Why Millions of Americans are Still "Trapped" in Their Homes

Housing-Market / US Housing Aug 09, 2013 - 07:24 PM GMTBy: Money_Morning

Gary Gately writes: For millions of Americans who were underwater on their mortgages, the tide is finally receding.

Gary Gately writes: For millions of Americans who were underwater on their mortgages, the tide is finally receding.

That's good news for the housing market, of course, and for the U.S. economy as a whole, as housing is a major engine of the economy.

Housing not only generates construction jobs, one of the hottest job sectors in the country right now, it also sparks spending on home furnishings and appliances. And as home prices increase, people feel more wealthy and tend to spend more.

Housing not only generates construction jobs, one of the hottest job sectors in the country right now, it also sparks spending on home furnishings and appliances. And as home prices increase, people feel more wealthy and tend to spend more.

The number of homeowners underwater - those who owe more on their mortgage than their home is worth - dropped in the first quarter to 25.4% percent of all mortgages, or 13 million homeowners, from 31.4 % a year earlier, real estate researcher Zillow reports.

Getting out from under debt and building enough equity enables homeowners to sell their homes and buy more expensive ones, which in turn boosts the housing market.

But many of those who are no longer underwater - known in real estate circles as "negative equity" - still don't have enough equity in their homes to put them on the market and move into another home.

Zillow says these homeowners, with 20% or less equity, have "effective negative equity" - and they comprised 43.6% of all U.S. mortgages in the first quarter, down from 48.7% a year before.

With many of these homeowners effectively trapped in their homes, the shortage of inventory of homes for sale continues in many markets, driving up prices, but often not enough - yet - that these homeowners can sell for enough to enable them to move.

With hardly any equity in their homes, despite the rising prices, homeowners also are frozen out of refinancing their mortgages and lowering their interest rates and monthly payments. That means they don't get a chance to put more cash in their pockets and drive retail sales higher.

Americans are "Trapped" in Their Homes

"If they have less than 20 percent equity in their home, it really makes it extremely tough for them to sell their house, cover the transaction costs of selling the home and then have enough money left over for a down payment for the next house," Zillow senior economist Svenja Gudell told Money Morning.

"If they have less than 20 percent equity in their home, it really makes it extremely tough for them to sell their house, cover the transaction costs of selling the home and then have enough money left over for a down payment for the next house," Zillow senior economist Svenja Gudell told Money Morning.

"To return to a completely normal market is very much a function of how quickly folks reach positive equity again," she said.

Money Morning Capital Wave Strategist Shah Gilani agreed.

"Until the rise of home prices readily exceeds the mortgaged loan value, it's all an 'effect.' It's not real," Gilani said.

"The real measure isn't the rising number of homes becoming less under water; it's only real and only really going to impact the economy if those homeowners can sell their homes. Otherwise, the 'effect' is smoke and mirrors."

But with the housing market recovering and prices rising, real estate experts note the number of underwater and nearly underwater mortgages has been on the decline, enabling many homeowners to sell their homes and move.

As prices keep rising, the number of homeowners trapped in their homes will continue to decline.

"Rising prices lift more people back above water.... It means they're less likely to feel trapped in their homes, and that's important to the housing market especially because inventory is so very tight," Jed Kolko, chief economist at real estate website Trulia.com, told Money Morning.

And as more homeowners get out from under, the effects spread well beyond those homeowners - and beyond the housing industry, Kolko said.

"It's important for consumer confidence but also for consumer spending because as prices rise both for people who get back above water and for people who get farther up into positive equity, they feel richer and that often translates into more consumer spending, which in turn helps stimulate the economy," he said.

Celia Chen, an analyst with Moody's Analytics, told Money Morning the decline in underwater mortgages is good for the housing market and the economy as a whole and creates jobs not only in construction but also in industries such as manufacturing, retailing and finance.

Chen pointed out the reduction in underwater mortgages also reduces the potential for default and enables more homeowners to trade up.

Shortage of Inventory

Home prices have been rising partly as a result of a shortage of inventory in numerous markets, including some like Las Vegas, Sacramento, Phoenix and Oakland where prices declined the most in the housing crash.

Even so, though, a staggering proportion of homeowners have negative equity or effective negative equity.

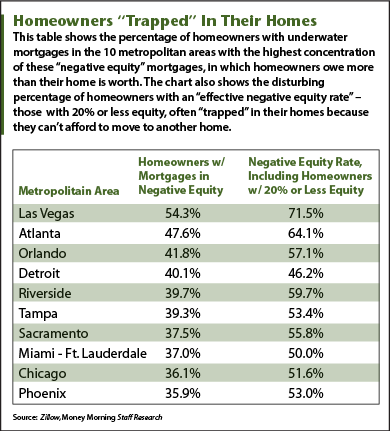

In Las Vegas, for instance, 54.3% of homeowners were underwater and 71.5% had less than 20% equity in the first quarter of this year. In Atlanta, 47.6% had negative equity, 64.1% effective negative equity, while in Orlando, 41.8% had negative equity and 57.1% effective negative equity.

"We won't be out of the housing quagmire until prices are back to break-even and then only if transactions happen," Gilani said.

Gilani said tight lending standards and high down payments make it tough for underwater homeowners or those with low equity to sell and move to another home.

For now, Gilani said, "We're no way near being out of the housing hole."

Even with some homeowners struggling under mortgage debt, the housing market has been on the rebound and you can learn How to Profit from the Housing Market Recovery.

Source :http://moneymorning.com/2013/08/08/why-millions-of-americans-are-still-trapped-in-their-homes/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.