Defying Gold and Silver Bulls Optimism

Commodities / Gold and Silver 2013 Jun 29, 2013 - 12:18 PM GMTBy: EWI

Gold and silver have been all over the financial news.

Gold and silver have been all over the financial news.

On Thursday, June 20, silver fell below $20 (-60% from 2011 high), and gold fell below $1300 (-30% from 2011 high).

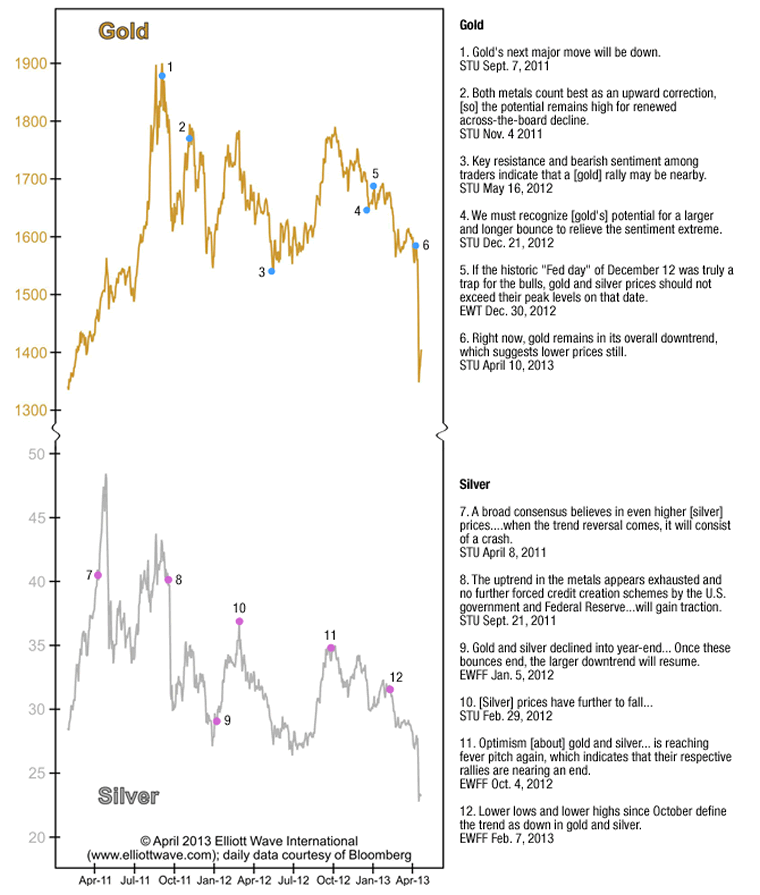

We first published the chart below after metals plunged in mid-April. It shows EWI's forecasts not only leading up to those big moves ... but during the past three years of opportunity.

Three years of volatile price action in these two markets is plain to see. And the forecasts speak for themselves.

Overwhelmingly, most metals experts favored the other side of the gold and silver trend for the past three years - and they still do today. Meanwhile, EWI subscribers were prepared ahead of time for nearly every important turn.

Now, some periods are more vexing than others. But currently we are in a period where the wave patterns are particularly clear.

Metals prices may bounce higher near-term - like we warned they would do after the April 16-18 lows - but the quotes on the chart clearly show how countertrends are the source of opportunity. And that is the great strength of pattern analysis via the Elliott wave method, along with tools like sentiment, momentum and price.

For a limited time you can see the full story in metals in a free report from EWI. See below for more details.

FREE Gold Video from Elliott Wave International

Elliott Wave International forecasted nearly every major trend and turn of the past three years in gold and silver. If you invest in precious metals, you owe it to yourself to see how we got to where we are today. In a 10-minute video titled Gold Defies Bulls' Optimism, Elliott Wave International's Chief Market Analyst Steve Hochberg lays out what has transpired in gold since 2011 so you can understand where it's headed next.

This article was syndicated by Elliott Wave International and was originally published under the headline Stunning Chart Shows Gold and Silver Defy Bulls' Optimism. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.