5 Ways You'll Lose Money in the Next 5 years

Stock-Markets / Financial Markets 2013 Jun 26, 2013 - 11:47 AM GMTBy: Submissions

Richard Moyer writes: We live in strange times. There are unimaginable amounts of money at stake, and someone is going to lose big, and that someone could be you. Here are the biggest risks that I see on the horizon.

Richard Moyer writes: We live in strange times. There are unimaginable amounts of money at stake, and someone is going to lose big, and that someone could be you. Here are the biggest risks that I see on the horizon.

1. Bond Funds

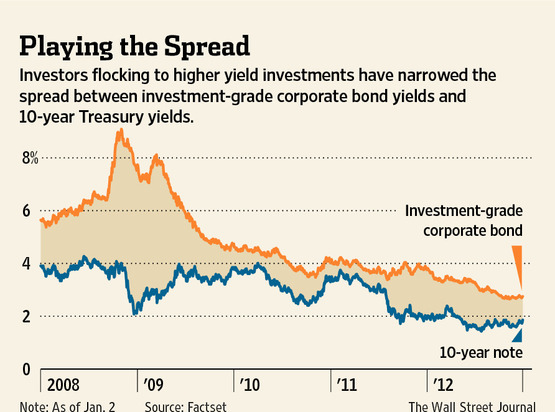

Rates can only rise, so values can only fall.

It's number one for a reason. If you have bond-based mutual funds in your 401(k), you have some crazy risk going on. The reason being, interest rates are basically the lowest they've been in the history of civilization, and this means bond prices are peaked out. There's almost no going up, because interest rates can't get much lower. Sell now, invest in moldy ox hooves, lead paint for kids, anything but bonds.

The worst part about these bond funds is that almost everyone over 50 has been automatically funneled into these funds by employer provided 401(k)s. Ask your loved-ones and friends if they have lots of bonds in their portfolio.

2. Adjustable Rate Mortgages

Monthly payment goes boom.

For God's sake, get a fixed-rate mortgage yesterday. As with the previous article, interest rates are the lowest they've been in nearly forever, they can't reasonably get lower, so if you wait, all you can do is lose. How do you know if you have an adjustable rate mortgage? Check your paperwork, and if you see the abbreviation "ARM" anywhere, you might have one of these "exploding mortgages".

3. Municipal Bonds

Retail investors are often shepherded toward municipal bonds for their tax-free status and decent yield. However, recent news has shown that pensions take a front seat to bond holders in the event of municipal bankruptcy. Expect to see a lot more municipal bankruptcies like Stockton's as interest rates ratchet up, and the monstrous debt racked up by municipalities comes due. Rising interest rates will also mean whatever "good" bonds you hold will have a lower sales price if you are ever forced to sell.

Municipal bonds are popular with retirement plans, so check and see if you are buying these without even knowing it.

4. Home Equity

Mortgage rates are bargain basement. That means house payments are low for any given sales price. That means home prices can be high and people can still afford the payment. For instance, a $150,000 30-year mortgage at 3.5% has a monthly payment of around $675. If mortgage rates rise to only 6%, $675 a month only buys $113,000 of mortgage.

Since the monthly price is what most homebuyers are limited by, the selling price will have to fall.

5. Annuities

Annuities are very popular with retirees, and if you're not into managing your money, annuities are tempting. You throw your money in, and you are locked into a safe, predictable income stream. Right now, though, annuities are as bad a deal as they can get. Since borrowing money is so cheap, why would a financial institution pay you handsomely to "borrow" yours? They won't.

If you hang until interest rates rise a little, the deal you get when you buy an annuity will be better.

Richard Moyer

http://shadesofthomaspaine.blogexec.com

© 2013 Copyright Richard Moyer - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.