Four Years of Economic Recovery, So Why Don’t You Feel Richer?

Economics / Economic Recovery Oct 29, 2013 - 08:45 AM GMTBy: Clif_Droke

Statistics can sometimes, as we all know, be very misleading. Take the unemployment report for example. If you examine the numbers out of context, you'd be forced to conclude that workforce participation has steadily increased over the last four years. A behind-the-scenes look at those numbers, however, reveals a startling discovery: most of those gains have occurred because job seekers have simply given up looking for a job.

Statistics can sometimes, as we all know, be very misleading. Take the unemployment report for example. If you examine the numbers out of context, you'd be forced to conclude that workforce participation has steadily increased over the last four years. A behind-the-scenes look at those numbers, however, reveals a startling discovery: most of those gains have occurred because job seekers have simply given up looking for a job.

Federal Reserve Chairman Bernanke is acutely aware of this, which is why he is intent on continuing to provide monetary stimulus through the central bank's quantitative easing (QE) policy. A growing body of evidence suggests that while QE has been extremely beneficial for the stock market, it has been decidedly less helpful in stimulating the U.S. economy.

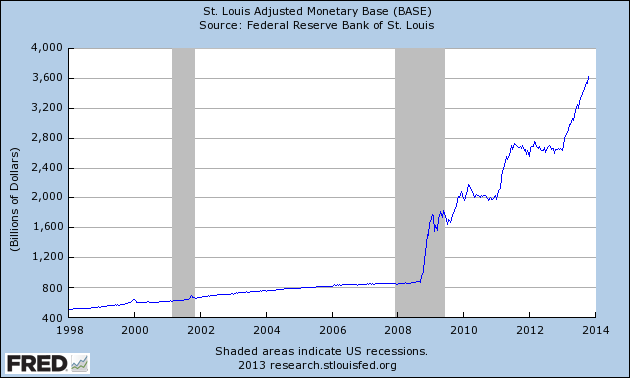

With the Fed providing a virtually limitless expansion of the monetary base since 2008, one must ask why this hasn't had more of an impact on increasing wage growth or reducing unemployment? Before we can answer this question we must first have a look at just how strong has been the Fed's commitment to fighting the anti-growth forces that were ignited during the credit crisis. The logarithmic rise in the U.S. monetary base can be seen in the following graph.

At any other time such an explosion in the monetary base would correspond with major inflation along with sky-high interest rates. The reason of course that interest rates remain relatively subdued is because the Fed continues to purchase $85 billion/month in Treasuries and mortgage securities. The monetary base rose to a record $3.6 trillion as of Oct. 16, compared to $1.5 trillion when QE was first initiated in late 2008.

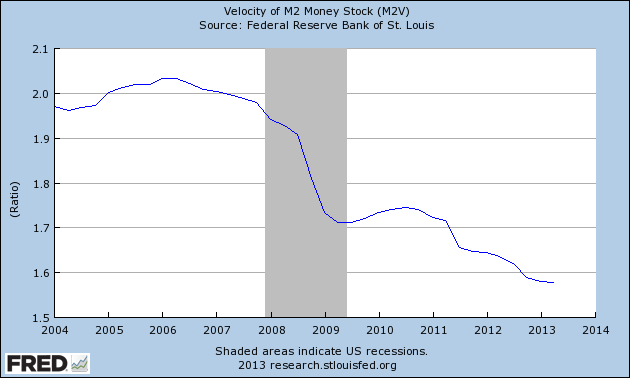

As economist Ed Yardeni points out, "There hasn't been much bang per buck in all this 'high-powered money.'" The reason can be seen in the following chart.

Even as the monetary base has soared since 2008, the velocity of M2 money has plummeted. (M2 velocity is calculated by dividing nominal GDP by M2 money stock). This chart provides a perfect description of how inflationary pressure has been kept subdued by the deflationary undercurrent of the long-term/long-wave economic cycle (e.g. the Kress/Kondratieff cycles).

Velocity can also be colloquially defined as the rate of turnover in money, i.e. how much money is changing hands in the economy. During times of true economic growth the money supply is increasing while interest rates are rising and money velocity is also rising. But in recent years money turnover is actually falling even as money creation is exploding. The economy's demand for more and more money during a period of true inflation is funneled into chasing fewer goods to higher prices. In today's undercurrent of deflation, by contrast, the demand for money isn't so that consumers and financial institutions can spend it, but rather so it can be hoarded.

The reason behind this hoarding mentality is simple fear: fear born of uncertainty about the future in a world where the cost of living keeps rising even as wages are declining. It's also a fear based on the observation that the culprits of the credit crisis (the reason for the economic slump) were never properly dealt with. In other words, producers and wage earners alike rightly fear for the safety of their hard-earned savings.

Yardeni suggests that monetary policymakers "seem oblivious to the possibility that their gusher policies maybe contributing to this disappointing [GDP] performance." Instead, he adds, "they've pursued Krugmanomics: If a trillion dollars didn't stimulate the economy, try another trillion dollars." So far it still hasn't alleviated the hemorrhaging in the job market participation rate.

Washington and the Fed have shown they aren't above sacrificing the U.S. dollar in the name of preventing deflation, which in turn would benefit consumers. The Fed has shown a commitment to a weak dollar policy via QE, which in turn has prevented the deflationary long-term cycle from doing its work of flushing out weak competitors and reducing prices across the board. Washington intervened during the deflationary wave of 2008 by declaring certain institutions as being "too big to fail." This concept undermined the work of the economic long-wave and has created the present situation of underemployment, sluggish growth and too-high prices for essential goods.

Monetary policy has a point of diminishing returns, however, and that point may have already been reached. Indeed, economist David Rosenberg believes QE has already reached the point of diminishing returns and has only benefited a small segment of the economy. He points out that the so-called "wealth effect" of monetary stimulus only works "if the positive shock is deemed to be permanent as opposed to transitory." With Fed officials making it clear that QE3 will be phased out at some point in the near future, its positive effects can already been seen to be diminishing (most notably in higher bond yields).

Underscoring my point about monetary velocity, Rosenberg observed, "What the Fed managed to do this cycle was help the rich get richer with no major positive multiplier impact on the real economy." The rich have certainly benefited from the past four years' recovery. The question is does anyone else feel richer?

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.