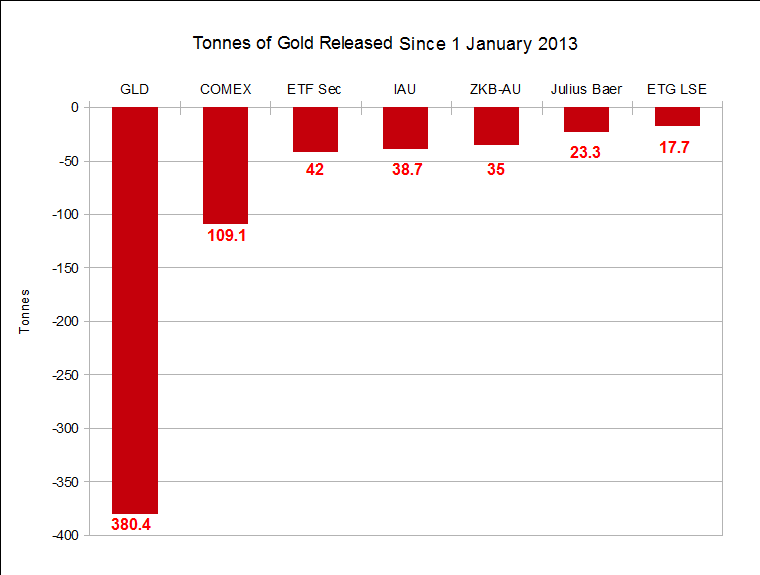

Tonnes of Gold Removed From the Major ETFs and COMEX

Commodities / Gold and Silver 2013 Jun 28, 2013 - 04:49 AM GMTBy: Jesse

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

With the help of Nick at Sharelynx.com, the keeper of records and master of charts, I was able to calculate the approximate number of tonnes of inventory that were released into the market, or some private storage area perhaps, from the top funds and exchanges in the western world. The time period is from the beginning of this year through 26 June.

If this is correct, and the hypothesis is correct, then it is 'mission accomplished.'

There should be no excuses for not delivering Germany's gold. And plenty of other bullion has been made available to solve those other pesky failures to deliver that seemed to be cropping up.

I have also included Nick's personal wave count for gold and silver, although I am not an adherent to the waves theory per se. But the stars seem to be aligning, with perhaps a few more antics and end of quarter shenanigans. Boys will be boys, and they can't keep their hands off their toys.

So one may presume that the bullion is in the mail to its rightful owners, in care of the Herr Weidmann at the Deutsche Bundesbank. The NY Fed sends its special regards. Ich liebe dich.

Unless of course it has been rehypothecated to those barbarian buyers in Asia and the Mideast, yet again.

C'est la guerre des monnaies. Quelle dommage!

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.