U.S. Treasury Bonds Break Down, Stocks and Commodities Not Far Behind

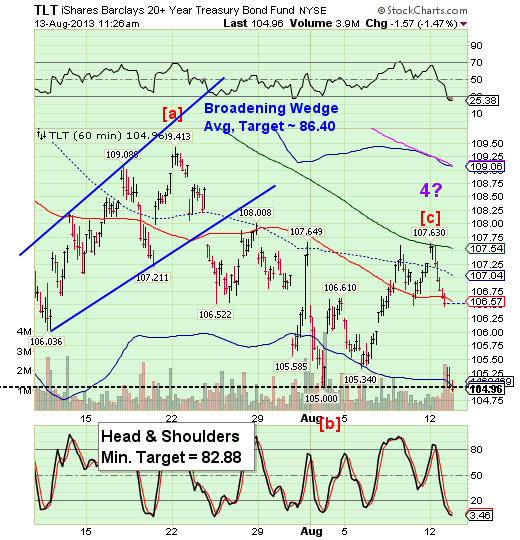

Stock-Markets / Financial Markets 2013 Aug 13, 2013 - 04:13 PM GMT The big news of the morning is the breakdown of the Treasury Bond market. TLT broke the prior low at 105 and triggered a potential Head & Shoulders neckline with a target at 82.88. There are two noteworthy items about the formation on the chart. The first is that Minute Wave [c] is shorter than its counterpart Minute Wave [a]. Second, this comes after a very short 17-day rally off the bottom of its last Master Cycle in Minute Wave [a]. This clearly indicates that the downside forces are much greater that the positive ones. Treasuries are in a hurry to make further lows.

The big news of the morning is the breakdown of the Treasury Bond market. TLT broke the prior low at 105 and triggered a potential Head & Shoulders neckline with a target at 82.88. There are two noteworthy items about the formation on the chart. The first is that Minute Wave [c] is shorter than its counterpart Minute Wave [a]. Second, this comes after a very short 17-day rally off the bottom of its last Master Cycle in Minute Wave [a]. This clearly indicates that the downside forces are much greater that the positive ones. Treasuries are in a hurry to make further lows.

GLD made a Trading Cycle high yesterday. Remember, Trading cycles are 60 days in length, which is exactly the time period from the Master Cycle low on June 13. However, it is not higher than the Primary Wave [A] high made on July 23. The reason? Wave [A] was the Cycle Top in a left-translated (25-day) rally from the Master Cycle low. As a result, yesterday’s Primary Wave [C]’s high had to be lower than the July 23 high at 130.14…and it was.

Had it been higher than 130.14, there would have been a good probability of this Wave [C] extending much higher as I had discussed in the past two weeks. That appears to no longer be a probability.

SPX also has had a breakdown after completing its Minute Wave [ii] high. It is bouncing in a corrective manner to relieve the oversold condition. A look at RSI and Slow Stochastics suggest it is not doing a very good job of it. This could mean that the decline may continue in an oversold condition, which is a potential crash behavior.

The next downside target may very likely be the 50-day moving average at 1654.00.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.