Stock Market's Edgy But On Light Volumes

Stock-Markets / Stock Markets 2013 Oct 08, 2013 - 10:51 AM GMTBy: Jesse

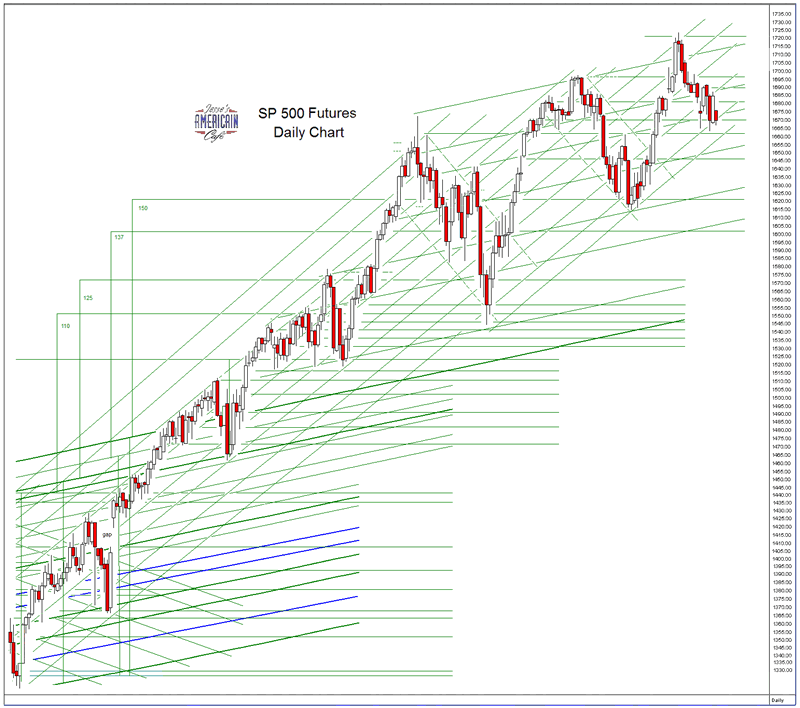

Stocks trended lower today but on light volumes. So I would call it an 'edgy' trade but no panic.

The consensus of traders seems to be that the House Republicans will draw out the Continuing Resolution issue as far as they can, and then the deadlock will be averted ahead of the October 17th estimate of a problem with the debt ceiling that would stop payments.

Right now the rhetoric is thick, and posturing is the order of the day. If I were in the position of the government I would probably refuse to negotiate on this under these conditions, simply because if one rewards this behavior, which has gone too far in its demands, you will face it every three months. It is not unlike extortion.

That is not to say that there should not be negotiations, far from it. But to demand a major program that has been passed by both houses of Congress, signed, vetted by the Supreme Court, and then tested successfully in a national election is nuts. This was very badly played by the Cruz faction and the House Republicans politically. But Boehner is a major enabler of the impasse since he is in effect using his office as House Speaker to prevent a clean resolution from reaching the floor for a vote. I think his personal fear for his office is overcoming his better sense as a seasoned politician, but the times are what the are.

The problem is that this is a contest between slimy and slimier, since I do not see many progressive champions and statesmen on the Democratic side either. The Dems sold out to Wall Street under the Clintons and that is where they remain.

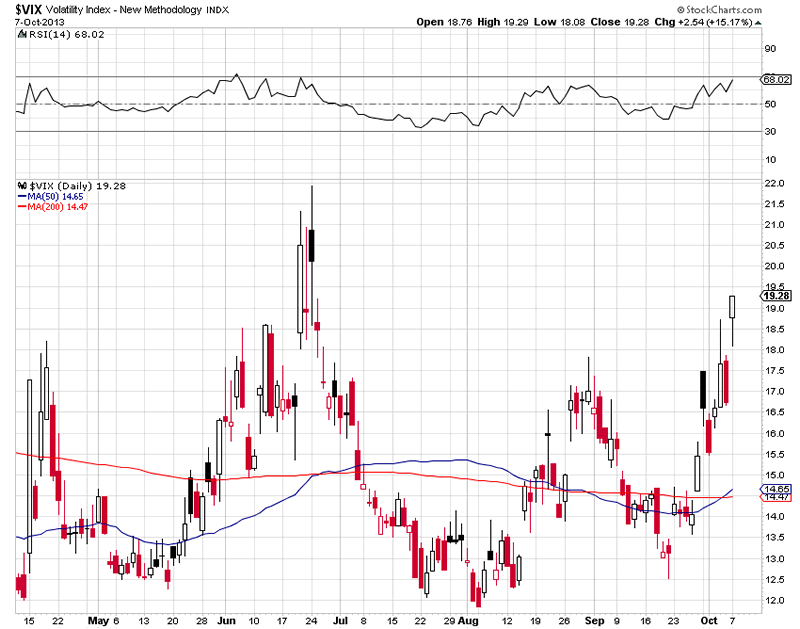

Life with go on, but in the short term it may be a bumpy ride. VIX is elevated and nearing a high for 'normal circumstances,' ie non default.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.