Oil Companies Shifting To Electric Gold

Commodities / Electricity Sep 18, 2013 - 06:19 PM GMTBy: Andrew_McKillop

PURE AND SIMPLE ECONOMICS

PURE AND SIMPLE ECONOMICS

Outside the US, Canada, China, Australia, India, South Africa, Indonesia and a certain number of other countries, electricity has become a highly valued asset for the financial strategy of leading energy companies – starting with Big Oil. In the highest-priced region for electricity – the EU – Eurostat gives the average price for household consumers as 11.9 euro cents (15.5 US cents) per kWh in 2012 pricing electricity at around $248 per barrel of oil equivalent.

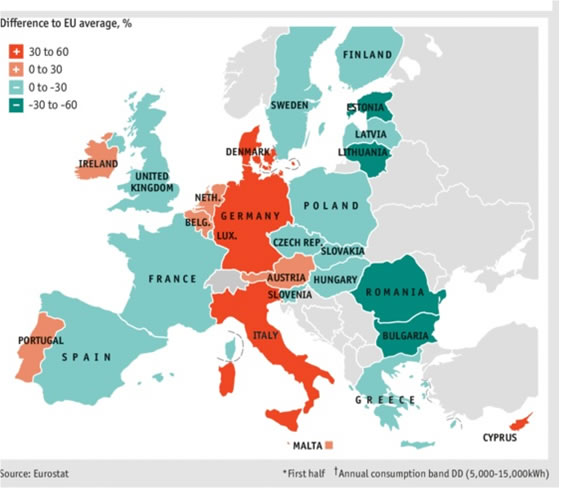

Source 'Economist' based on Eurostat data

The above map is set to change – with a vengeance – as Europe's climate correct energy policies, called the climate-energy package, aided by powerful tailwinds from the so-called “financial community” set fast rising electricity price rises across the Union. France for example has in 2013 announced that electricity price rises for the next 3 years will be 10% each year. Germany's own version of the climate-energy package, called Energiewende, is a wonder for raising traded electricity prices. These are easily able to attain more than 35 euro cents per kWh at “bad times” of the day, week, month or year when the nation's windpower and solar power capacity is low performing.

Peak prices in Germany and some other particularly righteous guardians of climate correct, including Italy, Spain, Denmark and Portugal can reach 70 cents/kWh at really bad times for consumers – which are wonderful times for bankers, brokers, traders and the so-called “financial community”. Electricity can therefore be produced and sold in Europe, at the right times for the price-gouging financial sector, at prices topping $450 per barrel equivalent of energy. There is no need for a war against Syria to gouge energy prices that high!

CLIMATE CORRECT – ECONOMIC SUSPECT

The Kyoto Protocol and EU 2020 energy targets are increasingly altering the energy industry landscape, gradually shifting energy consumption from coal, oil and natural gas, towards renewable energy sources. To meet the stated renewable energy goals (the national REAPs) while also pursuing the goal of energy security and independence - severing dependence on foreign oil and gas imports (but not coal imports) - European governments have laid an ultra-favourable groundplan for drawing new investments to electricity generation – especially based on renewable energy. Linked with this, there are large and generous, corporate-friendly “carbon abatement” development and research programs.

Only in theory, the carbon-free future would threaten O&G (oil and gas) companies with declining business growth in Europe. This line of patter has been taken to its ultimate by the UK's Lord Stern who claims that 60%-80% of all coal, oil and gas reserves of publicly listed and traded companies are 'unburnable' if the world is to have a chance of not exceeding global warming limits, set at 2 degC. Stern calls these energy reserves “stranded assets”. http://www.carbontracker.org/wastedcapital

Another line of patter developed by the promoters of this corporate strategy - such as Frost & Sullivan, Platts, Wood Mackenzie and others - is that O&G corporations must invest in power generation, distribution and sales – of course starting in the world's highest priced regions for electricity. Doing this, they can transfer their technology and skills into renewable energy while “discovering” new business opportunities.

Frost & Sullivan paint a particularly attractive picture for corporate profit gougers in Europe. Only using data to 2009, it claims that spending by Europe's renewable energy industry (offshore and onshore wind, geothermal, solar, marine and biofuels) boomed in 2006-2008 as the share of renewable energy, mostly in the EU power generating mix, increased from 14.6 percent to 16.3 percent. The corporate strategy and consulting firm was however forced to note that EU electricity demand has stagnated, while oil and gas demand have declined. It carefully does not mention that European coal demand – mostly imported – is on a tear, due to economic blowback from climate-energy policies. Imported coal remains at rock bottom prices, and the price of European ETS emissions credits has collapsed, resulting in coal-fired power being unbeatably cheap compared to other sources.

European defenders, or apologists of corporate price-gouging across the energy space – and particularly electricity price grouging – advance the energy security and independence goal, when pressed on the collapse of ETS, due to pure and simple overprinting and overissuance of CO2 credits, which has dramatically changed the economics of power production Europe. They claim that reducing EU dependence on gas imports (oil is almost not used at all for power production) is such a critical goal – that electricity prices able to attain $450 per barrel of oil equivalent are “justified”.

Also, the simple fact that EU consumption of electricity, in a large number of countries, has declined each and every year since 2008 while renewable-based power production continues to rise, is not explained as simply due to ever-rising power prices, deindustrialization and outplacement, and economic recession. Instead, the consulting firms which feed off corporate price gougers are pressing their hoped-for clients to go for the jugular – European governments obsessed by “carbon effluent in the atmosphere” and prepared to rack up power prices, spend their taxpayers's money, and increase state borrowing and national debt to finance epic-scale renewable energy projects. The poster child for these are ultra-expensive offshore windfarms.

One of the most attractive renewable energy areas for O&G companies is offshore wind. The offshore wind market, fast growing and backed by government support, must nevertheless overcome bottlenecks in the supply of components and a lack of purpose-built installations. The O&G industry can help offshore wind through experience and technology transfer and sharing equipment and labour force.

ANYTHING EXPENSIVE WILL DO

Another renewable energy sector recommended to O&G companies – for power production at the highest possible price – is the geothermal energy market. For basic technical reasons, geothermal energy resources and reserves are most suited to producing heat – not electricity. In the EU, some 50% of all energy of all kinds is used to produce heat in the temp range of 50 – 85 degC.

O&G companies have drilling expertise and services, and in some ultra-deep offshore oil and gas areas, such as the North Sea are producing hydrocarbons with a well-head temperature often at 175 degC. But to raise the price of electricity produced from geothermal energy, the development strategy must seek large scale, remote area geothermal energy development, unable to economically collect and transport heat energy to urban areas. Only the electricity produced from geothermal heat will be commercialized. This corporate price gouging strategy is called Enhanced Geothermal Systems (EGS) technology.

Solar energy, to be sure, remains corporate-friendly but the attraction is waning – world overcapacity of solar PV manufacturing is extreme, and prices have crashed. More important therefore, government FITs (feed in tariffs) and other subsidies must be maintained, to enable power price gougers to extract huge profits – this is politely called “great potential but still needs subsidies”. O&G corporate interest in the solar energy sector is for the least unsure and uncertain – due to the uncertain future of FITs and massive overcapacity in the solar industry.

The marine energy sector also offers high-cost power production potentials, and is therefore touted by firms such as Frost & Sullivan. This market could or might for example “recycle” offshore O&G platforms and infrastructures, and could or might be linked to offshore windfarm development. Marine energy can be non-intermittent, depending on technology and location, but without open-chequebook support from governments is of very low interest to corporate profit gougers who want the fastest buck return from their “alternate energy” asset plays.

Biofuels still offer opportunities - but not in the EU, where this market has collapsed due to subsidy withdrawal and the whittling down of EU energy policy targets for the percentage share of biofuels in European road transport by 2020, from a 10% goal in 2008, to at present 5.5%. Biofuels production costs are high from “first generation food crop sources”, and the heralded second generation of cellulose-based biofuels will need very heavy R&D spending – that no corporate price gouger is interested in. At present in the EU, biofuels producers are facing negative profit margins and also face competition from Brazilian or US ethanol exporters, and Indonesian or Malaysian palm oil exporters.

This focuses near-term and ongoing O&G corporate interest in power production to generating power in the highest-priced electricity markets, also taking a downstream value added strategy, including power T&D (transport and distribution), and any method or means for raising final-consumer prices, such as smart metering. Several oil majors are actively engaged in this strategy, but will only continue it as long as national government politicians continue their climate correct whining – as they shuffle huge new profits to their crony corporate benefactors and drive tens of millions of consumers into fuel poverty.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.