U.S. Housing Market New Homes Sales Plunge 13.4% on Rising Mortgage Rates

Housing-Market / US Housing Aug 24, 2013 - 12:48 PM GMTBy: Mike_Shedlock

On August 14 I penned Mortgage Applications Decline 13th Time in 15 Weeks; Are Mortgage Rates Cheap? What's Next For Housing?.

On August 14 I penned Mortgage Applications Decline 13th Time in 15 Weeks; Are Mortgage Rates Cheap? What's Next For Housing?.

Pertinent Snips

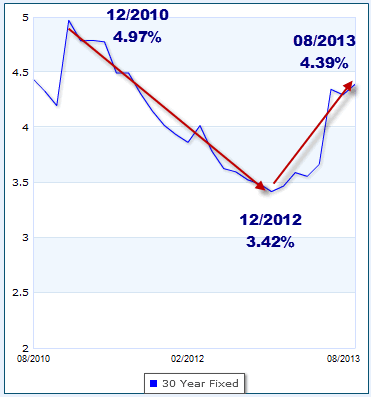

30-Year Fixed Rate Mortgages

Explaining the Rebound in Housing

If you are looking for what fueled the rebound in home sales and the increase in home prices, look no further than the above chart.

In the two-year period from December 2010 until December 2012, the rate on popular 30-year mortgages fell from 4.97% to 3.42%, a decline of 155 basis points (1.55 percentage points). In April, rates were still near record lows at 3.56%.

Treasury Yields and Housing Affordability

On June 24, in 10-Year Treasury Yield Up 100 Basis Points Since May; What's That Mean for Mortgage Rates and Housing Affordability? I commented ...

Anyone who stretched to buy is no longer qualified unless they locked some time ago.

Refinancing will soon be dead in the water (anyone who has not already locked no longer has any incentive) and new home affordability has taken a big hit.

Mainstream media talking heads say this will not affect the housing recovery. Assuming this trend sticks (even if rates simply level off now), how can this bond revolt not affect housing?

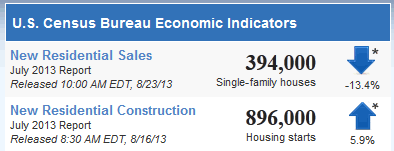

Sales Plunge Starts Rise

Today, the Census Bureau reports New Home Sales Plunge 13.4%

June was revised lower to 455,000 from previously reported 497,000.

Why the Surprise?

None of this should be a surprise given what I said on August 14. Nonetheless, it was a surprise.

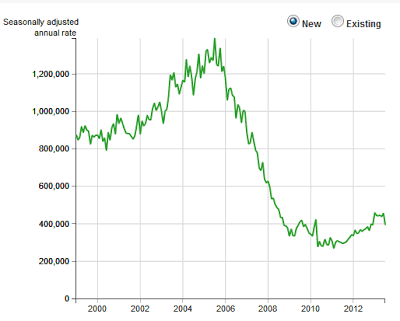

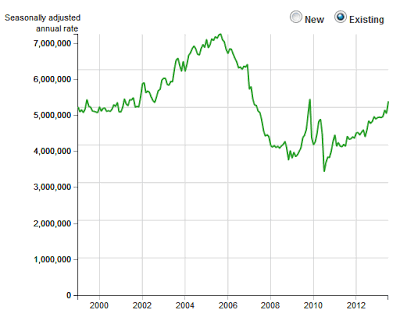

USA Today posted charts of new and existing sales along with this comment "Sales of new homes plunged in July. The seasonally adjusted annual sales pace of 394,000 missed analysts' expectations of 487,000."

New Home Sales

Existing Home Sales

Comments From Bloomberg

Here's a few comments from Bloomberg.

Sales of newly built homes declined 13.4 percent to a 394,000 annualized pace, the weakest since October, following a 455,000 rate in the prior period that was lower than previously estimated, Commerce Department figures showed in Washington. The median estimate of 74 economists surveyed by Bloomberg called for a decrease to 487,000. Last month's decline was the biggest since May 2010.

Purchases of previously owned homes jumped in July to the second-highest level in more than six years, data showed Aug. 21.

"New-home sales data was weak, but the existing-home sales was very good -- there's nothing that changes the FOMC general picture that the housing market continues to recover," Greg Anderson, head of global foreign exchange strategy at Bank of Montreal, said by phone from New York

That's a rather curious statement from the head of global foreign exchange strategy at Bank of Montreal.

New home sales are recorded at signing while existing home sales are recorded at closing. The surge in existing sales reflects contracts written months ago and possibly contracts rushed to closing to beat rate increases. Thus, we need to wait a month minimum to see what effect rising rates had on existing sales.

The plunge in July new home sales coupled with June revisions lower perfectly coincides with rising rates and "Mortgage Applications Decline 13th Time in 15 Weeks".

Builders Still Optimistic

Don't worry! Builders aren't. Housing starts are up 5.9% to a whopping 896,000 with sales coming in at an annual rate of a mere 394,000! Is that optimistic or what?

I sense a drop in prices and a further plunge in home buying if mortgage rates continue to rise. Home builders and analysts will be surprised when that happens.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.