Global Recession Forecast - Is PIMCO's Bill Gross Wrong Again?

Stock-Markets / Financial Markets 2013 Jun 17, 2013 - 02:01 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Stuart Varney put the question directly to me last week during his Fox Business show:

Keith Fitz-Gerald writes: Stuart Varney put the question directly to me last week during his Fox Business show:

What do I make of comments from PIMCO's Bill Gross...that he's projecting a 60% chance of a global recession in the next three to five years?

Now, Bill Gross is obviously one of the most powerful men in the world. PIMCO, the firm he founded, is the world's biggest bond manager. He has assets under management of more than $2 trillion (that's right, with a "t").

So what exactly do I think about Mr. Gross's latest prediction? Not much.

This is like predicting 10 of the last two recessions...eventually he'll get it right.

The problem is not that Gross is stupid or even wrong. In fact, I believe Gross is one of the most intelligent managers in the game today. But here's what Money Morning readers need to understand: Gross has been horribly wrong on three major market calls in the last three years:

- In 2011, he famously called for an exit on Treasuries.

- In 2012, he called the "cult of equities dead."

- In 2013, he said stocks would be low 4-5% single digit returners.

Wrong, wrong and wrong.

In 2011, Treasuries continued to run far higher, prompting an apology from Gross to his clients -- many of whom he had taken out of Treasuries and for whom he'd caused tremendous underperformance.

In 2012 equities ran up sharply in 2012, with the S&P 500 finishing the year 13.41% higher than when it started.

In 2013, adding insult to injury, the markets have flirted with record all-time highs. The markets have pulled back since May, but the S&P 500 is still up 11.19% as of June 11.

Anybody who made all-or-nothing decisions based on Gross's past prognostications is a lot worse for wear and has missed out on some really great profits.

Maybe he'll get it right this time... I don't know. . It's just that the odds aren't especially favorable that he does.

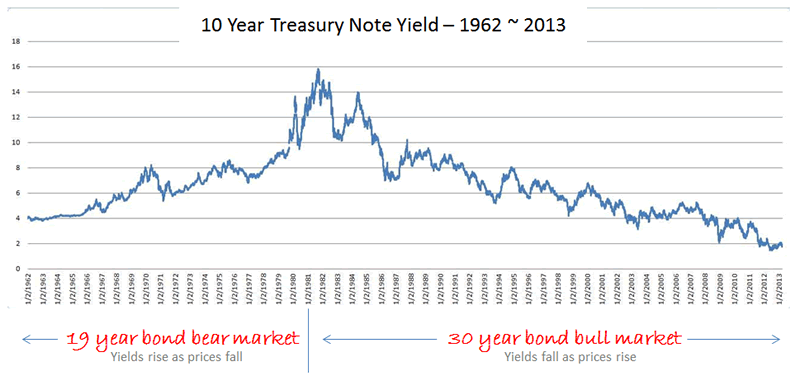

Gross (and PIMCO) has been the beneficiary of a 32-year bull market in bonds that began in March 1981. It's pretty hard to screw that up when the tide is running one way.

Where he seems to be having trouble in recent years is in doing something unfamiliar to him - picking major market reversals in both stocks and bonds.

The other thing to bear in mind is that Gross has been known to "talk his book." That's an expression that means you talk to the press in ways that clearly advance your money management interests.

Think about it for a minute. There are very few major money managers who don't.

Jim Chanos constantly berates China. He's an acknowledged short seller and stands to benefit significantly every time that nation takes a header.

Warren Buffett talks incessantly about value stocks and the need to stay in the game when things get tough. Most of the time, his comments are brought to light after he's made significant acquisitions and often at bargain-basement prices. The public follow-on can put a lot of wind in his sails.

John Bogle, who founded Vanguard and is regarded as the father of passive index investing, harps on individual stock pickers because he believes that index investing is the better way to go. Is it any surprise that the firm he founded, Vanguard, is one of the world's largest fund families with $2 trillion as of December 2012?

Nope.

Of course Bill Gross wants to stir things up by talking about what he believes in...bonds. That's only logical.

Here's the thing...I have no idea what the redemptions are at PIMCO since March 2009 when the markets bottomed, but I do know that a bond manager's biggest fear is that money will rotate into equities.

Not only does this change the characteristics of the investments he makes on behalf of his clients, but such shifts potentially shoot great big holes in the firm's revenue stream, too. Gross likely stands to lose billions a year in fees - give or take a few zeros - if interest in bonds wanes.

So, talk up a global recession where growth stagnates, stocks tumble under lower earnings expectations, and what investment sector is the best place for your money? Hmmm, bonds?

The point is, smart people like Gross are also successful people and much of that comes from convincing people that they're right, not just for intellectual purposes, but because there's also a lot of money on the line.

Buyer beware.

We are far more likely to see rates rise, significant depreciation and a mass exodus than a flood of new money into fixed income.

So what about the other side of the coin - the 40% that Gross didn't mention?

For that, I think we need to turn to Fed Chairman Ben Bernanke. The markets have become so addicted to cheap stimulus that I don't believe Bernanke has the guts to take his foot off the proverbial gas pedal lest he risk a Japanese-style meltdown like we saw on June 11th, when the Japanese opted to do "nothing." Therefore, the market bias remains - rightly or wrongly - to the upside for as long as he remains accommodative (and we'll know next week if he will).

The amount of debt which once caused such concern is now very strangely irrelevant. The game now is almost entirely about psychology.

But back to Gross and his prediction. I think we're long overdue for a serious correction or two. However, a recession is something I simply cannot wrap my mind around at the moment.

Central bankers have proven to be surprisingly creative and resilient when it comes to demonstrating a flagrant disregard for the long-term cyclic nature of finance. While their actions feel good in the short term, longer term the actions they are taking are the problem -- not the solution everybody thinks. Gross and I actually agree on this point, incidentally.

The concept of a recession is politically charged. Markets come and go.

Under the circumstances, the political apparatchiks will kick into high gear and manipulate everything they have to so as to avoid the dreaded R-word three to five years from now. It's not by coincidence that 2016 is an election year.

So what can you do about it?

Listen to Gross. Listen to Buffett. Listen to the news in general. Just remember what motivates them and stick to yourplan - you do have one, don't you?

Keep things in perspective. Understand that you don't have to suffer the ravages of a recession, nor a bear market. History, in fact, shows that both can be huge sources of profits if you know where to look and what to buy.

For example, everybody's got their attention focused on equities, which have been bid up to high levels despite significant cracks in our economic foundation. Commodities, on the other hand, have been cast aside and may slump further.

If you don't want to buy an asset that's dropping in price, look in the mirror and ask yourself if you'd rather buy something on sale when it's cheap or pay through the nose 'cause everybody else is buying?

The former is a time-proven means of achieving higher returns. The latter is a surefire way to doom your retirement.

And, finally, remember failure is an integral part of capitalism. Under the circumstances, it's entirely possible to be a market bull and an economic bear at the same time.

Source :http://moneymorning.com/2013/06/17/is-pimcos-bill-gross-wrong-again/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.