US Dollar Holds the Key for Stocks and Gold

Stock-Markets / Financial Markets 2013 Jun 26, 2013 - 06:04 PM GMTBy: Brian_Bloom

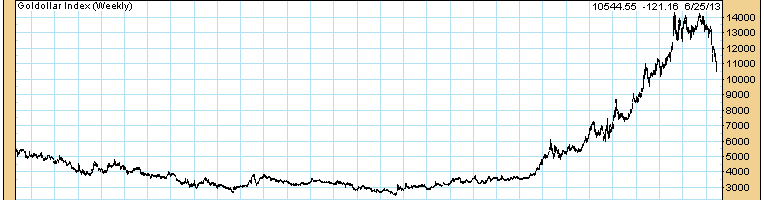

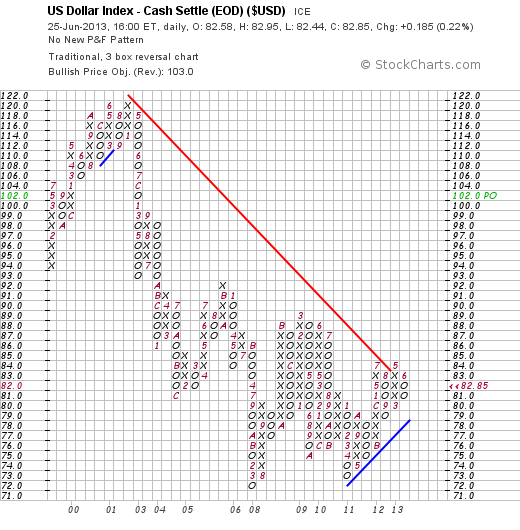

The weekly chart below (courtesy stockcharts.com) is significant for two reasons:

The weekly chart below (courtesy stockcharts.com) is significant for two reasons:

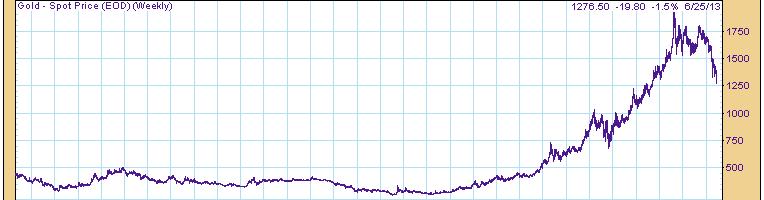

1. The US Dollar is “supposed” to move inversely to the gold price.

2. It is showing a broadening (megaphone) formation against a background of a collapsing gold price.

First, let’s debunk 1. above. If the Gold price and the US Dollar did indeed move inversely then the two multiplied together would be a horizontal line. The chart below of the Goldollar Index (Gold price X US Dollar Index, courtesy DecisionPoint.com)) is anything but a horizontal line. Ergo, these two markets do NOT move inversely:

A megaphone formation (higher highs and lower lows) is a sign of a market that is spiralling out of control. The bears are excessively bearish and the bulls are excessively bullish. Typically, as time passes in a bull market, the bears win this particular type of disagreement and the price eventually heads south in earnest. I have never seen an example of a megaphone formation at the culmination of a bear market, which doesn’t imply that it’s impossible for the breakout to be to the upside.

However, if BOTH the gold price AND the US Dollar Index tank against a background of rising interest rates in the US, then – given that rising rates should entice capital to flow into a country – the issue will devolve to the perceived creditworthiness of the Sovereign US. In turn, the twin developments of both gold and the US dollar heading south will deal a savage blow to confidence in the viability of the global financial system.

Let me put it this way: In 45 years of market analysis via the charts, whilst I have never come across a megaphone formation in a “bull” market that has resulted in a resolution to the upside, it is conceivable that, because the monthly chart below is a long term chart, this particular megaphone formation might well resolve itself on the upside.

If it does, I will give a huge sigh of relief because such a development will be consistent with rising yields and capital flowing into the US.

Of course, if capital flows into the US, this will beg the question regarding what will happen to the cash. Where will the cash be invested and will the wave of incoming capital place a downward pressure on yields?

Regardless of the outcome; because “value-add” is what drives economic growth, and because the deluge of QE has had little impact on the combined labour unemployment and labour participation percentages, an inflow of cash does not imply that a growing US economy will be the result. The end result will more likely be a retention of confidence in the global financial system, a slow deflation of the global sovereign debt balloon and a multi decade sideways churning of the US equity market as we experience rolling recessions in a period of general price deflation. The bubble economies like Brazil, Russia, India and China will likely contract. Signs of this are already emerging. In particular, the recent demonstration in Brazil of 2 million people. Happy people do not take to the streets to complain.

The technical evidence:

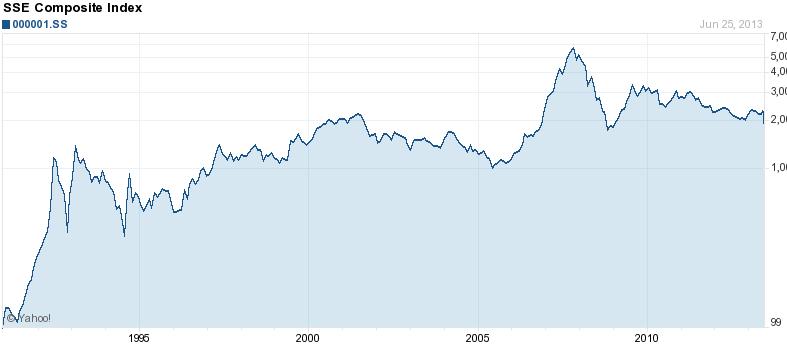

Shanghai

(Chart Courtesy Yahoo.com)

Minor (so far)recent sell signal, but the index has already fallen around 2/3 from its 2007/8 peak. That is not a trivial amount and it signals a market expectation that the Chinese economy will not continue to grow exponentially, if at all. Indeed, there is clear evidence of a credit crunch inside China and it should be remembered that domestic credit availability was loosened post GFC as China’s exports fell.

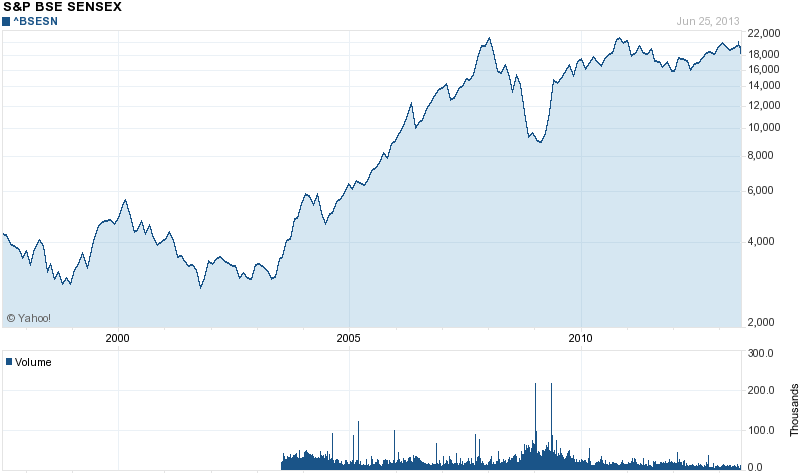

India

Minor (so far) sell signal. But we’re looking at a potentially bearish Triple Top formation, and SIGNIFICANT potential downside from a technical perspective.

Russian Micex

(Chart courtesy http://www.tradingeconomics.com/russia/stock-market )

Minor (so far) recent sell signal. Nevertheless, the general trend seems to be “down” and if the Head and shoulders breaks down we might see a collapse.

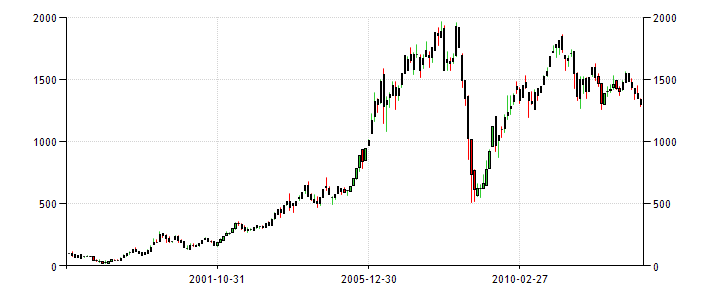

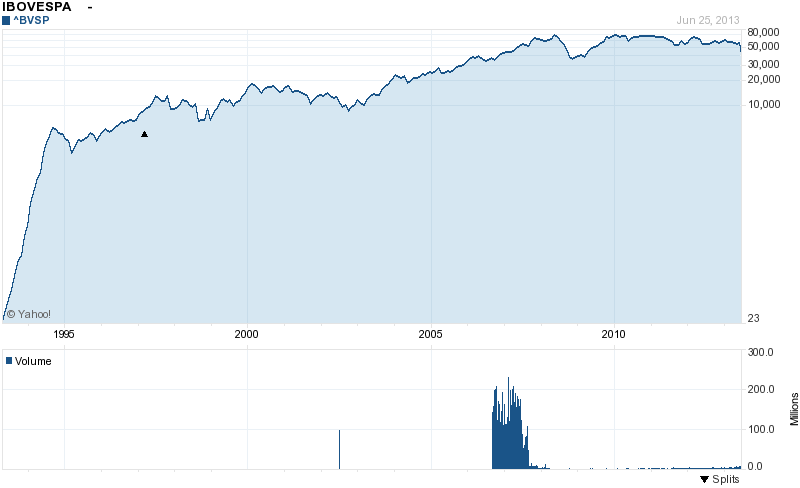

Brazil

(Chart courtesy yahoo.com)

Sell signal recently given in context of a market that has been generally declining since 2010.

The future of the BRIC economies in particular seems cloudy if not dark against a background of a moribund EU economy. It follows that for the US economy to grow, it will have to grow internally against a background where 2/3 of the US’s GDP is driven by consumers who are facing a rising cost of capital and questionable prospects of growing employment.

On a worst case scenario, if the US Dollar Chart’s Megaphone formation resolves itself to the downside, it seems reasonable to conclude that we will be facing a Global Depression.

However, to be even-handed, at this point in time the probabilities favour an upside break in the US Dollar – as can be seen from the Point & Figure Chart below:

Overall Conclusion

The party is over. We are facing tough economic times but, at this point, we seem likely to muddle through. Given the Greenspan/Bernanke driven excesses – which were enthusiastically embraced by the world’s central bankers in general and culminated in nearly $50 trillion Sovereign Debt worldwide – it will very likely take up to a generation for the global economy to heal itself.

BB Comment: A lot now hangs on whether the politicians, bankers and captains of industry are prepared to address the crying need for ethical behaviour. My two factional novels examine what “might be” if this behavioural predisposition emerges.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.