Why the Gaming Stocks Sector Should Be on Your Investing Radar

Companies / Sector Analysis Oct 24, 2013 - 09:44 AM GMTGeorge Leong writes: With the upcoming release of new video consoles from Sony Corporation (NYSE/SNE) and Microsoft Corporation (NASDAQ/MSFT), the video game sector appears to be set to experience a revival, as my stock analysis indicates.

According to NPG Group, the U.S. sales of video game-related hardware, software, and accessories surged by 27% year-over-year to $1.08 billion in September. (Source: The NPD Group, Inc. web site, last accessed October 22, 2013.) The sale of software, specifically, surged 52% to $754 million, accounting for 70% of total sales. Yet with the debut of two new consoles in November (Sony’s “PlayStation4” and Microsoft’s “Xbox One”), my stock analysis indicates that sales in the hardware sector will pick up, giving a boost to the share prices of Microsoft and Sony.

In the hardware area, Microsoft has done well with its Xbox console in spite of its lag in sales compared to Sony’s PlayStation console, based on my stock analysis. Yet the move by Microsoft into the gaming and entertainment console market is a big selling point for the company, as my stock analysis points out. (Read “Why Microsoft May Finally Be Set to Turn Its Fortune Around.”)

I know my son is anxiously anticipating the release of the PS4 and, in particular, the “NBA Live 14” game that is made by one of the top games developers Electronic Arts Inc. (NASDAQ/EA). Electronic Arts (EA) develops games for the Xbox, PlayStation, and ”Nintendo Wii” consoles. The company also develops games for mobile phones and tablets.

EA games are broad in scope and include action, military, sports, racing, simulation, strategy, family, kids, music, and puzzle-based games. Popular titles include “The Sims,” “Madden NFL,” “NBA,” “NHL,” “FIFA Soccer,” and numerous other lines.

The company has beat quarterly earnings-per-share (EPS) estimates in three of the past four quarters.

On the chart of EA below, note the upward price channel and the recent bullish golden cross, as indicated by the shaded oval. A surge could see the stock jump above $30.00, based on my stock analysis.

Chart courtesy of www.StockCharts.com

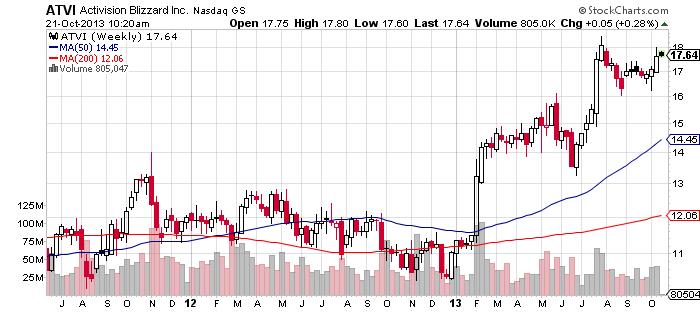

A second software games developer I like is Activision Blizzard, Inc. (NASDAQ/ATVI), based on my stock analysis. The company is best known for its hugely successful “Call of Duty” series.

According to Thomson Financial, Activision Blizzard is estimated to make $0.89 per diluted share in 2013, and $1.28 per diluted share in 2013; revenues are projected to fall 13.9% this year, rallying 8.5% to $4.66 billion in 2014.

On a quarterly basis, Activision Blizzard has beaten EPS estimates in each of its last four quarters.

As my stock analysis notes, the chart of Activision Blizzard below shows current hesitation following the stock’s recent run-up, due to the most recent release of its “Call of Duty” game. A golden cross remains in play, and the stock could break higher, based on my technical analysis.

Chart courtesy of www.StockCharts.com

Overall, my stock analysis indicates that the launch of the new consoles next month will surely help the video game sector and software games makers; investors would be wise to keep this sector on their radar.

This article Why the Gaming Sector Should Be on Your Radar is originally posted at Profitconfidential

George Leong, B.Comm.

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.