Gold Flows East As Three Pieces Of Bacon Sell For €105 Million

Commodities / Gold and Silver 2013 Nov 15, 2013 - 01:42 PM GMTBy: GoldCore

Today’s AM fix was USD 1,281.75, EUR 953.99 and GBP 797.65 per ounce. Yesterday’s AM fix was USD 1,266.00, EUR 951.25 and GBP 798.75 per ounce.

Today’s AM fix was USD 1,281.75, EUR 953.99 and GBP 797.65 per ounce. Yesterday’s AM fix was USD 1,266.00, EUR 951.25 and GBP 798.75 per ounce.

Gold rose $14.40 or 1.13% yesterday, closing at $1,294.07/oz. Silver hit a high $20.90 and closed the day with a gain of $0.25 closing at $20.81.

Yesterday, the World Gold Council released its Gold Demand Trends 2013 Report which demonstrates quite clearly that the Chinese continue to accumulate gold; gold continues to flow east to both government and consumer channels. The report also showed that central banks continue to accumulate and there is positive news that jewellery trade is up.

Key findings:

Continued consumer growth in China. Total consumer demand was 210t in Q3 2013, a rise of 18% compared to the same period last year.

Central banks continue to be strong buyers of gold, albeit at a slower rate. Q3 2013 was the 11th consecutive quarter of net purchases of gold.

Jewellery consumption in South East Asia, outside China, was also strong. Hong Kong was up 28%, Vietnam up 14%, Thailand up 57% and Indonesia up 19% on the same quarter last year albeit off low bases.

Government regulations in India are dampening demand figures. India recorded a 32% decline in consumer demand compared to the same quarter last year. However year to date, demand remains robust, up 19% compared to the first three quarters of 2012, following the surge in demand sparked by two price falls earlier in 2013.

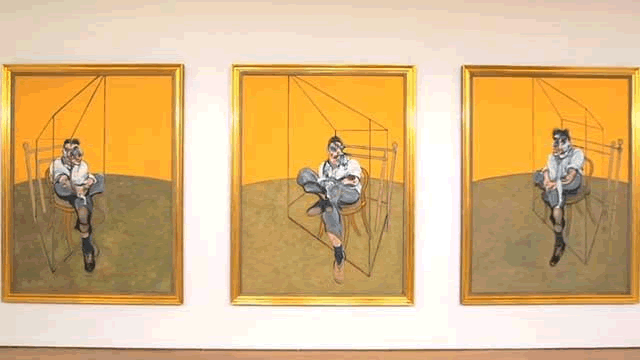

Francis Bacon’s 'Three Studies of Lucian Freud'

In another vote of confidence in the world of art, a triptych by Francis Bacon, titled 'Three Studies of Lucian Freud,' sold for €105 million ($142 million), a world record price for a painting.

However, Felix Salmon at Reuters believes that there is a speculative play in place and there is a number of people selling big-ticket contemporary art works at auction who have only owned these pieces for a short time and this is a key indicator that there is flipping in the market.

Salmon opines that there is signs of a speculative bubble, one that has been going on for years, even through the darkest hours of the financial crisis but that this latest burst of record selling prices could be the tipping point.

The price was pushed up by €44 million ($60 million) more than the auction house had estimated it would sell for. Believe it or not, but the price was decided after just ten minutes of bidding. This price smashes the previous record set when 'The Scream' by Edvard Munch sold for €89 million ($120 million.)

The auction also set a record for the highest amount ever made at one auction with €687 million (€511 million) worth of paintings were sold and included artists such as Andy Warhol, Jackson Pollock, Roy Lichtenstein and Mark Rothko.

Lucian Freud, who died in 2011, was also the subject of a second full-length Bacon triptych, painted in 1966. That work, however, is missing.

Whilst owning a Francis Bacon painting is out of the reach for most people, you can visit his studio where all these ‘expensive’ paintings were created. In keeping with the aura that surrounds Bacon’s life, his studio and its entire contents were moved from London to Dublin in 1998, and is on display in the Hugh Lane Gallery in Parnell Square, Dublin.

The Hugh Lane Gallery has its own amazing story in that Sir Hugh Percy Lane, its founder, died on board the RMS Lusitania in 1915 when she was torpedoed and sunk by a German U-boat.

No trip to Dublin is complete unless you visit this stunning exhibition; Bacon’s studio is a revelation and you can marvel at how three pieces of Bacon were sold for an incredible €105 million or 3.78 tons of gold at today's price of €953/oz.

Click here for this month’s Insight ‘Talking Real Money: World Monetary Reform’

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.