Vast $2.6+ Trillion Quantitative Easing (QE) to End?

Interest-Rates / Quantitative Easing Jun 20, 2013 - 11:33 AM GMTBy: DK_Matai

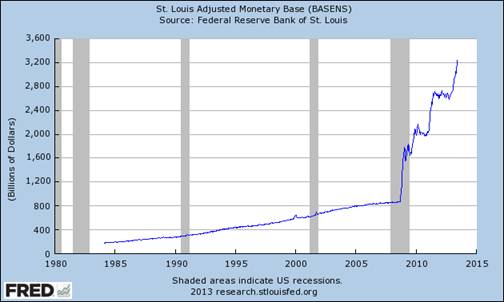

An unprecedented monetary policy so supportive of US and global recovery has now begun to turn, as indicated recently by the Federal Reserve chairman Ben Bernanke. The step-by-step halt and exit from this type of multi-trillion-dollar QE remains untried and untested, so we remain in totally uncharted waters in regard to unintended consequences. Is there huge market volatility next? Most probably, yes! Just watch the long term interest rates rising as there was no real sterilisation of this massive injection of money supply in trillions of dollars over the last five years on top of the $800+ billion total Federal Reserve balance sheet inherited in March 2008. [See Federal Reserve chart and note ATCA 5000 briefing: "Why The End of QE May Be Imminent? Faith, Trust and Pixie Dust"]

An unprecedented monetary policy so supportive of US and global recovery has now begun to turn, as indicated recently by the Federal Reserve chairman Ben Bernanke. The step-by-step halt and exit from this type of multi-trillion-dollar QE remains untried and untested, so we remain in totally uncharted waters in regard to unintended consequences. Is there huge market volatility next? Most probably, yes! Just watch the long term interest rates rising as there was no real sterilisation of this massive injection of money supply in trillions of dollars over the last five years on top of the $800+ billion total Federal Reserve balance sheet inherited in March 2008. [See Federal Reserve chart and note ATCA 5000 briefing: "Why The End of QE May Be Imminent? Faith, Trust and Pixie Dust"]

US Federal Reserve Balance Sheet

When looking at the massively exploded $3.41 trillion US Fed balance sheet as of June 2013, one can easily forget that in about 100 years, the Fed only printed $800+billion up until March 2008. [See Federal Reserve chart] Now the Fed balance sheet stands at more than four times the initial figure: most of it is outstanding debt and not all of it is high grade. What are the real long term consequences of this financial DNA-altering experiment, with all manner of impurities added, and are we just about to read the opening verse in the first chapter via the financial markets?

What are those swiftly rising interest rates in the long term -- as measured on ten year and thirty year government bonds -- really stating? In numbers, are they suggesting that inflation could steadily ratchet upwards and begin to go out of control?

Weimar oder Zimbabwe? Perhaps neither in the very short term because the south pointing resistance vectors to the velocity of money are still many to impede a northerly rocket-style take off into the stratosphere of super-inflation. However, the fear amongst sophisticated investors is that official inflation statistics may be artificially subdued and may therefore never indicate hyperinflation ahead, which can happen very very quickly as was the case in Weimar and also in Zimbabwe. [Note ATCA 5000 briefing: "Massive QE: Death by Insulin Overdose?"]

Ultimately, all fiat currency can become a license-to-thrill, a play on national debt, and a confidence trick. In this case it has been levitated, contrary to popular opinion, via massive QE. What happens if confidence evaporates when massive QE is switched off? We may witness not just equity markets volatility but currency and bond markets volatility simultaneously. It is not easy to give up on such a massive drug addiction without severe withdrawal symptoms including violent trembling, severe pain and suffering. Note, if extreme volatility carries on, it can become synonymous with further confidence and structural corrosion.

All this means in a nutshell is that QE could carry on for a lot longer than originally envisaged until the bond market volatility puts an end to it. When it is eventually switched off, beware the consequences. It is a colossal elephant in the room getting $85 billion larger every month and nobody is really looking at the Fed's balance sheet whose humongous size has crossed $3.41 trillion and is still rising! Is it now time to 'stress test' the Fed, the ultimate large cap financial institution, before it is too late?

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

By DK Matai

Asymmetric Threats Contingency Alliance (ATCA) & The Philanthropia

We welcome your participation in this Socratic dialogue. Please access by clicking here.

ATCA: The Asymmetric Threats Contingency Alliance is a philanthropic expert initiative founded in 2001 to resolve complex global challenges through collective Socratic dialogue and joint executive action to build a wisdom based global economy. Adhering to the doctrine of non-violence, ATCA addresses asymmetric threats and social opportunities arising from climate chaos and the environment; radical poverty and microfinance; geo-politics and energy; organised crime & extremism; advanced technologies -- bio, info, nano, robo & AI; demographic skews and resource shortages; pandemics; financial systems and systemic risk; as well as transhumanism and ethics. Present membership of ATCA is by invitation only and has over 5,000 distinguished members from over 120 countries: including 1,000 Parliamentarians; 1,500 Chairmen and CEOs of corporations; 1,000 Heads of NGOs; 750 Directors at Academic Centres of Excellence; 500 Inventors and Original thinkers; as well as 250 Editors-in-Chief of major media.

The Philanthropia, founded in 2005, brings together over 1,000 leading individual and private philanthropists, family offices, foundations, private banks, non-governmental organisations and specialist advisors to address complex global challenges such as countering climate chaos, reducing radical poverty and developing global leadership for the younger generation through the appliance of science and technology, leveraging acumen and finance, as well as encouraging collaboration with a strong commitment to ethics. Philanthropia emphasises multi-faith spiritual values: introspection, healthy living and ecology. Philanthropia Targets: Countering climate chaos and carbon neutrality; Eliminating radical poverty -- through micro-credit schemes, empowerment of women and more responsible capitalism; Leadership for the Younger Generation; and Corporate and social responsibility.

© 2013 Copyright DK Matai - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DK Matai Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.