Another Reason Not to Trust the Big Banks

Companies / Banksters Jun 12, 2013 - 06:39 PM GMTBy: Money_Morning

David Zeiler writes:

When Big Banks say their trading desks posted a profit every single trading day for an entire quarter, it seems hard to believe.

David Zeiler writes:

When Big Banks say their trading desks posted a profit every single trading day for an entire quarter, it seems hard to believe.

And yet not one but two Big Banks -- JPMorgan Chase (NYSE: JPM) and Bank of America (NYSE: BAC) -- recently reported that they had perfect trading records in the first quarter of 2013.

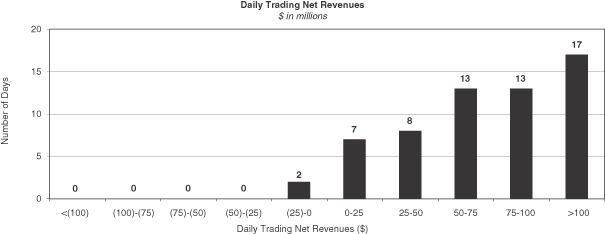

And most days they weren't squeaking by either. A chart of JPMorgan's daily net revenues from the quarter shows that on most days the profits were quite fat -- $50 million or more, with 17 days posting profits of more than $100 million.

Rivals Goldman Sachs (NYSE: GS) and Morgan Stanley (NYSE: MS) didn't do nearly so well. Goldman had two negative trading days in the quarter, and laggard Morgan Stanley posted losses on eight days.

Brokers from those two firms won't be showing their faces at the country club anytime soon.

Such perfection - and near perfection - would seem remarkable from one Big Bank, much less all of them. I mean, how many investors can come out ahead every single day for 60 days or more?

But just like your parents told you, if something sounds too good to be true, it probably is.

"Don't believe everything you hear about the banks, and don't believe anything they say," said Money Morning Capital Wave Strategist Shah Gilani. "Without actual, let's call it 'honest' transparency, we will never know where the banks are making money when it comes to their 'trading.' "

Gilani would know. He started running his first hedge fund back in 1982 and later worked at investment banks in both London and New York.

"Don't forget, banks are liars," Gilani said. "In the fall of 2008, all their CEOs were telling us publically they were all in great shape. Meanwhile they were taking trillions in handouts to keep from declaring themselves and the financial system dead in the water."

What Are the Odds?

To understand why the Big Banks simply can't be telling the truth, consider how hard it is to have the kind of winning records their trading desks post on a regular basis.

While the Big Banks aren't always perfect, the law of averages never quite seems to catch up with them.

Back in 2010, for example, JPMorgan had a perfect trading record in three out of four quarters, losing money on only eight days in the second quarter (if you're keeping score, that's a winning percentage of .950).

At the time, Bloomberg columnist Jonathan Weil sat down and tried to calculate the odds of the trading desk of any Big Bank having a perfect quarter.

Weil started out with the assumption that the Big Bank trading desks are so good at trading that they have a 70% chance of posting a profit on any given day, which he called "a remarkable achievement in most markets."

But even with that generous assumption, he figured the odds of posting a net gain 63 days in a row are 5.7 billion to one.

And mind you, those are just the odds of one Big Bank doing it once. One can only guess what the odds are of multiple banks doing it simultaneously, or repeatedly.

"Is it possible to make money every day. No. To have a great run? Yes. To be honest about the difference? No," Gilani said.

How the Big Banks Patch Together Perfect Trading Records

What most people don't realize, Gilani said, is that the "trading desk" at a Big Bank is not a singular entity, but numerous entities operating separately.

"They have multiple trading desks trading different instruments. Whether it's credit default swaps, equities, government bonds, foreign exchange, commodities, you name it, they have a desk for trading it," Gilani said.

Crazier still, he said, a Big Bank's different trading desks "don't always work on the same side."

Gilani used government bond traders as an example.

"The guy trading bills may be short while the guy trading notes is hugely long, but hedged out, and the guy trading the bonds is massively long but day-trading to make his profit/loss look better for the end of the quarter and his annual bonus."

And all those numbers from all those separate trading desks can easily be fudged into consistently winning overall trading days for the Big Banks.

"To say a bank made money X number of days in a row trading is misleading," Gilani said.

"The bottom line might be the collective net of the combined desks maybe made money all of those days, or maybe they only counted the days where there were trades and not losing mark-to-mark positions on other desks on the same days. The problem is no one knows because there is no trading book, or across-the-trading-books-and-desks breakout."

Why the Big Banks Lie About Their Trading Records

It's not hard to understand why the Big Banks fluff up their trading desk records - they have reputations to maintain, and don't want to let on just how fallible they truly are.

"Now, with all their losses on mortgage-backed securities and collateralized debt obligations and other instruments, do you think they're going to come out in the shadow of the Volcker Rule and tell anyone they are losing money hand over fist "trading" ...no way," Gilani said. "They will mix and match profits and losses from around the bank to show a gussied up trading record."

So, given that the Big Banks are lying about... well, pretty much everything, how can retail investors protect themselves?

"Don't try and beat them, you can't," Gilani said. "Just play the game the way they set it up for themselves and you'll figure out pretty quickly that volatility can be your friend, and that you can make money trading from both the long and short side of rapidly rising and falling markets."

"The way to play the Wall Street game is to do what they do, not what they say you should do," Gilani said.

[Editor's Note: If you're fed up with the rampant corruption, double-dealing, and protection of Wall Street by Washington (at the expense of the taxpayers on America's Main Street), then you need to read Shah Gilani's Wall Street Insights & Indictments newsletter. As a retired hedge fund manager, Gilani is a former Wall Street insider who knows where all the bodies are buried. But unlike most insiders, he's not afraid to tell you where they are. He's also got some pretty good ideas how to fix this mess - and how to protect yourself until the cleanup takes place. Please click here to find out more. The newsletter is free.]

Source :http://moneymorning.com/2013/06/10/another-reason-not-to-trust-the-big-banks/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.