Japan 'Insurance' Gold Buying Doubles On Yen Concerns

Commodities / Gold and Silver 2013 Jul 08, 2013 - 03:35 PM GMTBy: GoldCore

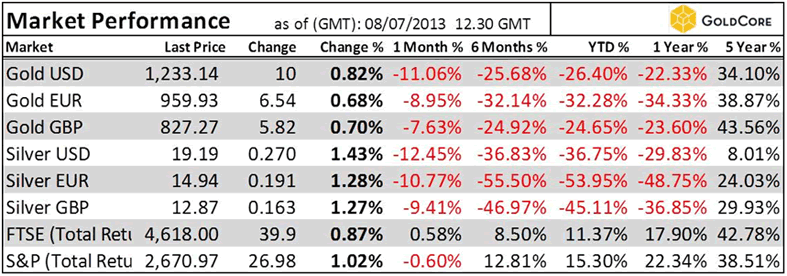

Today’s AM fix was USD 1,225.50, EUR 954.22 and GBP 822.70 per ounce.

Today’s AM fix was USD 1,225.50, EUR 954.22 and GBP 822.70 per ounce.

Friday’s AM fix was USD 1,232.75, EUR 957.40 and GBP 822.55 per ounce.

Gold fell $31.20 or 2.49% on Friday and closed at $1,221.70/oz. Silver closed at $18.86 or slid 4.75%.

On the week gold was down 0.85% and silver was down 3.87%

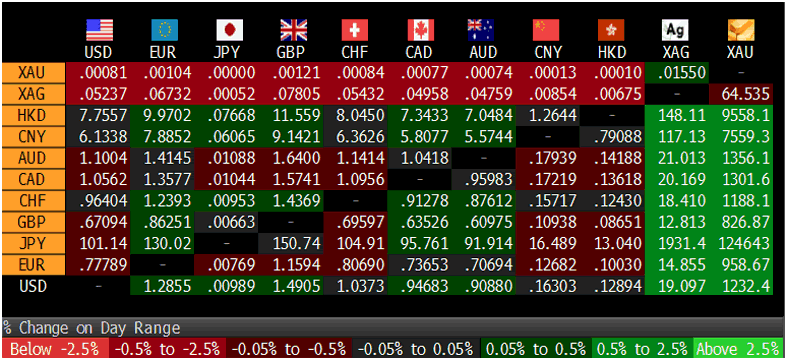

Cross Currency Table - (Bloomberg)

Gold has inched higher today in all currencies. Friday’s U.S. nonfarm payrolls figure came in better than expected (195Kvs166K) which may have led to gold falling in price.

Gold demand internationally remains robust - especially in Asia. China’s gold imports from Hong Kong for May jumped over one third from April, confirming again that Asian buyers shrewdly buy on dips in price.

In Japan, gold bullion demand in 2013 is twice the levels seen in 2012. Japanese gold imports have doubled to 7,686 kilograms from January to May verses 2,994 kilograms the prior year noted data from Japan’s finance ministry.

Many Japanese are now buying gold as a diversification and as insurance due to the risks of volatility in stock markets and of a further devaluation in the yen.

Abenomics has seen the yen fall 15% against the greenback year to date, its lowest since 2008.

Gold in Japanese yen depreciated 15% this year while gold in dollars sank 27%. On the TOCOM (Tokyo Commodity Exchange) the yellow metal hit a record of 5,081 yen a gram ($1,562/oz) on February 7th as the yen deteriorated.

Gold in Yen, 5 Year - (GoldCore)

Despite the recent falls, gold in yen terms is 20% higher in the last 5 years of the global financial crisis. Japan’s largest bullion retailer, Tanaka Kikinzoku Kogyo K.K., said sales to Japanese citizens will exceed their purchases for the first time since 2004. The cheap yen is spurring buying interest.

“Japanese individuals are thinking of gold as an asset for their investment portfolio as well as insurance for the future,” said Kate Harada, general manager of the precious metals department at Tanaka Kikinzoku, a unit of Tanaka Holdings Co. “A growing number want to use gold partly to hedge against their yen-based assets such as stocks and properties.”

Tanaka Group is seeing their customer demographics shift to younger customers over the past 3 years. Japanese “salarymen” are concerned about jobs, their pensions and the two decades of deflation, which is turning them to gold as a safe haven investment.

Has Gold's 'Bubble' Burst Or Is This A Golden Opportunity?

Our recent well attended webinar has been uploaded to YouTube.

Topics covered in the webinar included:

* Outlook For Gold And Silver This Year and Coming Years

* Learning From 1970s Bull Market & 1975/76 Price Collapse

* Safest Way To Own Gold And Silver

* Paper and Digital Gold

* Knowing When To Reduce Allocations Or Sell

* Safest Way To Own Gold And Silver

* Extremely Negative Sentiment Towards Gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.