Disappearing Deliverable Comex Gold Bullion

Commodities / Gold and Silver 2013 Nov 03, 2013 - 03:48 PM GMTBy: Jesse

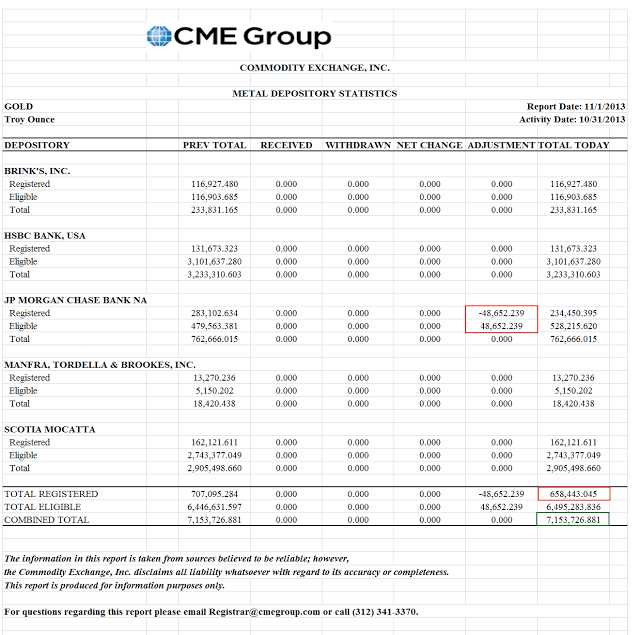

There was a change in status of 48,652 ounces of gold bullion in the JPM warehouse which were withdrawn from the registered to the eligible category. Apparently someone had a change of heart.

There was a change in status of 48,652 ounces of gold bullion in the JPM warehouse which were withdrawn from the registered to the eligible category. Apparently someone had a change of heart.

Big change of heart. About one and half tonnes worth.

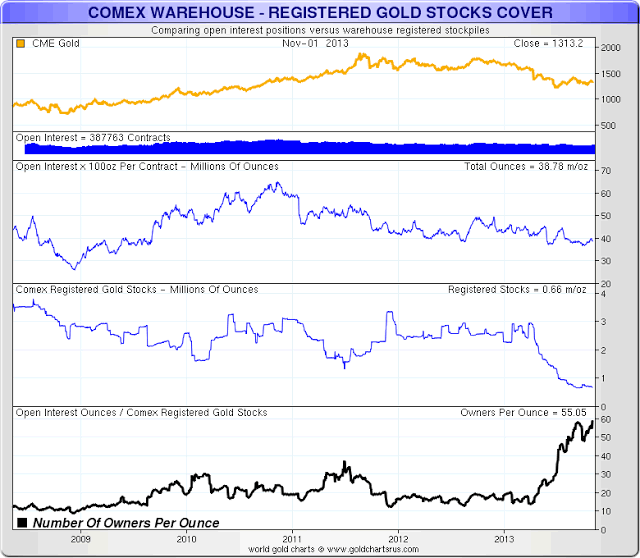

The claims per ounce of deliverable gold stand at 55. As I have explained before, this is a metric, a way of measuring inventory against potential ownership.

Like the velocity of money or a speedometer on a car it does not do anything. But it does provide information that can be quite useful if you are interested in where you are and where you might be going.

But it is a measure of some related things with meaning. And one that apparently annoys some who would rather not notice it now that it is at an extreme reading. Extremely low readings of deliverable gold relative to demand generally mark a trend change in price within six months.

And that makes sense. It will take higher prices to move more of that gold out of the eligible to the deliverable category, the antics of JPM notwithstanding.

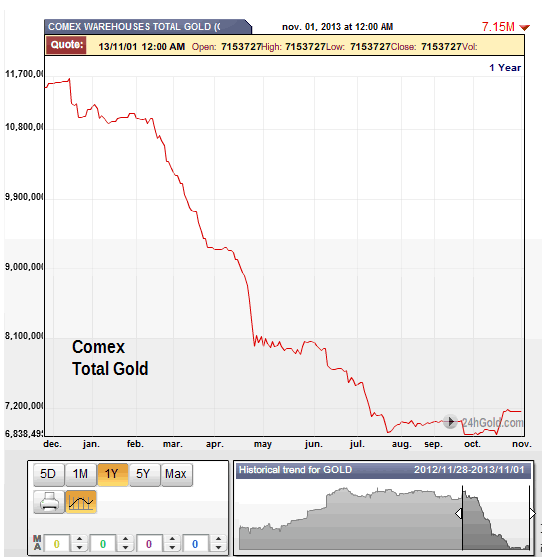

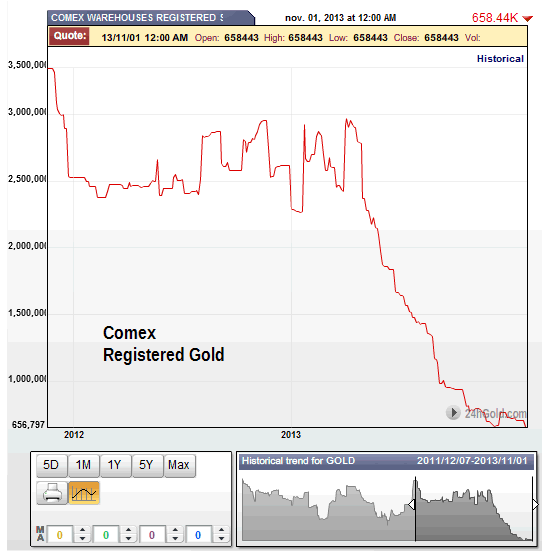

But in the meanwhile quite a bit of gold has been draining away from the West to chase the premiums for delivery in the East. The offtake in the Comex and the GLD ETF have been remarkable, not seen in any of the other precious metals.

This does not strike some people as odd. And that is understandable. The really big changes, what are called sea changes, always catch most of the people unawares and tosses them for a loss. And experts are not exempt, not at all, because they often become lost in the familiar. I think we have seen that most recently in the financial crisis that so many economists failed to see coming even as it rolled over the economy.

And then there is the 'investment' activity of the western Central Banks with their nation's gold reserves. The obligations must weigh heavily.

I find it quite interesting that there is a new scandal brewing in the FX markets involving price rigging. It is odd how the Banks have been caught rigging so many markets, but when it comes to precious metals, the apologists find all sorts of odd behaviour to be quite innocent and above reproach.

We are approaching the time when those who have will throw down, and those who have not, will fade away. I do not see the future as inevitable. But I do believe that there will be a reckoning of sorts. There always seems to be.

Weighed, and found wanting.

Stand and deliver.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.