Sillver - QE4ever, POMO4ever, Nevermore4ever

Commodities / Gold and Silver 2013 Oct 06, 2013 - 01:22 PM GMTBy: Michael_Noonan

The central bankers have no rudder, adrift in a sea of fiat, taking everybody with them. Witness Cyprus and Greece being forced to walk the plank. Those who choose to stay on this Ship of Fools will suffer the same fate, even worse as the growing panic emboldens banker reactions.

The central bankers have no rudder, adrift in a sea of fiat, taking everybody with them. Witness Cyprus and Greece being forced to walk the plank. Those who choose to stay on this Ship of Fools will suffer the same fate, even worse as the growing panic emboldens banker reactions.

Unless one has become anesthetized to the proverbial handwriting on the wall, symptoms are teeming all around. Barack "Yes We Can" [more than double the debt] Obama told everyone, promised everyone that he would cut the deficit in half. What he did not say is cutting it in half would then be the measure by which it would multiply. Issuing fiat does one thing and one thing only: it robs everyone of whatever value they have. It is a hidden transfer of wealth from you to the government, plain and simple.

POMO, [Permanent Open Market Operations], with emphasis on Permanent, designed to maintain the illusion that stocks are in a healthy bull market, so all must be well...at least for the top 1%; for the rest, not so much. Everything the Federal Reserve does is an illusion, including its existence, but it has become the financial bully no one dares to challenge.

One of our favorite lines comes from Leonard Cohen's Anthem, "There is a crack in everything, that's how the light gets in." For all those in the Western world mired in the endless debt forced on by central bankers, silver is part of the light that gets in and provides an escape.

Some of the smartest people in the financial world are the Stackers. Bankers have been doing everything possible to squeeze the life out of Precious Metals, but those in the PM community are not in the least bit fooled by fiat money creation. Stackers understand there is no third-party risk owning the physical metal, and eventually price will adjust to reflect the massive distortions created by the Creatures From Jekyll Island.

While there have been projections for silver to reach $100 the oz, $200, even $300, it really does not matter. Whatever the price, it will justly reflect all the mishandling of the economy by the central bankers, and those who own and hold silver, and gold, will reap the benefits of their foresight learned from hindsight.

The day is coming when central bankers will lose total control, and the message to them will be clear as sound money is reestablished: Nevermore! 4ever!

A look at what the charts are saying, in the interim.

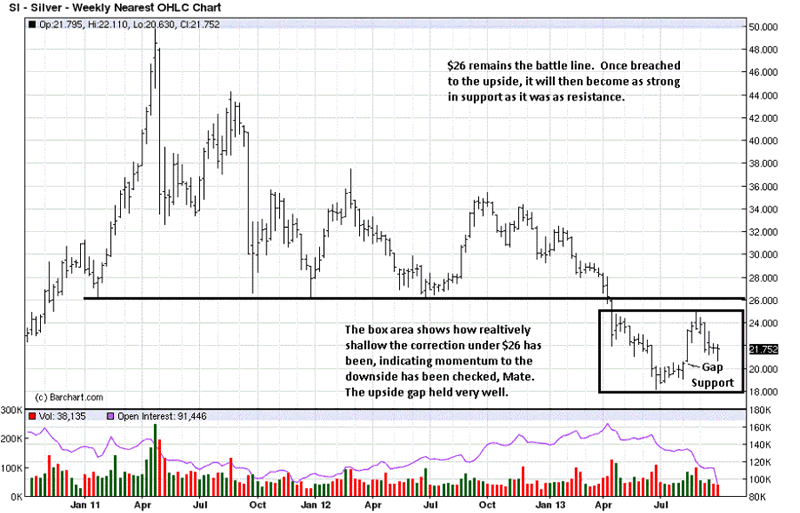

The timing for the end of the central banker's world as we regrettably know it will always be in doubt. Time weighs more against the Masters of Fiat than it has been in their favor for the brief time since the April 2011 highs. The fact that price rallied to $50 is evidence that bankers are on the losing end of this battle, and the correction that has been overly exaggerated to the downside is but a temporary respite, their own illusion of "victory" that is massively failing.

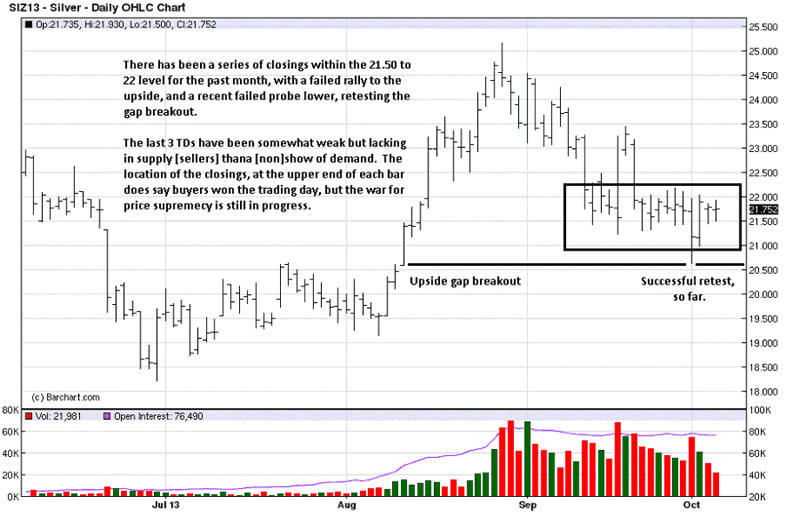

The gap breakout to the upside was seen as important when it happened, as we said at the time, [here, 4th chart]. The lower time frames show more important detail.

What appears to be more positive about how silver has been developing in its current TR, [Trading Range], is the fact that it is developing on top of the last TR. The upside breakout gap in August was just successfully retested in another attempt to push silver lower, yet price is showing some resiliency. The rally of the last 3 TDs has upper range closes shows buyers won the battle, but the decline in volume indicates it was a result more from a lack of sellers.

The failed probe lower, as it occurred further along the RHS, [Right Hand Side], of the TR also adds to the positive aspect of the its development. What we need to see from here is a test of the failed probe. The last 3 TDs may be that retest, and if so, what is also needed is a strong wide range rally on increased volume above resistance.

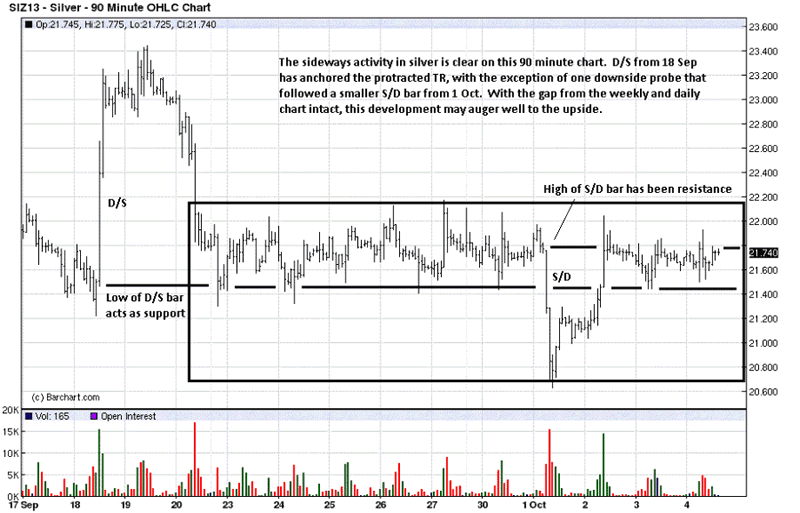

The 90 minute chart shows a D/S bar, [Demand over Supply], which often acts as support, and price has held the lower level of that bar. There was a smaller S/D bar on 1 October, and it led to the recent failed probe. It is possible it is a probe to see if there were any appetite to take price lower. The fact that the gap held suggests not.

In the long run, silver is going higher, much, much higher. In the short run, anything can happen, but silver's ability to withstand selling assaults is growing. Getting long a proven retest of last week's low makes sense.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.