo.

Figure : Zero Hedge/ Bloomberg / Annotations Fitz-Gerald Research

3) The Bank of Japan lost control over normally placid Japanese markets for the day.

The way I see it, this drop was Japan's "Lehman Brothers" moment.

It's the first time traders have really felt panic in a while and a sign that all is not well in any central bank-manipulated market, but especially in the big three markets of the United States, the EU, and Japan.

All it will take to induce a watershed moment is traders taking matters into their own hands. Absent additional liquidity, whatever central bank they target will lose control and the markets will adjust on their own, as completely as they need to.

What that actually looks like and when that happens, we don't know. Nobody does. But the bet is this is more of a "when" question than an "if" question. The same derivatives traders that locked the PIIGS (Portugal,

Italy, Ireland, Greece and Spain) out of the barnyard in Europe have now set their sights on Japan. And Prime Minister Abe's unlimited stimulus is simply more slop in the trough as far they're concerned.

Japanese financial companies at the center of this tempest fell off the proverbial cliff. Consumer lenders were particularly hard hit as were major industrials. Shinsei Bank (8303), Mitsubishi Motor Corp (7211) and Tokyu Land Corp (8815) were among the biggest losers.

While they are still tallying the wreckage as I write this, some sources are suggesting that last Thursday's fire sale may have just buzz cut 1.5%-2% of Tier 1 capital from the Japanese banking system. That's bad.

Tier 1 capital, in case you are not familiar with the term, is what the bankers call "core equity capital," meaning it's the money that a bank has on hand to support all the risks it takes, including lending and trading.

The point: The banks Japan needs for its recovery just got weaker.

Now for the trillion-Yen question...what does this mean for your money?

- As long as traders perceive central bankers have room to maneuver and are willing to use the printing presses, the markets will have an upward bias. Don't fight the Fed is now don't fight the Feds - plural.

- Selling because others have panicked is never good. Sell because the underlying premise upon which you own a stock has changed or you've hit your trailing stop (which you hopefully have in place ahead of time as we continually encourage you to do)

- Stay in the game...just make sure it's the right game. If you're nimble you can probably trade Japan's equity markets. But the far better alternative is to bet against the Yen using either currency or an ETF alternative like the ProShares UltraShort Yen Fund (NYSE: YCS). If there's one thing that's going to torpedo Japan eventually, it's higher rates ahead and the currency will reflect that when it happens, regardless of why it happens.

At the end of the day, somebody is going to make a bundle on the volatility ahead...it might as well be you.

Source :http://moneymorning.com/2013/05/30/japans-lehman-brothers-moment-what-it-means-to-you/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.