Gold Stealth Confiscation

Commodities / Gold and Silver 2013 Jun 28, 2013 - 04:40 AM GMTBy: Jesse

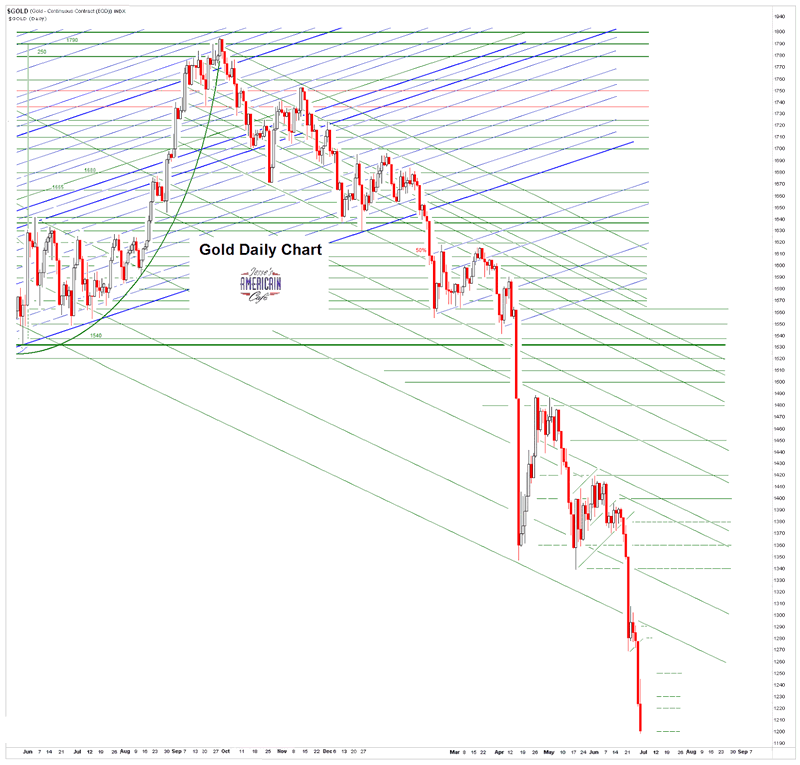

One remarkable thing about today's market action was the rebound in the miners even as gold underwent another waterfall bear raid of selling down to the 1200 level.

One remarkable thing about today's market action was the rebound in the miners even as gold underwent another waterfall bear raid of selling down to the 1200 level.

While one can assign any motives they wish to the speculation about if and why there is a stealth confiscation happening, I do believe that the trigger for this was the request from Germany to have their sovereign gold returned, and the refusal of the custodian in New York to do so until 2020.

That is huge. It is almost incomprehensible.

Any fails to deliver or difficulty in obtaining supply at the LBMA or the Comex is most likely a secondary effect to this request.

The scramble is on to find bullion, because a failure to deliver on a legitimate request from a sovereign nation to have their gold bullion returned at the insistence of their citizens, who actually own it, is stunning. I am surprised that more has not been made out of this, and that the German people took this so blithely.

A default on an exchange can be covered up with forced cash settlements. A rehypothecation of customer assets by an MF Global can be sectioned off and minimized with the right PR campaign, localized to the investors whose property has been misappropriated and will not be replaced, except in discounted cash.

But for a central bank to release another country's bullion to their cronies in the market and then be unable to replace it without roiling he markets and sending a shock into the financial system is almost unbelievable.

This is what has happened in my opinion, and why the 'dogs of the market' were released by the financiers on their own people to try and hide what must be an embarrassment of the first order.

And if you believe I am mistaken, or engaging in some obtuse conjecture, I have only one response.

Prove me wrong. Make the markets more transparent. And return Germany's gold.

"Truth never damaged a cause that is just."

Mohandas K. Gandhi

This has become a badly done shell game of rehypothecated assets that cannot be unwound except with much higher prices which are viewed as an embarrassment and an impairment to a few of the TBTF Banks. Well, they have had plenty of opportunity to cover their massive short positions, and free up bullion from the big ETF.

The initial misdeed may have been minor, but as it always seems to happen, the coverup is growing like some gothic structure. This is MF Global on steroids.

I think these fellows are playing for time, perhaps hoping for some 'big event' that will allow them to reset the markets and the rules of the game, for themselves and their cronies, once again.

Maybe there will be a rationale, a fairy tale, that this was a way to pressure Iran, who was rumoured to be resorting to gold payments when their currency was blocked in the international payments system. The American people might believe this. I doubt the rest of the world will.

Show us the truth while they is still an honorable way out. Make the markets honest and transparent again. Stop stonewalling on the investigation of the silver market. Fulfill your oaths.

Stand and deliver.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.