Why Soaring Crude Oil Production Growth Isn’t Helping Prices

Commodities / Crude Oil Jun 11, 2013 - 06:05 PM GMT

Mitchell Clark, B.Comm writes: There is now pressure on oil prices.

Mitchell Clark, B.Comm writes: There is now pressure on oil prices.

West Texas Intermediate (WTI) crude is getting awfully close to the $100.00-per-barrel level again. Futures traders are interpreting economic news, including last Friday’s employment report, as strength in the U.S economy.

Resource stocks have generally been trending lower, particularly in precious metals. But this hasn’t been the case with the oil stocks, especially large-cap integrated oil companies. They continue to do relatively well on the stock market even though the spot price of oil has been mostly flat until just recently.

From a business perspective, virtually any equity market portfolio is well served by having some exposure to oil stocks (environmentalists may disagree).

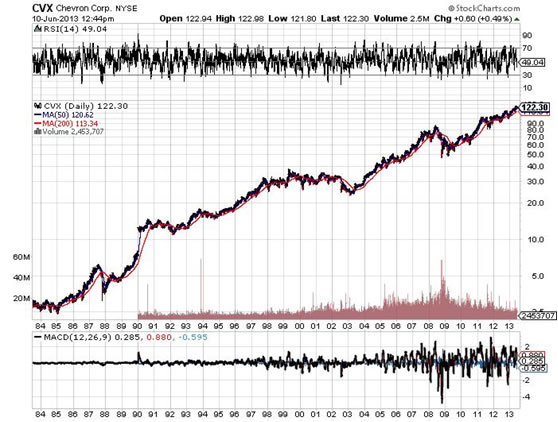

The last time we considered Chevron Corporation (NYSE/CVX), the position was trading around $117.00 a share. It’s currently around $121.00, having pulled back from a new stock market high of $127.40. The stock is currently yielding 3.3%.

Stock market strength among big oil stocks is pretty impressive with oil prices just under $100.00 a barrel and natural gas prices still in a long consolidation.

ConocoPhillips (NYSE/COP) is holding up extremely well, especially after spinning off Phillips 66 (NYSE/PSX), which has been an outstanding oil stock since the divestiture. Adjusted first-quarter earnings for ConocoPhillips were basically flat comparatively. The stock is currently yielding 4.3%.

Crude oil inventories in the U.S. market recently hit an 82-year high (due to all the new production). Data shows that inventories have been drawn down over the last couple of weeks.

In many ways, oil prices are also trading off the Federal Reserve.

Right now, Chevron is toying with its 50-day moving average (MA). The stock broke its 50-day MA back in the middle of April, then reaccelerated. The company’s long-term stock chart is featured below:

Chart courtesy of www.StockCharts.com

The equity market experiences waves of enthusiasm from different places, and for quite some time, it was trading off the action in oil prices. The fact that oil prices are now close to $100.00 a barrel again in the face of escalating domestic production is telling of the willingness of traders to bid this market. (See “The Only Way to Beat Rising Gasoline Prices.”)

The recent spike in oil prices seems to be a spin-off itself of the stock market’s enthusiasm of late. Actual supply and demand figures on oil are being attributed less weight by traders in this monetary expansion.

Second-quarter earnings estimates for big oil have been going up on presumed margin improvement.

Chevron’s 2013 first-quarter earnings were $6.2 billion, down from $6.5 billion comparatively. Revenues last quarter were $54.0 billion, down from $59.0 billion comparatively, mostly due to lower oil prices.

Chevron advanced a good $10.00 a share in the first quarter. The effects of the monetary expansion are now—without question—cajoling oil prices.

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.