Commodities 2013 Halftime Report: A Time to Mine for Opportunity?

Commodities / Commodities Trading Jul 16, 2013 - 05:54 PM GMTBy: Frank_Holmes

It was a challenging first half of the year for most commodities, with only two resources we track on our Periodic Table of Commodities Returns rising in value. Natural gas and oil rose 6.5 percent and 5 percent, respectively, while silver lost a third of its value and gold lost a quarter of its price from the beginning of the year.

It was a challenging first half of the year for most commodities, with only two resources we track on our Periodic Table of Commodities Returns rising in value. Natural gas and oil rose 6.5 percent and 5 percent, respectively, while silver lost a third of its value and gold lost a quarter of its price from the beginning of the year.

At first glance, the correction seems to support naysayers who believe the supercycle in commodities has ended, such as Credit Suisse analysts, who had declared that the “era is over,” in its digital magazine, The Financialist.

We disagree. Instead, we see severe price declines as possible buying opportunities during this ongoing commodity supercycle.

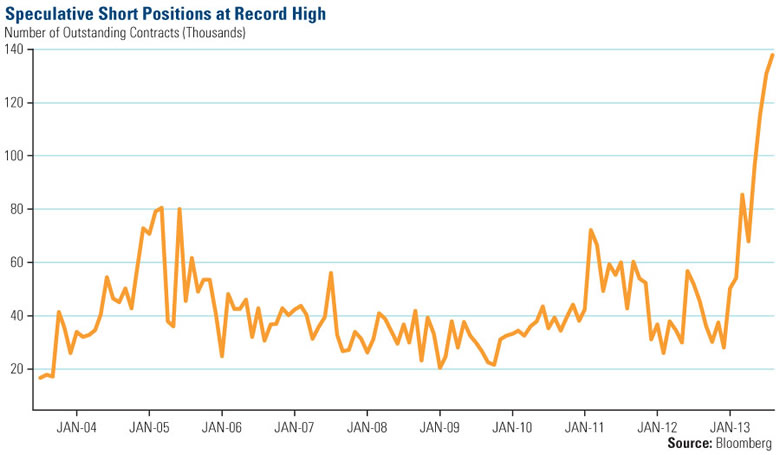

Consider the extreme pessimism on gold. As one measure of how bears have ganged up against the yellow metal, take a look at the spike in the level of short positions on the precious metal since the beginning of the year. As of the beginning of July, the number of outstanding gold short contracts was close to 140,000!

In June, while I was on CNBC’s Squawk Box, Howard Ward, the chief investment officer of GAMCO Investors, made a bullish call based on the severity of the speculative short position:

“It was off the charts, just like it was a week ago for the short position and the yen, the pound and euro. Well, we’ve seen what happened to that. You wanted to be on the other side of that trade. I’ll take the other side of the gold trade as well. Whenever so many people are on one side, I will take the other side. I think gold probably rallies between here and the end of the year.”

There is certainly a pervasive sense of doom and gloom not only for gold, but for the entire resources space. BCA Research’s Commodity & Energy Strategy report points to a recent Bank of America-Merrill Lynch fund manager survey, which shows that exposure to commodities is as low as it was at the end of 2008. The firm’s first-hand experience reveals a similar investor reaction to resources: “Recent client visits to Europe, Australia and Asia confirm widespread pessimism towards the outlook for ‘anything outside the U.S.,’” says BCA.

This is all music to a contrarian’s ears because it’s another sign of a bottom, but BCA advises taking a “patient approach to front-running the eventual cyclical rally in commodities.” It’s all about your time horizon, says the firm.

Supercycles are not short-term; rather, they are long, continuous waves of boom and bust that can last several decades. While the overall trend is up, there are often short-term bursts of volatility. And looking over the next decade or so, the trends driving the current commodity supercycle remain in place.

I recently read an insightful report on the subject from ETF Securities. In it, analysts highlight two primary long-term drivers.

One entails the urbanization and industrialization trends that are “resource-intensive,” specifically, those found in emerging markets with large populations. Take their energy use, for example, which is “only a fraction of the developed world equivalent,” says ETF Securities. Developed markets, including Australia, France, Germany, Japan and the U.S., all have a higher GDP per capita as well as greater energy use than the emerging markets of Brazil, India, Mexico and China. These countries have significantly large populations, and “a relatively modest rise in per capita energy use will transform into a large absolute increase in global energy use.”

According to ExxonMobil’s 2013 “Outlook for Energy” report, the energy demand in developing nations “will rise 65 percent by 2040 compared to 2010, reflecting growing prosperity and expanding economies.”

The second driver of the supercycle is the rising cost to produce many commodities, says ETF Securities. I’ve discussed on numerous occasions the difficulties facing gold miners, which have seen lower grades and a lack of discoveries. This has made mining the yellow metal more expensive. And, as I indicated in a recent post, with a lower gold price, miners are rethinking projects that are too costly.

With many other commodities, resources companies are increasingly facing labor strikes, increased taxes and a backlog of projects that ultimately drive up the cost to mine and produce.

We agree with ETF Securities that the supercycle in commodities is alive and well. We are also in agreement with Credit Suisse when the firm explains that “the prices of individual commodities will no longer rise and fall together as they have for the last five years.” Instead, investors “are going to have to focus on the specific supply and demand dynamics for individual commodities.”

In this environment, an active manager with a wealth of experience can thrive. In our experience, commodity prices can move quickly and an active manager is able to tactically shift assets into areas of opportunity.

So, instead of trying to guess which commodity will outshine all others, we suggest diversifying across all commodities to try to smooth out the inherent volatility. See the approach that the Global Resources Fund (PSPFX) takes here.

And when it comes to gold, my position remains: Maintain a 5 percent weighting in gold bullion and a 5 percent weighting in gold stocks, selling when the price moves up significantly and buying when the opportunity presents itself.

Want to receive more insights on gold, natural resources and emerging markets? Provide us with your email address and you’ll receive a note every time Frank Holmes updates his blog. You can also follow U.S. Global on Twitter or Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.