Was Second Quarter The Peak For U.S. Economic Recovery?

Stock-Markets / Financial Markets 2013 Aug 30, 2013 - 07:18 PM GMTBy: Sy_Harding

With economies in China and Japan, the world’s second and third largest economies slowing, and economies in emerging markets and the 17-nation eurozone struggling mightily, hopes have been that the U.S. economic recovery will pick up its anemic pace and provide more global support.

With economies in China and Japan, the world’s second and third largest economies slowing, and economies in emerging markets and the 17-nation eurozone struggling mightily, hopes have been that the U.S. economic recovery will pick up its anemic pace and provide more global support.

Markets around the world received some really good news in that regard this week. The U.S. Commerce Department revised second quarter GDP growth significantly higher, to an annualized rate of 2.5% from its original report a month ago of only 1.7%.

However, global markets paid no attention, continuing their declines in a negative week to end a quite negative month.

Why were markets not impressed by the upward revision of second quarter economic growth?

Could it be that markets, always looking ahead, are seeing the second quarter as possibly having been the peak of the U.S. economic recovery?

There are indications that could be so. The second quarter of April, May, and June may be old news given the decidedly negative reports that began in June and have continued in July and August.

That is particularly so in the employment picture and the all-important housing industry.

The Labor Department’s last jobs report showed only 162,000 new jobs were created in July, and the previous report of 195,000 in June was revised down to 188,000.

In the all-important housing industry, a major driving force in the recovery, the reports have been especially negative.

New housing starts plunged 9.9% in June, to their lowest level in ten months. Permits for future starts fell 7.5%. Existing home sales declined 1.2% in June, versus the consensus forecast for a 1.5% increase. Pending Home Sales fell 0.4% in June, and another 1.3% in July. Construction Spending fell 0.6% in June, well below the consensus forecast for an increase of 0.5%.

Then there were miscellaneous surprises like this week’s report that Durable Goods Orders fell 7.3% in July, and that consumer spending barely held on, rising just 0.1% in July versus the consensus forecast for an increase of 0.3%. Then there was the previous week’s report that the Chicago Fed’s National Business Index, a compilation by the Fed of 85 different economic indicators, remained negative at -0.15 in July, indicating economic contraction.

Against that backdrop markets may also be factoring in the reversal this year of the fiscal stimulus (elevated government spending and tax cuts) that has been so important in the economic recovery of the last five years, and the potential that the Fed may begin to taper its monetary stimulus soon.

In any event, the failure of global markets to react positively to the surprising upward revision of second quarter GDP seems odd.

I could perhaps believe the popular opinion this week that the problem with global markets has been the situation with Syria - except that the alleged use of chemical weapons took place August 21, nine days ago.

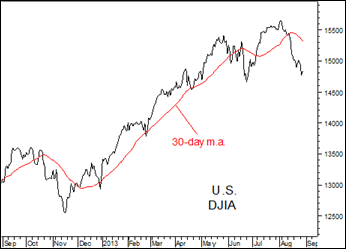

The U.S. market topped out August 2, four weeks ago, Asian markets several months ago, and European markets on August 15.

Markets are good at forecasting economic downturns, but of course have no way of predicting some individual off-the-wall event like Syria is going to take place, especially weeks and months before it does.

So it looks suspiciously like markets are expecting the second quarter was the peak for the U.S. recovery, at least for a while.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.