Yahoo Stock - Buy, Sell or Hold?

Companies / Tech Stocks Sep 19, 2013 - 11:10 AM GMTBy: Money_Morning

David Mamos writes: For over a year now former Google all-star Marissa Mayer has been at the helm of Yahoo! Inc. (Nasdaq: YHOO) and has managed to steer the ship in one focused direction.

David Mamos writes: For over a year now former Google all-star Marissa Mayer has been at the helm of Yahoo! Inc. (Nasdaq: YHOO) and has managed to steer the ship in one focused direction.

So far Wall Street has been enamored with Mayer as a businesswoman and a personality. She has outlined a much clearer vision for Yahoo than her predecessors.

Investors in Yahoo stock are happy - the share price is up more than 80% since Chief Executive Officer Mayer took charge.

That gain looks juicy for thirsty investors, but before buying in, we have to ask the question: Is this run over, or can Mayer keep delivering...?

What Mayer's Done for Yahoo

Here's what Mayer has done right.

Mayer's mantra is, "People, then products, then traffic, then revenue" - a step-by-step approach to turning the company around.

In September 2012, after Yahoo sold nearly half of its original 40% share of Chinese e-commerce company Alibaba for $7.6 billion before taxes, Mayer went on a shopping spree.

To date she has acquired more than 20 mostly startup companies. The idea is not only to buy the unique applications and products of these startup companies, but also to lock in the creative talent pool of engineers into long-term contracts that keeps them under the Yahoo umbrella.

The largest and most dynamic purchase was the acquisition of Tumblr for approximately $1 billion. Tumblr is a free social media/blog platform that caters to the younger crowd and has a strong mobile presence. Yahoo is trying to regain its standing as "trendy," and its association with Tumblr is one way to combat the stagnation of Yahoo's appeal.

With advertising being Yahoo's focal point of revenue, it is going to be interesting to see how this takeover plays out when Tumblr, which is currently free and offers no ads, re-engineers itself to a make a profit on a group of kids with no money.

There are many doubters (myself included), although supporters will point to Facebook's purchase of Instagram as proof that it can work. But then again I can retort with "Remember MySpace?"

As far as the other smaller companies/products Yahoo has purchased, they run the gamut of various ultra-narrow slices in the technological world.

One thing is clear - they are all geared toward mobile smartphones and tablets.

But, is there room for Yahoo in the mobile sphere when it has to contend with Google and Facebook for every advertising dollar?

Mobile advertising has been a struggle for all companies and is the reason why Yahoo is viewing it as the only area where it has a chance to compete with the big boys.

After all, Yahoo is continuously slipping further and further with its traditional online-advertising revenue model, which currently represents 40% of the company's sales.

The online-advertising market grew 15% last year, according to the Interactive Advertising Bureau, but Yahoo lost market share. Yahoo's slice of this $17 billion market is expected to keep decreasing, from 9.2% in 2012 to 7.9% in 2013. Meanwhile, Google's and Facebook's are expected to grow.

Therefore, it is no wonder that Yahoo is betting its future growth on mobile advertising.

Especially when its profitable relationship with its cash cow is about to change...

China Is Yahoo's Backstop

Yahoo owns a 24% stake in privately held Chinese e-commerce company Alibaba, which has been dubbed the "Amazon of China."

Comparing Alibaba to Amazon is misleading; it generates more revenue than Amazon and eBay combined.

And it's growing like crazy. Sales soared by 71% in the first quarter, with net income rising over 200%.

That's because - as our Private Briefing investment service editor Bill Patalon told investors in his Aug. 21st column - online retail sales in China rocketed a scorching 60.2% in the first six months of 2013 to reach $139.62 billion (855.9 billion yuan).

According to Internet Retailer, China is poised to be the world's biggest online retailer market, surpassing the United States this year.

This $1 billion investment, arranged by Yahoo co-founder Jerry Yang back in 2005, has propelled huge revenue gains for Yahoo.

For Yahoo investors, Alibaba has provided share-price protection in the short term.

But there's a looming change that could disrupt this sweet deal.

Alibaba is expected to go public later this year, and this will change the dynamic between the two companies. Yahoo will have to divest some of its stake in Alibaba.

Alibaba's value varies from analyst to analyst, ranging anywhere from a market cap of $50 billion to $120 billion. If an initial public offering (IPO) were to price at the higher end, it could turn into $30 billion of value for Yahoo.

If Mayer uses that billion-dollar boost wisely, it could push Yahoo ahead of competition - but it would have to be enough to make up the revenue loss from Yahoo's stake in Chinese growth.

A Yahoo Game Changer

There is a way Mayer has been winning - and one that could transform the company if played right - and that's eyeballs.

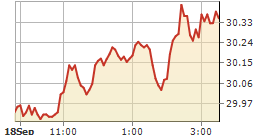

NASDAQ: YHOO

NASDAQ: YHOO

Sep 19 10:20 AM

Price: 30.46 | Ch: 0.02 (0.1%)

For the first time in two years, Yahoo bested Google by 4 million visitors in July 2013, according to a report by comScore - and these figures don't include those from the Tumblr purchase.

However, so far eyeballs haven't translated into profits...

The jury is out on whether or not Yahoo can compete with either the likes of Google with its Android operating system and mobile advertising or the very powerful Facebook app and its advertising.

Yahoo is placing a lot of small wagers and parlaying its Alibaba windfall into its new acquisitions with the hope that one of them turns out to be the big winner.

It is important to note that this success not only includes the future value of an Alibaba IPO but also a massive share buyback funded through the proceeds from the partial sale of Alibaba in September 2012.

Bottom line on Yahoo (Nasdaq: YHOO) stock: If I were a current shareholder, I would want to hang on to this stock until the Alibaba story plays itself out further. Yahoo may have been a very smart way to play the Chinese e-commerce boom, but going forward, Yahoo will be just another company trying to find a niche in the ultra-competitive mobile advertising world.

For more on tech stocks like Yahoo, check out The Ultimate Tech Stock "Treasure Map"

About the Author: David Mamos brings nearly 15 years of analytical experience to the table with a background ranging from big-picture fundamental analysis to highly technical trading decisions. He began his career working as a financial advisor with Royal Alliance in 2001 and helped clients with portfolio management as well as buy-sell decisions before transitioning to the development, implementation, and execution of trading strategies for aggressive investors.

Source :http://moneymorning.com/2013/09/10/...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.