UK House Prices Plunge Over the Cliff

Housing-Market / UK Housing Apr 08, 2008 - 07:13 PM GMTBy: Nadeem_Walayat

UK house prices plunged by 2.5% in March (Halifax seasonally adjusted), the fall was far bigger than estimates and points to an acceleration in the pace of house price falls across the UK.

UK house prices plunged by 2.5% in March (Halifax seasonally adjusted), the fall was far bigger than estimates and points to an acceleration in the pace of house price falls across the UK.

The credit crisis is continuing to lead to a much tighter mortgage lending environment as highlighted in December's article. Mortgages continue to vanish from lenders shelves, with the total number of products having been reduced from 11,000 in May 2007 to just over 3000 today. The tightening is as a consequence of risk averse lenders seeking to repair their balance sheets from US mortgage related losses and batton down the hatches in advance of a surge in repossessions and mortgage defaults amongst UK borrowers.

Today saw the last of the 100% mortgage products withdrawn (Abbey) and the criteria for the remaining products further tightened. The days of easy loans of as much as X7 salary have now disappeared for good with reluctant banks tightening lending criteria towards loan limits of just X3.5 salary, this coupled with the demands of hefty deposits of as much as 25% of the value of the properties is going to ensure that the UK housing market will correct towards X3.5 salary from the present X6 valuation.

UK Housing Bear Market into its 8th Month

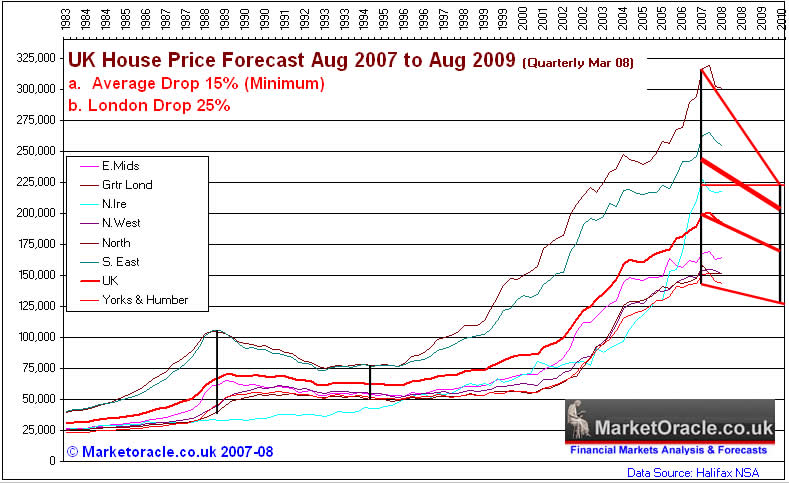

The Market Oracle forecast as of August 2007, is for a minimum 15% fall in UK house prices over 2 years to August 2009. The latest Halifax data confirms this trend, which is flashing a red wake up call to those home owners that have taken on too much debt and have yet to realise the implications of negative equity.

Negative Annualised House Prices

UK house prices have now gone negative for the first time since the early 1990's housing bust, falling by 1.3% on a non seasonally adjusted basis. The trend is at the more extreme end of the forecast range which originally estimated UK house prices to go negative in April 08. However seasonal adjusted house prices are still 1% above their level from a year earlier therefore the headlines of negative annual house price inflation are still scheduled to appear during May 08 on release of April's house price data.

US Recession 2008, UK Recession 2009 - Housing Bust into 2010

Just as the US housing bust of 2007 has lead to the US tipping into recession during 2008, which is expected to lead to at least 3 quarters of negative growth, so will the UK housing bust of 2008 lead to a UK recession during 2009 as the UK housing market is expected to continue to fall throughout 2009. Therefore the Market Oracle forecast will be updated towards the end of 2008 to expand the forecast trend into 2010. Preliminary analysis suggests that UK house prices are on track for an average 33% decline from their peak in August 2007 to the eventual trough.

Credit Crisis Has Further to Run

The IMF now estimates the losses from the collapse in the US Housing Market of as much as $945 billion which is nearly triple their previous estimate, as the subprime failures spread to the prime US mortgage market. The estimates are now well in advance of the original estimates of $200 billion.

Ben Bernanke attempts to pick up the pieces from Greenspans US Housing bubble bursting through a multi-pronged strategy of bailing out failing banks, providing cheap money to the banking system and making deep cuts in US interest rates to stimulate the housing market and economy. This strategy is leading to inflation which will eventually halt house price falls in nominal terms, however with the US Dollar down 20% in a year the real terms falls are much more significant.

Ben Bernanke attempts to pick up the pieces from Greenspans US Housing bubble bursting through a multi-pronged strategy of bailing out failing banks, providing cheap money to the banking system and making deep cuts in US interest rates to stimulate the housing market and economy. This strategy is leading to inflation which will eventually halt house price falls in nominal terms, however with the US Dollar down 20% in a year the real terms falls are much more significant.

The credit crisis is now expected to continue into early 2009, and therefore exceed $1 trillion in losses. However, the key requirement for an end to the crisis will be a stabilising US housing market, which should coincide with an end to the US recession towards the end of this year, therefore the $1 trillion mark may be prove to be an accurate estimate of the magnitude of losses, which at present amount to just under $200 billions.

During the boom years the City of London as the worlds financial centre contributed disproportionately to UK GDP growth, and this growth has been reflected in the degree to which London House Prices have been bid ever higher. However during the current credit crisis, London will experience the deflationary impact of the lack of liquidity as bonuses dry up for city workers and huge job losses occur as banks and financial institutions curtail their lending. This is something that I pointed out as the eventual consequences of the credit crisis in August 2007. The expectation is for London's Credit Crisis to accelerate into 2009 on the back of the UK housing bust that will see London hit particularly hard given the extent of overvaluation of London's House Prices.

UK LIBOR Interbank Market Credit Crunch Tsunami Waves

The LIBOR Interbank market (the interest rate at which banks lend to one another) has been hit by three credit crunch Tsunami waves so far as illustrated by the above graph which shows the spread between 3 month LIBOR and the Bank of England Base interest rate. What is evident from the spread's trend is that the credit crisis is easing as a result of unprecedented measures adopted by the Bank of England and more importantly the US Fed to attempt to unfreeze the global credit markets. However, what is also clear is that that the credit markets will be hit by several more credit crunch tsunami waves of instability in the rest of the year, perhaps two further hits that may coincide with major bank defaults. However the trend is towards an easing of the credit crisis as the Bank of England continues to cut interest rates. The graph suggests a rough 3 month cycle between peaks in the spread, therefore the next credit crisis wave to hit the UK financial markets is anticipated to occur by late June, which may coincide with a loss of confidence in the financial markets in the weeks leading upto the end of June 2008. This may take the form of a major UK mortgage bank having to be rescued in a similar manner to Northern Rock Bank, therefore the UK mortgage market is expected to remain tight for at least a further 6 months, as banks have to deal with extreme levels of periodic systemic instability.

Mortgage Approvals

The number of mortgages made available to borrowers continues to contract as illustrated by the below graph. Mortgages for house purchases is now down by more than 40% from the late 2006 peak and at levels not seen for 10 years. The BBA data is matched by data from the Council of Mortgage Lenders, which has seen the number of mortgages slump to a record low of 49,200. Northern Rock saw long queues of people seeking to transfer their savings out, will we shortly see long queues outside those banks that are more willing to lend to prospective home buyers?

UK House Price Affordability Index

UK house prices remain near extreme levels of unaffordability that requires a substantial fall in UK house prices until prices reach the levels of even 2002. The Market Oracle affordability index clearly illustrates that the housing market tends to move between extremes of sentiment driven trend, when buyers tend to over pay for housing at market peaks and tend to avoid housing when the market is cheap in terms of real disposable income.

The current trend clearly indicates a weak UK housing market for several years, especially as during a recessionary period that the UK is expected to enter towards the end of 2008, real disposable incomes tend to decline. This implies that despite falling house prices, the affordability index may not see any significant improvement until 2010.

UK Interest Rate Cuts

The Bank of England is expected to bring forward the next cut in UK interest rates to this week from the originally scheduled cut for May 2008. The trend for UK Interest rates to decline to 4.75% by September 2008 presently remains inline with the Market Oracle forecast. However as I have pointed out in earlier articles, interest rate cuts will not help borrowers as the tendency increasingly is not to pass on rate cuts.

British Pound

The British Pound plunged on the release of the halifax house price data to a 6 week low of below $1.97, as the forex markets factor in much lower UK interest rates and economic growth.

The British Pound plunged on the release of the halifax house price data to a 6 week low of below $1.97, as the forex markets factor in much lower UK interest rates and economic growth.

The British Pound is clearly in a downtrend that is targeting a move towards $1.94, for which there is now increasing risk of a break lower that could take the pound towards support at $1.90. However declines beyond $1.90 against the dollar would seem unlikely given that the US Fed is on a path of deep interest rate cuts that could see the US Fed Funds rate cut to 1.75% from 2.25% this month.

Conclusion

The UK Housing market is on track for a significant drop in house prices going into 2010 of as much as 33%. March's 2.5% price drop will be followed by a further sharp fall in April 08, following which time many house price indices will have gone negative on an annualised basis. This will be the trigger for house price crash headlines across much of the UK media.

Important UK Housing Market Articles :

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Attention Editors and Publishers! - You have permission to republish THIS article if published in its entirety, including attribution to the author and links back to the http://www.marketoracle.co.uk . Please send an email to republish@marketoracle.co.uk, to include a link to the published article.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.