COMEX Gold Registered Inventories - JP Morgan Moves the Shells Again

Commodities / Gold and Silver 2013 Oct 01, 2013 - 01:11 PM GMTBy: Jesse

With regard to metals inventories, the eligible category includes any bullion of a suitable format that is held in one of the COMEX authorized warehouses, which are individually managed by one of the bullion banks.

With regard to metals inventories, the eligible category includes any bullion of a suitable format that is held in one of the COMEX authorized warehouses, which are individually managed by one of the bullion banks.

The second category of metal is called registered, or dealer, bullion inventory. This is bullion of a suitable format that is held in one of the COMEX authorized warehouses, AND has been registered as deliverable into the market by its owner.

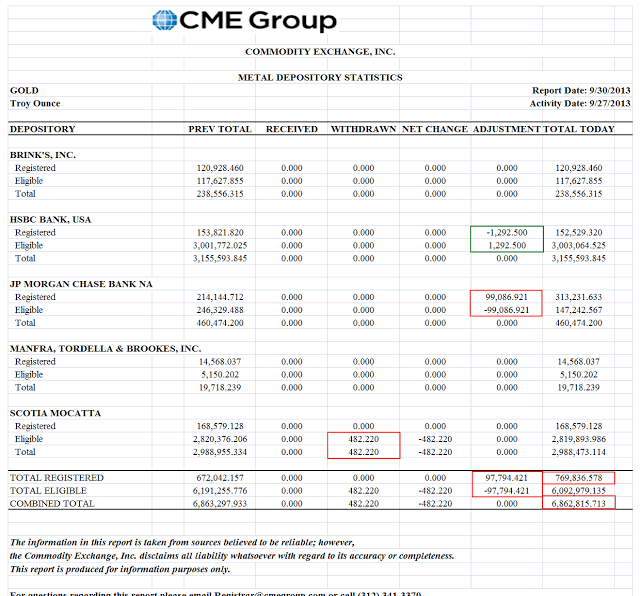

Yesterday JP Morgan changed 99,086 ounces of gold bullion in its warehouse from eligible to registered. Since as you know if you frequent this café, the level of registered gold was at record lows, and so with the advent of the October deliverable month, Morgan thought they would throw a tranche of metal into the breech.

I will put up the graphs of inventory levels as they become available later tonight.

As you know tomorrow begins the active delivery month of October for precious metals on the COMEX.

With a few other minor changes, the total amount of gold bullion at the COMEX, both registered and eligible, now stands at 6,862,816 ounces. This is a very low level of total inventory.

The total amount of registered, or 'deliverable' gold, is now at 769,837 ounces. This is better than it has been, and will bring the 'owners per ounce' back down from the stratosphere.

But it does have the character of 'robbing Peter to pay Paul,' since all the metal comes from the eligible category which seems to be attracting no new bars of high quality 100 oz. bullion. And so it does nothing to improve the leverage of all paper claims to allocated ounces of real gold bullion.

While October is active, the month of December is the one that will test the resolve of the bullion banks and their masters to continue to cap the precious metals at artificially low prices, before their discretionary horde of bullion becomes too thing to hold the line.

Antics notwithstanding, the flow of gold from West to East is steady, pronounced, and certainly no secular phenomenon, but a great trend change that is being driven by an evolution in world finance.

The metal came from within the warehouse structure, so it resulted in the same amount of metal leaving the 'eligible category.' They cling to the thin threads of their great shell game that has run past its prime.

That game will end when someone puts a stop to the motion on the table, and forces the bullion banks to show what they have in both hands. And then there will be a reckoning of accounts, which is long past overdue.

Weighed, and been found wanting.

Stand and deliver.

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.