Bottomless Financial Sector Bottom

Stock-Markets / Financial Markets Mar 27, 2008 - 11:42 AM GMTBy: Jim_Willie_CB

Global exchanges and the 13-hour trading day - The prevailing force-fed sentiment is that the US financial sector has bottomed out, the worst is over, the mechanisms for remedy are here, and time to get back in the water for profound bargains again. Let me rebutt! The financial sector is merely taking a breather in a long death march after the great bond bust and horrific unwind of reckless mortgage creation. Monoline bond insurers are nowhere near properly capitalized to handle upcoming substantial losses, nor are banks with loss reserves. Hundreds of billion$ in overvalued and soon-to-be hit mortgage bonds still have yet to occur. And besides, the housing price decline has not even remotely stabilized.

Global exchanges and the 13-hour trading day - The prevailing force-fed sentiment is that the US financial sector has bottomed out, the worst is over, the mechanisms for remedy are here, and time to get back in the water for profound bargains again. Let me rebutt! The financial sector is merely taking a breather in a long death march after the great bond bust and horrific unwind of reckless mortgage creation. Monoline bond insurers are nowhere near properly capitalized to handle upcoming substantial losses, nor are banks with loss reserves. Hundreds of billion$ in overvalued and soon-to-be hit mortgage bonds still have yet to occur. And besides, the housing price decline has not even remotely stabilized.

That, stability in housing prices, is the ultimate criterion for the end of the banking bond woes. Pauses do not constitute recovery. New important grand systemic rescue programs have been authorized, but are not yet put in place, nor are in operation. My forecast is for painfully slow implementation, and tremendous additional bank and bond losses this year, well before the remedy even begins to take root in action. The implications to the USDollar, the USEconomy, the gold & silver prices, and the energy prices are immediate and definite.

The pumped nonsense about the bank problems being behind them is more propaganda. The financial sector desperately needs a breather. It makes up 20% of the entire S&P500. They need for a vast wave of dumb money to come in to bid up the bankrupt banks. Their insiders need an opportunity to dump billion$ tied up in their life savings to the naïve and gullible public. Wall Street wants a technical bounce, one that must be aided by a long line of bull cookies to sell to the public as chocolate chips. Look no further than the Bear Stearns conjob. It led to buyers all day Friday the 14th (too bad not the 13th) at the $30 phony price. It led to sellers in recent days at the $2 and $3 phony price. Billion$ were made probably by JPMorgan itself and other Wall Street insiders in stock and option plays, fully orchestrated.

One cannot overlook some important messages. Lower interest rates should not be perceived as a panacea to solve the many problems plaguing the banking system and USEconomy. Long lag times for impact are months away. The same groups and agencies and pundits and mavens which could not see the market top in stocks and housing, cannot now see the ongoing pervasive banking and economic problems which are sure to deliver continued deadly powerful blows to the system.

The US Federal Reserve continues to be wrongfully viewed as a solver of problems, an omnipotent revered active institution. Two very important financial devices have been put into action, not to be minimized. The Term Auction Facility and the Term Security Lending Facility will continue to pump billion$ into the bank system toward banks and investment banks, accepting finally AAA-rated private mortgage bonds. Unfortunately, a series of chain reactions has begun, very difficult to halt. Damage spreads. Just like the mortgage debacle extends far beyond the subprime loans, the financial sector crisis extends far beyond the mortgage bond arena. See commercial mortgages, corporate bonds, junk bonds, as well as car loans, credit cards, and their associated bonds. A recovery cannot be legitimate without serious address of structural design flaws for consumption and bubble generation.

Public investors bought hookline & sinker the tech telecom bubble by bidding up stocks for companies with no earnings. Public investors bought hookline & sinker the housing bubble by bidding up homes and related mortgage finance stocks, when homes had absurdly overstated values. The public will thus earn a strategic spot in bread lines, as their lifetime savings slowly vanish, as their home equity slowly vanishes, as their pension funds slowly vanish. The consumer has fading job security, little credit to rely upon, and is increasingly under-water in upside down home loans. The USFed lost control of the monetary handle long ago, the monetary spigot, and the monetary cure.

The historic decline in the USDollar is the global report card on their horrendously destructive legacy. The rising gold price is the siren call of financial distress felt worldwide. When gold returns over $1000 mark, when silver returns over the $20 mark, the distress signals will be heard again. Give it another two weeks for sentiment to repair from the hedge fund margin call coordinated in the last ugly week. Raise suspicions that those margin calls occurred when JPMorgan was capturing Bear Stearns. A coincidence? Not a chance!

QUICK LOOK AT BKX STOCK INDEX

The banker stock index BKX was shown last week. It has defended the important 75 critical support. IN NO WAY is it out of the woods yet. Some claim from the technical chart standpoint that a ‘Double Bottom' has been formed and tested. That is nonsense. January and March permitted a two-month time period, nowhere near enough time. An old principal is brought to mind, one recited at a wedding ceremony a long time ago from Lebanese poet Kahlil Gibran. The principal was to permit a healthy degree of separation between husband and wife, for to allow stability to be fostered from a certain amount of independence. They should have some separate activities, some different friends, and should not spend all their time together in an insecure setting. The comparison was made in the recited Gibran passage to a stone temple, whose pillars must be built with adequate separation so as to shift and support the stress so as to maintain balance in the structure. The BKX index chart has a double bottom to be sure, but not a strong one separated over an adequate time span. It also appears to be a contrived Plunge Protection Team recovery complete with a propaganda message heralded by a subservient financial press.

Crucial indicators belie the claim of any recovery among major banks. The two main moving averages are still in decline. That is verified by a miserable looking MACD series (moving average convergence divergence) that is nowhere near heading into positive ground. Notice that the gap between the two moving averages is not closing, reflected by the damaged MACD series, lingering at low levels. This week, the 20-week MA stopped the recovery cold in its tracks. Watch for a bearish triangle to begin to form possibly. Technicians worth their salt will watch behavior near the 20wkMA to see whether the BKX can surpass it. My forecast is for yet another test of the 75 low, probably a series of tests. By summertime, or late spring, expect a failure. Coincident will be horrible continued news from the banks on bond losses, which are nowhere near over.

Bank sector profitability had better revive from the positive yield curve. However, the flow of loans is not brisk. The profits for new loans cannot conceivably overcome the ongoing avalanche of revalued bonds that clutter, infect, and conspire to destroy the banks. Such losses come in quantum leaps of powerful crushing blows. The banking system is underwater, operating with negative capital core outside of lent capital from the USFed. Bank loan loss reserves have not been adequate for a few years, a gross example of mismanagement. Now they will not be able to draw on those reserves, but must raise cash in exchange for capital instead. If not successful, bankruptcies will be declared. A raft of midsized bank bankruptcies is coming, a process not even begun. The wonderful work of Aaron Krowne of the Bank Implode-o-Meter lays out the details of bank failures, dead credit unions, and cumulative losses of major banks and broker dealer firms, (click here ). One can still make the claim that the entire US banking system is wrecked, without any imminent remedy. Fallout from European banks is intertwined with US banks. Do not be fooled by the reduction in Fannie Mae bond spreads from 230 basis points to 160-170 bpts, nor the reduction in corporate bond spreads of lesser amounts. Relief has come, but not enough.

My full expectation is that more shoes will fall. Citigroup has stalled in finding fresh cash in exchange for capital from foreign investors, who maintain a ‘Wait & See' attitude. Arab sheiks and their henchmen, along with European tycoons will be holding back. Joe Lewis realized a sudden $1 billion loss with his pet Bear Stearns project. The world of tycoons is watching. Lehman Brothers bears the closest profile to Bear Stearns, and is the most likely to suffer demise. It could be sudden. Watch Citigroup merge in order to share its pain, in a gesture that hides its desperation. In the last week, a credit derivative meltdown centered on JPMorgan soil was averted. The next chapter in this unwinding disaster will probably not be so clean in its appearance. One should take some sort of comfort from justice that the entire JPMorgan snatch & grab of Bear Stearns is being scrutinized by the US Congress, but don't expect much. The JPMorgan behemoth might not be capable of holding in balance the uncontrollable pyramid of credit derivatives, with or without legal carte blanche and judicial impunity. Lastly, Merrill Lynch gave away their weakness, trying to acquire an XL Capital unit. Merrill appears to hedge defaulted and reneged on a swap contract. Could Merrill be broke and out of cash? Will the crows on Wall Street kill them next, one of their own? Heck yes, if it attends their needs.

USDOLLAR & GOLD BOOMERANGS

As quickly as the USDollar recovered, it lost its gains on the backswing. The euro currency has jumped to new highs suddenly. The Swiss franc and Japanese yen are near highs again. The bounce in the clownbuck was widely seen as an opportunity to sell it. Relief of overbought euros enables even higher highs. Lower lows come for the beleaguered doomed USDollar.

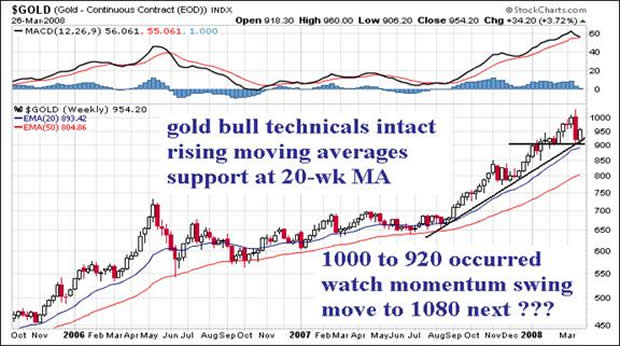

The gold price returned toward 900 support, aided by the bull uptrend. Rising moving averages offer strong additional support. Watch for a quick potential momentum swing snap recovery. The USDollar remains weak. Monetary inflation is of staggering proportions, even as gold is its meter. As the banking crisis and economic downturn become even more evident, the need for even more accelerated monetary inflation will become painfully evident too. Gold and silver will reflect it instantly. Liquidation of some hedge fund positions is temporary. New eager buyers will seize the day and opportunity, as seen already quickly this week. Watch for a swing momentum move toward the 1100 gold level. The silver chart recovery looks similar. Watch for a swing momentum move toward 25 silver level.

ULTIMATE REQUIREMENT

The ultimate requirement for a true valid bank sector recovery is for a halt in the housing price nationally. The S&P Case-Shiller metropolitan 10 city index registered a horrendous national decline of 10.7% in January, on an annual basis. That is not stable! In fact, it looks like it is growing worse as some heavy inventory is clearing at lower prices. Underlying bond collateral continues to erode. When that collateral behind the asset backed bonds, the mortgage bonds, and all their leveraged Collateralized Debt Obligations, declines in value, all such securities continue to fall in value, regardless of whether cheerleaders, conmen, and carnival barkers scream and yell to the contrary. The big banks are desperately dragging their heels in reluctantly moving cratered bond securities to their balance sheets. We have seen newly devised shell games repeatedly inflicted upon the markets, what with SIVs, MLECs, UFOs, and SIEs, all intended to delay and deceive. Don't even bother to understand what the acronyms means, just think fecal coated bonds worth less than posted, made to appear like M&M candies. The usual outcome of busted bubbles is a return to pre-bubble prices.

That means at least a return to 1999 housing prices, and possibly a return to 1992 prices if the new collections fail to deliver. The gigantic rescue platform for mortgages, the official bond refund lending facilities, the flimsy USGovt stimulus plan, these had better be designed as large, really large, because the current housing crisis and mortgage debacle is bigger than anything the nation has ever faced. It will require a remedy apparatus larger than anything ever devised.

VAST MECHANISM SLOW TO BE IMPLEMENTED

The new Resolution Trust Corp has only begun to be defined, formulated, and blessed for operation. Who cares what they call it. A bigger broader and deeper platform is called for, compared to what was constructed in 1990 for usage to clean up the last big bank mess. This crisis will eventually be perhaps 10 times larger. The requisite cleanup platform will be necessarily 10 times larger. Worse, my forecast is that it will be in operation for ten years at minimum, and likely result in a new Administration Cabinet post. If attacks made upon ourselves in the national security arena can produce a new cabinet post to deal with the charade of heightened security, complete with private profiteering at grotesque levels, then so can undermines upon our financial system produce a new cabinet post to deal with the colossal bond fraud and loan portfolio fraud at grotesque levels, complete with Wall Street profiteering at grotesque levels. The point is that considerable profound deep damage will continue while the new rescue platform is being designed, agreed upon, funded, built, implemented, and put in to operation. My forecast is that the New RTC will not begin operation until late 2008 or early 2009. Progress is slow. Plenty of debt security downgrades and bank bond writedowns will be declared in the shadow of the construction of the New RTC. Housing prices continue down while the authorities fiddle and diddle.

Much must be done before a fully functioning platform can fulfill the three tragic functions: 1) buyer of last resort at inflated mortgage bond prices to create a cemetery, 2) recycle loans and package them into mortgage bonds to create a secondary mortgage market centrifuge, 3) renegotiate under-water home loans at lower balances with newly defined mortgage contracts as they stiff the USGovt with the difference from forgiveness. The third function is labor intensive. If you think deep fraud was involved in the Hurricane Katrina Relief programs, then wait until you see the deep fraud in this New RTC. The current Administration has proved beyond doubt that it champions fraud with impunity, tolerates it, and actively creates new opportunities for future fraud. They represent in my view the pinnacle of Institutionalized Dishonesty that has contributed to wreck our national fabric. While all these complicated functions are being designed and implemented before fulltime duty, much like a vast array of fire trucks and passage routes and debris collection and protocol, Rome will continue to burn.

The New RTC 2008 requires a vast apparatus to be created if ever we see a fully functioning platform. It must hire thousands of people. It must contract for several hundred offices. It must procure thousands of pieces of equipment. It must first overcome the limitations imposed upon Fannie Mae & Freddie Mac for past criminal fraud, and overcome inherent obstacles from having negligible capital bases.

If truth be known, the fat pair is probably in the red, as in negative, by a few hundred billion$, maybe several hundred billion$, possibly even a trillion$. That is, if their hedge book ever received proper valuation, marked to market. Of the $6.0 trillion mortgage bond market, Fannie & Freddie hold $4.1 trillion in bonds. The potential for being a full cool $1 trillion in the hole is very conceivable, especially with their credit derivatives in the balance. Freddie Mac now has permission to pursue jumbo mortgages over $700k in loan value. Fannie & Freddie (F&F) were each given a more lax leverage ratio of 20% (formerly 30%) on their capital requirement, thus freeing up another $200 billion in loan coverage. The US Congress also stopped the forced partial liquidation process where F&F had to reduce their book of business. Nobody seems to care much that F&F are full of fraud, full of acidic bonds, and cannot possible serve as an adequate strong foundation for any New RTC platform. Don't get in the way of the remedy! By the way, just a footnote. The Federal Deposit Insurance Corp is another den of fraud with a long ugly history. They are a main player in the fraudulent Mortgage Freeze Program. They were involved in the 1990 Savings & Loan debacle. Their history includes fraud in long twisted threads. They will be called upon when a rash of bank failures occur, most being large banks.

ECONOMIC PENDULUM

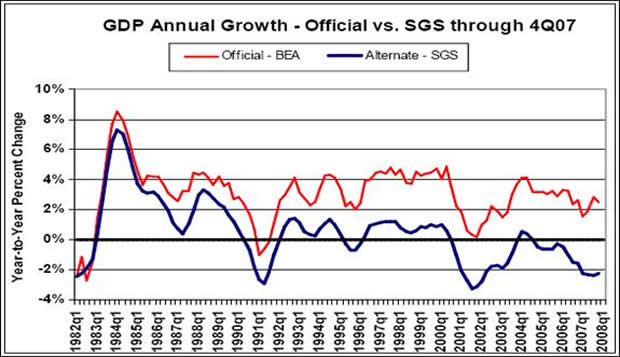

If the bank crisis is over, or at least within view of its end, then not only must the housing decline be close to completion, but the USEconomic recession must be at end and in reversal toward growth again. That is not even close, since the recession has only started. It needs to do its work, to clean the decks of some debt, a lot of debt. The Shadow Govt Statistics folks remove the nonsense, numerical chicanery, deception of calculations, gimmicks, and fraud in order to produce as clear a high level perspective as known in my travels. The USEconomy is moving in reverse by over 2.0% per year, complete with highly destructive price inflation. Leading Economic Indicators are racking up consecutive negative readings. Durable orders are on the decline still, with the important business spending in retreat.

The STAGFLATION word is being used frequently, in accurate manner. That means jobs will continue to be shed, evidence being the new string of wretched Jobs Reports. People losing jobs eventually halt in loan repayment, whether for homes, cars, or credit cards. Businesses that shed their workers often fail to honor some loan obligations. The commercial mortgage arena is the latest to turn sour. The cancer spreads. The overused wrecking ball device of monetary inflation to render cheap the current debts has failed to prevent the debts from escalating out of control, even as it has produced shoddy phony recoveries. The upshot has been sustained price inflation, which further squeezes the system of corporate business profit and household disposable income. A falling USDollar aggravates that entire process. The prospect of gasoline at $4 per gallon will lead to deep problems, the most visible and understood element of pervasive under-reported price inflation. All material costs are rising from diesel fuel surcharges.

The USEconomic recession in progress has only begun. Its end is not within view. Recall the vicious cycles outlined in the perfect storms from early March, in “Dollar-Gold: A Perfect Storm” (click here ). These vicious cycles have only begun to rev up. Their interruption will take a considerable amount of power, that power not seen yet, devices not erected yet, funding not yet arranged, commitment to resolve nowhere yet a deep consensus. Heaven help the USTreasury Bond complex if the equilibrium it seeks tries to factor in what actual price inflation is, and imposes a bond yield in synch with real value erosion from inflation. Asia has already balked at continued USTBond support. Without England and the Arabs, the USTBonds would be toast, losing principal value, and sporting much higher yields. The impact to borrowing costs in the USEconomy and for the USGovt would be truly deadly. We have not yet even touched this nasty cloud.

Incomes continue to slide. With official wages on a slow decline after adjusting for officially stated price inflation, one must properly regard wages as falling by at least 6% to 7% per year. This is an astonishing fact of life, since the official Consumer Price Inflation does not come anywhere remotely close to the rate endured by the people who must live in reality. Household balance sheets have never in modern history been weaker. With over 10% of homes suffering negative home equity, heading for at least 25% by year end, the primary asset for households is reeling in pain. Car sales are reeling downward. Car loans are rotating more into impractical time traps. In 2004, under 33% of car loans had six years or more of installment loan payments. In 2008, that share is now over 45%. So households are increasingly underwater with negative equity in homes and also cars, being upside down after two years into the loan. Consumer confidence is falling off a cliff. Sadly, many households do not realize they are broke without equity in their homes. The rash of foreclosures and quick recent sales has taken down home prices. The February foreclosure count was 60% over last year for the same month.

Fitch reports that default conditions are actually worsening for both subprimes and marginal Alt-A mortgages. All it takes is one or two lower priced home sales to reduce the value of entire neighborhoods in asset writedowns. This trend is nowhere near an end. The second biggest asset of households is stock & bond accounts, which must be under siege or dealing with attrition. Prevention of a recession is a quintessential goal of the USFed and policy makers. The main tool they have is easy money and high volume of new money. It is phony money. Gold responds in acute fashion, as always. The recession will render more loans in default, which is its purpose. Bank bonds will be further harmed, as the vicious cycle turns and spins more destruction. The banks will fall like pigeons from the sky. Gold and the USDollar will react accordingly. By June, the bank crisis will intensify, even cause panic.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“Your financial commentaries are extremely insightful and have saved me a ton of money. The subscription has more than paid for itself. This should be an interesting year to say the least!” (RickF in Texas )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.