Gold Buying Opportunity As Good As It Gets

Commodities / Gold and Silver 2014 Oct 29, 2013 - 08:49 AM GMTBy: Aden_Forecast

Many events moved the market this month. Gold demand was stable but more important, gold is getting a boost from the weaker U.S. dollar.

Many events moved the market this month. Gold demand was stable but more important, gold is getting a boost from the weaker U.S. dollar.

The U.S. dollar is now clearly bearish, and since gold and the U.S. dollar generally move in opposite directions, this is very bullish for gold. So is the fact the Fed's QE stimulus is currently expected to continue well into 2014.

Plus, gold tends to rise every time Congress raises the U.S. debt ceiling. And with the debt ceiling recently lifted, gold is indeed looking upward.

Gold's Big Picture

While gold has been much stronger than most currencies over the past 12 years, it still hasn't compared to the grand rise in the 1970s.

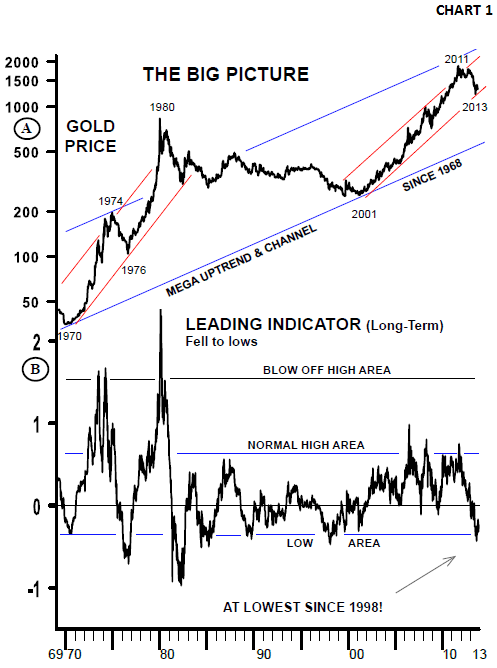

Chart 1 shows the gold price since 1969. Back then, gold rose 2300% in 10 years, from 1970 to 1980. The blow-off peaks were clearly pronounced. But this time around, the gold rise has been moderate in comparison.

Gold had a steady 10 year rise from 2001 to 2011 and it gained 661%. That wasn't shabby by any means, but it certainly wasn't like the 1970s.

As you can see, gold's leading indicator reached a normal high area during the 2001-2011 rise. But the spike peaks to blow off high areas seen in the 1970s are still to come.

Many are comparing today's decline to the 1976 decline. Then, gold gave back 50% after rising about 460% from 1970 -74. Today, gold has given back 36% of its 661% rise.

However, the troubled world we live in is proving plenty of ammunition to say a rise similar to the 1976-80 rise could still be ahead of us.

In addition, gold's leading indicator is currently at a major low area. In other words, gold is bombed out and very oversold, reinforcing the likelihood of an upcoming sustained rise.

For now though, we'll take gold's renewed upmove one step at a time...

Much will tell us the direction over the next month or two. We're currently in a seasonally strong month for the metals and a rise, even if it's not a strong leg upward, should continue to be promising.

Timing Is Key

This is where gold timing comes in.

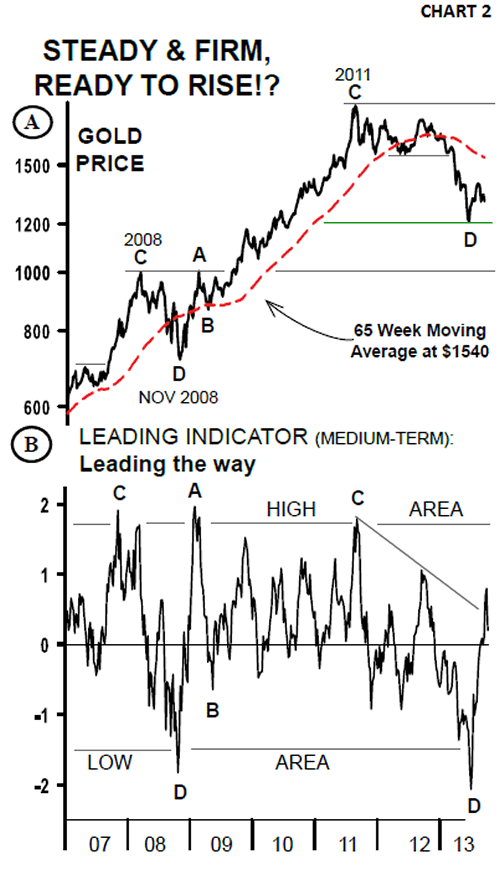

Gold has been forming a good looking base since reaching its closing low above $1200 on June 27. And it's becoming more important for this low area to hold (see Chart 2A).

As long as it does, the market will be fine.

This chart shows the major steps in the market. The green line shows the $1200 low. And if it holds, as most indicators suggest, we could next see gold rise to the $1536 - $1540 area.

This is a key level. It's the old support and the 65-week moving average.

If gold fails to break above this level, the bear will not be out of the woods. But if it's clearly surpassed, we could then see the $1700 level tested and possibly the old highs revisited!

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.