East African Infrastructure Development - The Northern Corridor

Economics / Africa Nov 15, 2013 - 01:37 PM GMTBy: STRATFOR

Summary

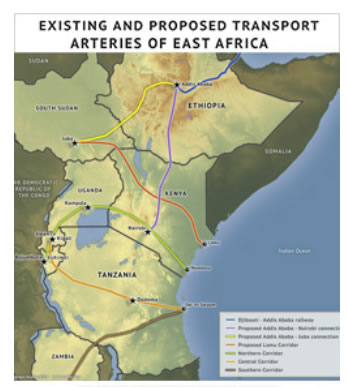

SummaryEditor's Note: This is a four-part series on the development of transport infrastructure in East Africa. The region is looking to expand its economy and increase international trade as it becomes a seemingly attractive destination for low-end manufacturing. Part 2 examines how such economic growth will necessitate the expansion and improvement of the Northern Corridor transport route.

East African countries naturally compete for foreign investment and economic development. Transport capabilities attract such investments, but cooperation to further develop capabilities and guarantee a certain degree of efficiency has proved necessary to continue to entice critical investments. The region's Northern Corridor continues to draw greater development financing than its Central Corridor because of its heavier traffic. Moreover, the Northern Corridor has always been the most active and reliable corridor in the region, even if it is not terribly efficient. This competition has generated frictions between Tanzania and East African countries along the Northern Corridor as Tanzania works to catch up and position itself as a credible alternative to Kenya while Kenya scrambles for the financing to further develop its infrastructure and secure its regional position.

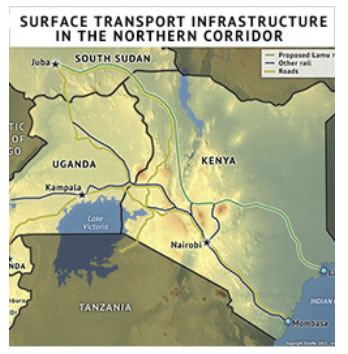

Among transport routes in the East African Community, the largest share of goods pass through the Northern Corridor, which connects the Kenyan port city of Mombasa to Uganda, Rwanda, Burundi and Ituri province in the Democratic Republic of the Congo. The route is a remnant of the colonial era, when the British sought to link the Great Lakes region to the Kenyan coast. Today, the transport artery is constrained in its efficiency and capacity, though not as much as the Central Corridor, which runs primarily through Tanzania. The Northern Corridor is particularly important as it passes through the most economically active area of East Africa -- especially the area north of Lake Victoria, which is home to the main concentration of East African agriculture, still the biggest sector in the region by far. Recently, such factors have helped attract complementary investments along the route, further increasing its importance.

As with the Central Corridor, most transport on the Northern Corridor is road-based. The main rail connection, which runs east to west through Kenya and into Uganda, would need to be refurbished or replaced to relieve some of the traffic burden on Northern Corridor roads. While transport by rail is cheaper and -- theoretically, at least -- faster than by road, the line is unreliable and beset with frequent delays.

Still, Northern Corridor railroads function better than those of the Central Corridor. The level of service -- a reflection of the achieved transport speed relative to the design speed -- along the northern route averages around 41 percent, with the main Nairobi-Kampala connection scoring 44 percent. By comparison, the average level of service on the Central Corridor is only 24 percent. This difference is part of the reason why goods from Burundi, for example, that could travel a shorter distance to port through the Central Corridor are often routed through the longer northern artery instead.

Still, Northern Corridor railroads function better than those of the Central Corridor. The level of service -- a reflection of the achieved transport speed relative to the design speed -- along the northern route averages around 41 percent, with the main Nairobi-Kampala connection scoring 44 percent. By comparison, the average level of service on the Central Corridor is only 24 percent. This difference is part of the reason why goods from Burundi, for example, that could travel a shorter distance to port through the Central Corridor are often routed through the longer northern artery instead. Due to the difference in delays and the more robust economic activity along the Northern Corridor, the route accounts for more than twice the amount of goods -- upward of 20 million tons per year -- as the Central Corridor. While countries along each route do not necessarily compete directly for the transport of goods, they do compete for external investments in transport infrastructure or ancillary sectors. Since East Africa is made up of net importer countries, these corridors support projects under development within the region rather than simply providing routes for exports.

Nonetheless, export operations could grow exponentially along the Northern Corridor in the coming years, driven by multiple investment projects underway in the Great Lakes region such as the Mount Kodo iron-ore mining project in the Democratic Republic of the Congo's Ituri province. When completed, the facility is expected to produce somewhere between 25 and 50 million tons of export materials per year. These likely would not affect the port of Mombasa or existing roads and railways in the Northern Corridor; the project will probably require the construction of its own heavy haul railroad and specialized export terminal. Further studies and development are needed before the project can become operational, however, and this is not expected to happen in the next decade.

Other mining projects could increase traffic along the Northern Corridor more immediately, though most of the traffic will support the development of the mining facilities rather than the exporting of raw materials. One sector likely to contribute to traffic is the gold mining industry in Ituri. The Congolese province currently taps into the Northern Corridor through the Ugandan town of Gulu, from which the railway runs all the way to Mombasa. The high grade of gold ore found in this location makes it very attractive, but development is constrained by transport limitations, insecurity and a lack of transparency and reliability on the part of the Congolese government. The small amount of output from this sector will limit the importance of transport capabilities mostly to the provisioning of ongoing mining activities. Thus, while the Democratic Republic of the Congo wants to scale up gold mining in Ituri, doing so would require more reliable infrastructure.

Additional infrastructure improvements will be especially vital to Uganda and Kenya's development as manufacturing hubs, since their population centers are not situated directly on the coast. The countries are forced to move industrial products, steel, boilers and other manufacturing equipment farther inland, and they will need to find ways to do so cheaply to stay competitive. Cost will also be a factor in exporting their manufactured goods. Uganda and Kenya are attractive as potential manufacturing hubs because of the low cost of operations. However, the current transport infrastructure is so poor that it effectively cancels out the appeal of the large, cheap and stable workforces in the countries. Improving the transportation network is thus a prerequisite for manufacturing to move there.

To increase transport capacity and allow Kenya and Uganda to continue attracting economic activity to the region around the Northern Corridor, the Kenyan government hopes to complete the construction of a standard gauge railway along the trajectory of the existing rail line by 2018. Unlike Tanzania, which also has been considering replacing its central railway with a standard gauge line, Kenya has already taken the first steps in the process. The country has already secured a $3.75 billion loan from China -- $2.5 billion for construction of the railway and $1.25 billion for locomotives and carriages. The project will give Kenya -- which already is home to the most important sections of the Northern Corridor -- with a line capable of providing a higher level of service and a higher capacity.

To increase transport capacity and allow Kenya and Uganda to continue attracting economic activity to the region around the Northern Corridor, the Kenyan government hopes to complete the construction of a standard gauge railway along the trajectory of the existing rail line by 2018. Unlike Tanzania, which also has been considering replacing its central railway with a standard gauge line, Kenya has already taken the first steps in the process. The country has already secured a $3.75 billion loan from China -- $2.5 billion for construction of the railway and $1.25 billion for locomotives and carriages. The project will give Kenya -- which already is home to the most important sections of the Northern Corridor -- with a line capable of providing a higher level of service and a higher capacity.

One of the more ambitious projects taking place mainly in Kenya, the Lamu Port Southern Sudan-Ethiopia Transport Corridor, will take some strain off Northern Corridor infrastructure. The new project's roads, railways and pipelines would accommodate primarily traffic heading to and from South Sudan and Ethiopia, rather than Uganda and other countries further inland in the Great Lakes region. This would allow some diversification of rail and road transport within Kenya, but most important, the establishment of the port in the town of Lamu could relieve some of the pressure on the Port of Mombasa. However, the entire project has been hampered by several political constraints and a hefty price tag in excess of $22 billion, for which financing has yet to be secured despite Kenya's concerted efforts to attract funding from China, Japan and Europe.

As with Dar es Salaam on the Central Corridor, the Port of Mombasa's position as the Northern Corridor's main exit and entry for goods greatly limits the routes capacity. Mombasa does slightly better than Dar es Salaam, with average delays of only two to three days compared to three to four days Tanzanian port, and the Kenyan port also handles a larger amount of cargo. However, Mombasa is as limited as Dar es Salaam in further development due to a lack of space behind its berths, and the size of ships that can enter the port is limited by a lack of depth in the approach channel. An increase in vessel sizes has led to greater development of hub ports and feeder ports, with ports like Mombasa and Dar es Salaam remaining feeders due to their inability to accommodate deep-draught, post-Panamax (the size limit for ships passing through the Panama Canal) vessels. The Port of Lamu will be able to accommodate post-Panamax vessels once completed.

The ship size limitations, along with the congestion at Mombasa, could thus be alleviated by the expansion of the Lamu Port. Creating specialized ports, with Lamu focusing on bulk cargoes while Mombasa focuses on container handling, would increase efficiency in two ways: Deeper berths at Lamu could allow Kenya to accommodate larger types of vessels, while moving bulk goods through Lamu would free up much-needed space in Mombasa to expand its container operations. However, attempting to establish Mombasa as a regional container hub would create direct competition with Tanzania's less-realistic plans to develop its Maruhubi Port as a regional container hub.

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2013 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.