Why QE3 Hasn’t Triggered Inflation – So Far

Economics / Quantitative Easing Jul 10, 2013 - 12:58 PM GMTBy: Money_Morning

David Zeiler writes: When you pump massive amounts of money into an economy, as the U.S. Federal Reserve has done with QE1 through QE3, you're supposed to get some measure of inflation.

David Zeiler writes: When you pump massive amounts of money into an economy, as the U.S. Federal Reserve has done with QE1 through QE3, you're supposed to get some measure of inflation.

And yet despite some $2.3 trillion of quantitative easing since 2008, the core inflation rate has actually fallen over the past year from about 2.25% to 1.7% as of May.

It defies both common sense and monetary theory - or at least until you find out where all that QE3 money ended up.

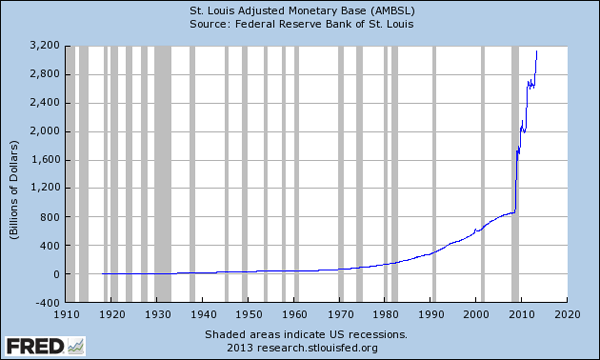

Here's a chart that illustrates the growth in the U.S. money supply, mostly as a result of QE1 through QE3:

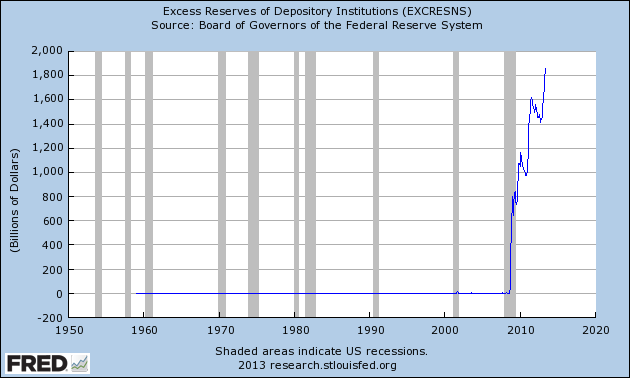

Now here's a chart of the amount of excess reserves sitting in private banks. See any similarities?

Note that until the 2008 financial crisis, those bank reserves were close to zero. Now they have swelled to nearly $1.9 trillion, almost all of which is the money produced by QE1 through QE3 and beyond.

In other words, more than 80% of the hundreds of billions of dollars that the Fed created supposedly to stimulate the U.S. economy never made it to the U.S. economy.

This is why some critics have derided QE3 as "pushing on a string."

The big banks are simply sitting on the QE money - not lending it out or using it in any way that would promote economic activity. They're happy to sit on the deposits because the Fed is paying them to do it.

Last year, the Fed paid out about $4 billion in interest to the big banks on their reserves. Bloomberg News has estimated that the annual payments to the banks could soar as high as $77 billion a year by 2015, depending on how much interest rates rise by then.

This chart from Zero Hedge shows the disconnect between how much money the banks have in their reserves and how much they're loaning out. This not only helps explain why there's so little inflation, but also why the U.S. economy continues to struggle.

qe3 bank deposits and loans

How Idle QE3 Puts a Lid on the Velocity of Money

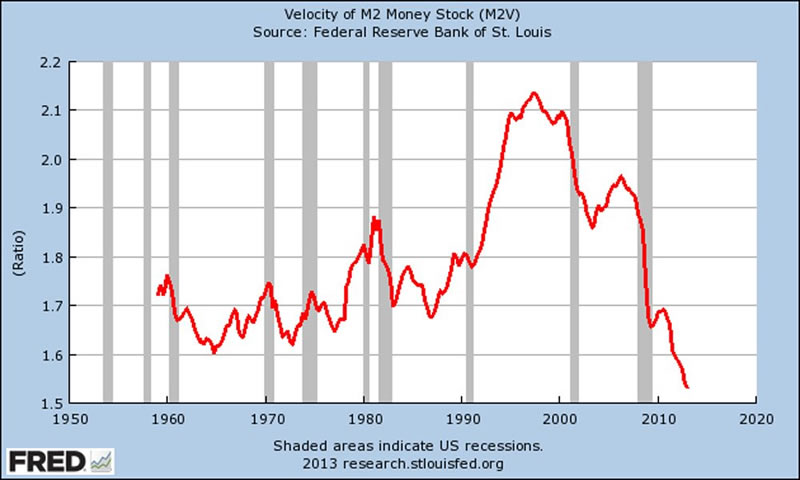

Since all that money isn't in the economy, no one can spend it. The spending of money -- and in particular the rate at which money changes hands -- is what creates inflation. Economists call this the "velocity of money."

Adding to the money supply, as the Fed has done with QE3, should greatly increase the velocity of money.

But instead, this happened:

That's the opposite of what should have happened, and it's because all the QE money is sitting quietly in bank vaults - as if it were stored in a garage or an attic. Out of sight. Out of mind.

Well, unless the banks decide to use it. Then things will get dicey.

"You are in uncharted territory in many ways. This is what the ancient mapmakers would call, 'Terra incognita, or 'Land unknown,'" Wall Street veteran trader Art Cashin told King World News recently. Cashin is director of Floor Operations for UBS Financial Services.

Cashin warned that the trillions of dollars of QE3 now idle could touch off an epic bout of inflation.

"The ingredients are set up for spontaneous combustion. It's not there yet," Cashin said. "When people start to lend it and spend it step back, because the Fed may not be able to put that genie back in the bottle."

Cashin said he's specifically watching the Fed's velocity of money figures for any sign that inflation could be stirring, noting that it will start very slowly at first.

"That's what happened in the Weimar Republic," he said. "They printed money, and inflation didn't happen, and it didn't happen, and then it happened suddenly."

Yet another expected side effect of the Fed's QE3- the decline of the dollar against other currencies - also failed to happen. This story explains why the dollar keeps rising - and why it is nevertheless still doomed.

Source :http://moneymorning.com/2013/07/09/these-charts-show-why-qe3-hasnt-triggered-inflation-so-far/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.