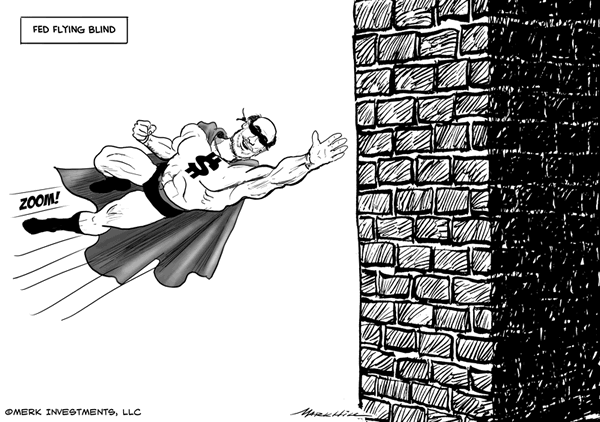

Fed Flying Blind - Fixing the Economy as Easy as 1-2-3

Politics / US Interest Rates Oct 22, 2013 - 04:29 PM GMTBy: Axel_Merk

With the economy stuck in first gear, a couple of common sense steps that wouldn't cost taxpayers an arm and a leg could help the economy shift into a higher gear.

With the economy stuck in first gear, a couple of common sense steps that wouldn't cost taxpayers an arm and a leg could help the economy shift into a higher gear.

Eliminate low interest rates

Quantitative easing (QE) is poison to an economy. Instead of allowing anyone to finance a project at zero cost no matter how speculative, credit must be priced according to the risk profile of borrowers. QE is bad for policy makers too as they have taken away their own all important ability to gauge the health of the economy by studying the yield curve (the relationship between long term and short term interest rates); that's because, historically, the Fed would look at the yield curve to gage how the market judges the health of the economy.

The Chinese have recognized this, moving away from having the government settle the cost of credit to encouraging competition in the banking sector. Historically, state owned enterprises had abundant access to the government set cost of credit; small and medium sized enterprises had to revert to loan sharks if they did not qualify. The new leadership is fostering competition in the banking sector, thus allowing credit to be priced according to the risk profile of borrowers. This simple change in attitude alone might help to boost the economy, even as it will take the banking system there some time to get adjusted with the new environment.

Failure must be an option

The government should stop trying to prevent us from making stupid decisions. Instead, it should focus on preventing the stupid decisions of an individual from wrecking the whole system. Bankers make great targets for populist attacks, but as long as we embrace credit in some form, we have to put up with them. While it's good to preach good ethical behavior, greed is human nature too. As such, policy that channels greed to productive use might be more effective than bureaucrats trying to outwit the overzealous banker. All regulation does is increase the barrier to entry, cementing too big to fail.

It turns out allowing failure can be achieved with the simplest of concepts:

- Mark-to-market accounting

- Collateral for leveraged transactions

Critics of mark-to-market accounting, including Forbes publisher Steve Forbes, have argued that mark-to-market accounting is a key reason why we had a market meltdown in 2008, forcing companies to have fire sales when they might not have had a problem holding securities to maturity. With due respect to Mr. Forbes, who I greatly respect, his logic on this point is mixing cause and effect. To illustrate my point, consider a speculator in the run-up to the 2008 crisis that shorted oil at $80 a barrel, betting the price should decline to $40. Oil did indeed fall to $40 a barrel, but only after first surging to $145. If that investor employed no leverage, he or she would have made money. However, if that speculator employed leverage, he or she might have had to close the position at a loss as margin calls required additional collateral given that the price of oil was heading higher. Such a person might argue it's unfair to be stopped out: had he or she just been allowed to hold the position longer, all would have been fine. Clearly, though, there was no guarantee that the price of oil would fall back to $40; by posting collateral for leveraged bets, the integrity of the system is preserved. If no collateral were required and the bet did not work out, "contagion" would have spread to cause losses to many market participants beyond the person making the wrong bet. In contrast, by posting collateral, should a person's equity be wiped out, it won't inflict damage on others.

What's important here are that the rules must be known ahead of time. By knowing the rules ahead of time, every market participant knows the risks of employing leverage and can't cry foul if the market stays irrational longer than they stay solvent. Mark-to-market accounting plus the requirement to post collateral for leveraged transactions provides a disincentive to use excessive leverage.

Mr. Forbes correctly observes that abolishing mark-to-market accounting increases stock prices, but the leverage in the system that gets us to these elevated prices makes the system as a whole unstable. The root problem of the 2008 crisis was too much leverage. Mirco-managing the various activities financial institutions are allowed to engage in doesn't make a system more stable; but simple rules can provide an incentive for less leverage and a more stable financial system.

Some observers think speculation should be curtailed altogether, but note that the commercial hedger can only hedge if there is a speculator willing to be on the other side of the trade.

Predictability of policy

As the example above shows, predictability of policy is immensely important. Real harm to economic growth is caused when the rules of the game are unknown; policy is made on the fly or changes unpredictably.

In the Eurozone, the above concepts help explain why confidence has been returning, despite the fact that there continue to be plenty of problems that are unlikely to be resolved anytime soon, if ever. Notably:

- Failure: the failure of the Cypriot banking system could have been handled better, but it's paramount that bad businesses must be allowed to fail. The problem with blanket guarantees is that everything is safe until the guarantor collapses, at which point the entire system comes crashing down.

- Predictability. In the U.S., we have bank failures on a regular basis; individuals with deposits exceeding the FDIC insurance do lose money. Yet we don't have a currency crisis every time a bank fails. That's because there's a sound institutional process in place to wind down banks. In the Eurozone, we are far from a sound process, but the way policy makers react to crises is reasonably predictable.

- Differentiated interest rates. During the peak of the crisis in Cyprus, Spain had a Treasury auction where the country paid the lowest yields since the early 1990s. Good policy is rewarded; bad policy is punished by the market.

While the above points are common sense, they were not in place during the peak of the crisis in the Eurozone. It was these changes that the media did not focus on that might have had the biggest impact to allow the Eurozone to move forward.

Note that this discussion did not focus on the tax code. While there are lots of ways our tax code could be improved, predictability in taxation and regulation may be at least as important. As proof, look again at Europe, where both regulatory and tax environments, depending on the place, appear excessive. Yet there are some highly competitive businesses despite those hurdles. Good management in these businesses makes the best of a bad situation and is able to do so because they can plan ahead.

To summarize, let's allocate credit according to the risk profile of borrowers. Let's agree on the rules and allow folks to make bad decisions. And no, just because we point to progress in the Eurozone and China, there's no need to relocate there. Instead, let's convince our policy makers to focus on common sense solutions. If we return to these common sense principles, we could shift economic growth into high gear in a more stable financial system with less regulation.

Please register to join us for an upcoming Webinar as we dive into these dynamics in more detail. Also make sure you subscribe to our newsletter so you know when the next Merk Insight becomes available.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.