Federally Funded Stock Market – Jawbones and Asses

Stock-Markets / Stock Markets 2013 Jun 28, 2013 - 03:19 PM GMTBy: PhilStockWorld

Wheeeee, what a ride!

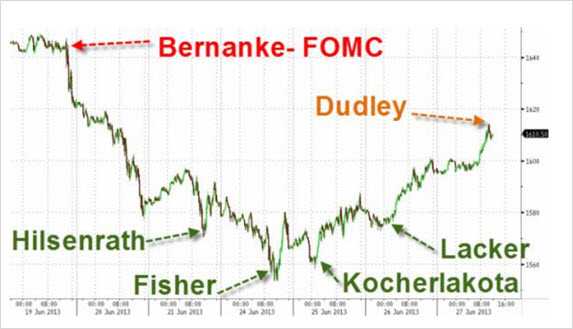

The Federal Reserve giveth and they taketh away and they giveth again, and taketh some more. Remember when the markets were ruled by sales and profits? Me either… As Dave Fry points out, the key turning point came on Wednesday, when usually bearish Lacker said he didn’t see the Fed as “anywhere near cutting balance sheet size” and “maybe markets got a little bit ahead of us on QE." He is also “fine with FOMC tapering QE now” or at any time evidently, but he’s a team player.

Thursday we got a troika of Fed governors beginning with uber-dove and former Goldman Sachs honcho William Dudley. He restated Bernanke’s view that QE tapering may begin in late 2013 and/or early 2014. He was followed by Fed governor Jerome Powell who stated, “Market adjustments since May have been larger than would be justified by and reasonable reassessment of the path of policy," adding, “

The reaction of the forward and futures markets for short-term rates appears out of keeping with my assessment of the FOMC’s intentions, given its forecasts.” In other words, the markets were just wrong. Lastly, Fed governor Lacker stated, “…as the Chairman made clear, there is no 'predetermined' pace of reductions in the asset purchases, nor is the stopping point fixed.” The bottom line is Fed governors have been united in their efforts to jawbone financial markets higher. It’s no coincidence that POMO today was unusually large at over $5 billion.

Another important point Dave made was a quote by Terex CEO, Ron DeFeo, who said “I am hesitant because I really don’t believe the U.S. economy is in a strong growth mode.” TEX makes the machines that actually build things and, if this guy isn't seeing the economy improving – it's not really improving!

As I noted earlier this morning in Member Chat, Draghi shoveled another pile of BS on us this week and it did it's trick but, as with the last 5 times he talked up the markets – no actual action is taken and, in fact, the EU is going the OPPOSITE direction – releasing a $1.25Tn 7-year budget that CUTS spending for the first time in their history.

So, Europe is cutting their budget, the US is sequestered and China is cutting back – I guess it's up to Japan to carry the Earth on their back next…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.