Stock Markets Point of No Return

Stock-Markets / Stock Markets 2013 Oct 10, 2013 - 12:05 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: If you're like most folks, there's a nagging fear at the edge of your brain that's trying desperately to make sense of what's happening each day the market drops further.

Keith Fitz-Gerald writes: If you're like most folks, there's a nagging fear at the edge of your brain that's trying desperately to make sense of what's happening each day the market drops further.

It's tough to control under normal circumstances, but even tougher to dismiss against the backdrop of Washington's infantile behavior.

I know... I feel it too - which is why, at moments like the present, I turn to my charts.

There's no guesswork and no ambiguity with charts. Just good old-fashioned technical analysis that is void of all emotion and free from the second guess that all too often interferes with our decisions.

That allows me to calmly, methodically answer a number of questions, including the one I'm getting most right now.

What's the point of "no return"?

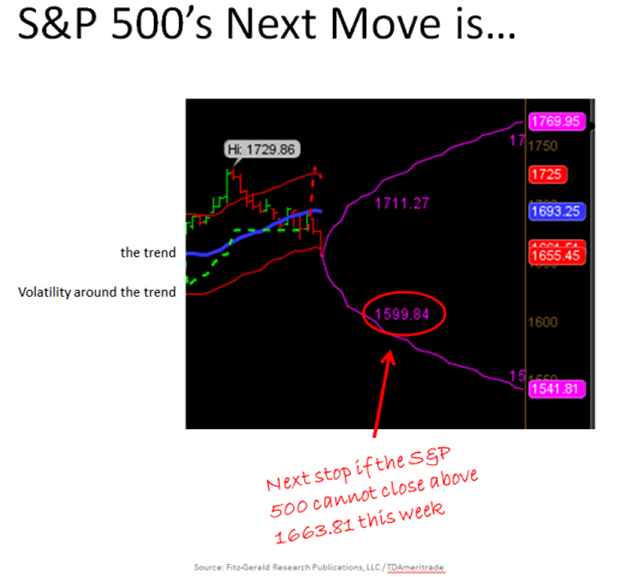

The chart of the S&P 500 I constructed Tuesday gives us some clues.

Take a look...

Now let me tell you what you're looking at...

The red lines represent expected price movement and volatility around the trend. That's the blue line that runs according to a proprietary non-linear set of calculations I created.

You can see that Tuesday's close took the S&P 500 down to 1655.03, which is just below the lower red line, which rests at 1663.81. At the same time, the blue line has begun to roll over. It's visually almost unperceivable so you have to look hard.

There are two key takeaways:

- The S&P 500 has already bounced off of support; and

- If the SPX does not close above 1663.81 this week, the next stop is 1599.84 by Oct. 18, 2013.

To that end, there is a tremendous battle being fought between the bulls and the bears as I write this. What's sad is that Washington is providing both with plenty of ammo.

So now what?

That's actually the interesting part...

Three Actions You Can Take Now

Many investors think that the world's about to end, especially when they see a chart like this.

Nothing's farther from the truth - the markets move up and down all the time. The key is learning how to move with them rather than trying to second guess them. That way you are constantly on the offensive rather than being forced into a purely reactionary posture.

To that end, I think investors should be doing three things right now:

- Taking profits. Any move to the downside spells an opportunity to do so... if you've been handling the upside properly. Most investors don't, which is why they fear down days. The easiest way to do that is via trailing stops, which are typically percentage or dollar based. More sophisticated investors can use purchase put options to accomplish the same thing.

- Hunting for beaten down companies. The uninformed run for cover. On the other hand, guys like Rogers, Mobius, and Soros are the legends they are because they often wade in when others can't see the upside they do. You'd be wise to emulate them.

- Hedging their bets. Most investors don't understand that specialized inverse funds can be used to take the sting out of falling stock prices. That's because holding 3% to 5% in non-correlated assets can significantly dampen overall portfolio volatility by zigging when everything else zags. In that sense, and if for nothing else, they're great for helping you keep perspective when the stuff hits the fan.

This bothers some people. But wouldn't you rather buy something when it's put on sale (like it is when the markets are in a foul mood) than when it's too expensive (like it's been)? Energy is my favorite sector right now because it's largely immune from government swings and has built-in long-term demand that's growing. Plus, many companies kick off hefty dividends.

And if the markets do close above 1663.81?

Chances are you'll be glad you stayed on board with upside exposure. I can easily envision the Fed kicking in more money to compensate for political incompetence, especially if Yellen is actually confirmed as the incoming Fed Chief.

In that case, the initial target is 1711.27...

Source :http://moneymorning.com/2013/10/10/the-sp-500s-point-of-no-return/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.