Ron Paul - The End of U.S. Dollar Hegemony

Politics / US Politics Oct 10, 2013 - 05:34 PM GMTBy: Casey_Research

By Nick Giambruno, Editor, International Man:

By Nick Giambruno, Editor, International Man:

I spent the past weekend in Tucson for the Casey Research 2013 Summit, indeed a memorable and information-packed experience. It was truly a pleasure to meet with everyone who joined us.

Notably, it was extremely encouraging to meet so many intelligent people who had taken concrete steps to internationalize their savings and obtain a second passport—and thus reducing their exposure to whatever happens in their home countries.

Doug Casey kicked things off with a look at the striking parallels between the rise and fall of Rome and the rise and fall of the US.

In a way, Doug reminded me of the video below, which I stumbled across recently and which I highly recommend that you view. It shows, in a little over three minutes, how the borders of Europe have changed over the past 1,000 years.

It is an amazing and concise illustration of how, contrary to popular opinion, the borders of political entities are anything but permanent. In a historical perspective, nations and national boundaries tend to have as much permanence as a double cheeseburger placed in front of Chris Christie.

It is for this reason (and many others) that I believe you should internationalize various aspects of your life and not totally bind your future to any particular nation-state.

At the Summit I also had the chance to do something that I had wanted to do for a long time—sit down with Ron Paul for an informal (but in-depth) discussion on what I believe to be his most important speech.

It is a speech that many, even most libertarians, have never heard. This is because it occurred in 2006, before Ron had really broken through on the national level, and during an otherwise dull session of Congress.

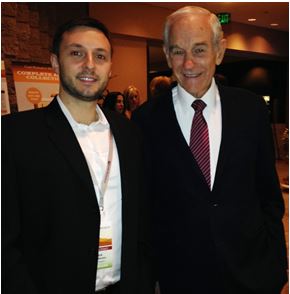

Nick Giambruno and Ron Paul

The speech is titled "The End of Dollar Hegemony" and discussed the breakdown of the Bretton Woods system—which most people know about—and the de facto system that replaced it—which most people do not know about. This speech is an absolute must-view you can watch it or read a transcript of it.

The most important part of the speech is when Paul discusses the petrodollar system, a primary factor in maintaining the dollar's role as the world's premier currency after the breakdown of Bretton Woods.

"It all ended on August 15, 1971, when Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold. In essence, we declared our insolvency and everyone recognized some other monetary system had to be devised in order to bring stability to the markets.

Amazingly, a new system was devised which allowed the US to operate the printing presses for the world reserve currency with no restraints placed on it—not even a pretense of gold convertibility, none whatsoever! Though the new policy was even more deeply flawed, it nevertheless opened the door for dollar hegemony to spread.

Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from US authorities, struck an agreement with OPEC to price oil in US dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence "backed" the dollar with oil. In return, the US promised to protect the various oil-rich kingdoms in the Persian Gulf against threat of invasion or domestic coup. This arrangement helped ignite the radical Islamic movement (Al Qaeda) among those who resented our influence in the region. The arrangement gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as dollar influence flourished.

This post-Bretton Woods system was much more fragile than the system that existed between 1945 and 1971. Though the dollar/oil arrangement was helpful, it was not nearly as stable as the pseudo-gold standard under Bretton Woods. It certainly was less stable than the gold standard of the late 19th century.

The agreement with OPEC in the 1970s to price oil in dollars has provided tremendous artificial strength to the dollar as the preeminent reserve currency. This has created a universal demand for the dollar, and soaks up the huge number of new dollars generated each year.

Using force to compel people to accept money without real value can only work in the short run. It ultimately leads to economic dislocation, both domestic and international, and always ends with a price to be paid.

The economic law that honest exchange demands only things of real value as currency cannot be repealed. The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better."

Ron Paul told me that although this speech is relatively unknown in the US, it was widely received around the world. As we discussed the implications of these issues, Paul said that the premise of this speech still applies today.

I believe that once the dollar loses its status as the world's premier reserve, the US will start to implement the destructive measures we frequently discuss: capital controls, people controls, price controls, currency devaluations, confiscations, nationalizing pensions, etc.

Such things have happened recently in Poland, Cyprus, Iceland, Argentina, Zimbabwe, Venezuela, and a number of other countries.

Take a glance at history and you will quickly notice these measures are the norm when a government gets into serious fiscal trouble. Many nations have made the mistake of thinking they were somehow "exceptional" and that these kinds of things couldn't happen to them.

There is no question the US is and will continue to be in serious fiscal trouble unless it implements drastic (and politically impossible) changes. The only saving grace for the US has been its ability to print the world's reserve currency. But once that special privilege is lost, it will revert to the measures all other governments throughout history have taken.

You absolutely want to be internationalized before the US dollar loses its status as the world's premier reserve currency. I truly believe the window opportunity to take protective action will slam shut at that time.

Internationalization is just one of several timely topics touched on by the experts who gathered at the 2013 Casey Summit, 3 Days with Casey. Unusually, most speakers stayed after their presentations to mingle with attendees and listen to others' talks—which speaks volumes as to the quality of the conference. If you missed out—or even if you were fortunate enough to be in attendance for Ron Paul's keynote address, plus presentations by Lacy Hunt, Catherine Austin Fitts, Chris Martenson, and many others, not to mention the Casey Brain Trust led by Doug Casey himself—you can still hear it all. Every presentation. Every breakout session. Every Q&A. All of it—including speakers' visual aids, if used—will be available on the 2013 Summit Audio Collection.

That's over 27 hours of insight, analysis, speculation, discussion, recommendations... and much more. And you can get a substantial discount by ordering today. Click here to learn more and reserve your CD or MP3 copy of the 2013 Summit Audio Collection.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.