Technical Evidence Dow's Bew high is Not a Stock Market Breakout

Stock-Markets / Stock Markets 2013 Nov 16, 2013 - 02:40 PM GMTBy: Brian_Bloom

Complacency does not equal buying hysteria

Complacency does not equal buying hysteria

There’s too much “loose talk” that the public is going to pile into the market for the third, and final, blow-off phase.

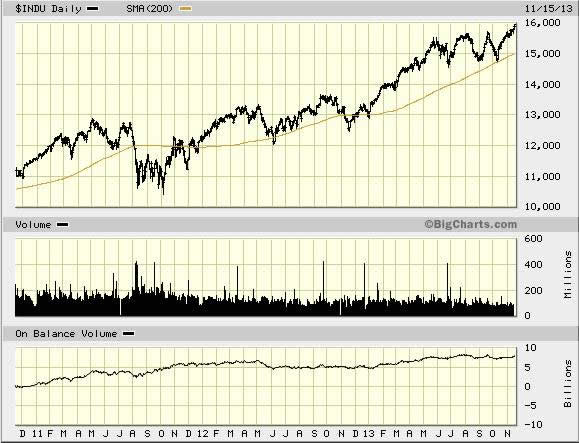

The first chart below (bigcharts.com) shows that, since August 2011, the index has been rising on falling volume. Over a two year period (+- 700 days) at an average daily volume (visually) of around 150 million, (700 X 150 million =) 105 billion shares changed hands. By contrast, OBV has risen from around 2.5 billion to 7.5 billion = 5 billion.

i.e. Roughly 5% of volume has, on balance, been buying pressure. Share prices have been rising because institutions have been trading in and out against a background of investor complacency flowing from QE. (This analysis was done visually and should be regarded as evidencing the principle that there has been an absence of buying hysteria)

Note two things:

1. The Dow rose to a new high but the OBV did not. It follows that the index price floated up rather than being pushed up by “buying pressure”. I.e. The new high was more a function of an absence of selling pressure.

2. Note how volume in the past two months has been averaging around 100 million shares a day.

This is one tricky market. If a “black swan” should emerge, sentiment could turn on a dime. It’s what we don’t know that’s important. What we know is the following, and it has already been factored into prices:

· The Syrian and Egyptian economies are basket cases that threaten to engulf the gulf.

· Some countries in Europe are trending towards economic basket cases

· Yellen wants to keep her foot on the accelerator, notwithstanding the “fact” that $1 of QE has historically given rise to less than $1 of GDP

· China is facing the consequences of massive mal-investment and is re-examining it priorities.

· The world has >$47 trillion sovereign debt

· Iran is edging towards having its nuclear energy ambitions accepted by the world

· Coal stocks (mined ore) is piling up mountainously in Newcastle Australia, where much of the coal destined for China is loaded onto freighters.

· Obamacare is providing embarrassing evidence that the US president is a smooth talking, ivory tower theoretician who is not really on top of his utterances.

· The Philippines has just suffered what appears to be a significant validation that climate change is not just some weird ivory tower concept

· The US finance industry has written off most of the historical bad debts arising from the real estate implosion, and domestic real estate in the US now represents a fairly lucrative investment relative to (say) US treasuries.

· The US is benefiting from its fracking industry (oil and gas)

What we don’t know is:

· What the Chinese authorities are going to do about the internal issues of:

o Mal-investment

o Exceptionally high personal debt levels

o Slowing economy

· Whether one of the European PIIGS will default while the ECB stands aside

· Yellen is saying one thing and thinking another

· The rest of the world will continue to meekly accept the US’s QE

· Whether the Typhoon that battered the Philippines is an early warning sign of mother earth flexing her muscles.

· How Israel is going to react to Iran’s nuclear push being accepted as a fait accompli by the rest of the world.

· Whether Russia will see an opportunity to re-establish itself as a “player” on the world’s power stage.

· What will happen to the world’s capital markets if interest rates start to rise.

So, those of us who have an ability to sleep well regardless of these unknowns will probably remain fully invested in an environment where the charts are hitting new highs.

By contrast, those of us who are focusing on the “knowns” and, seeing most of them as inhibitors of future economic growth, will be worrying about the unknowns and watching the charts like hawks for subtle signs that the “good times” may not be as robust as they seem - as evidenced by the OBV charts above.

Other technical indicators that are flashing warning signs are:

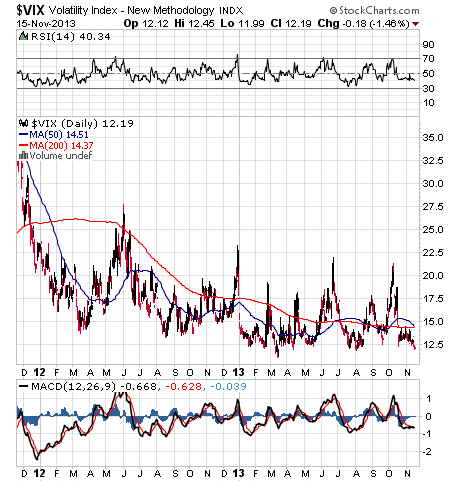

The volatility index below (stockcahrst.com) is at a 3 year low and the MACD cannot fall further because the $VIX would have to fall out of bed for that to happen. i.e. Volatility (fear) has nowhere to go but “up”

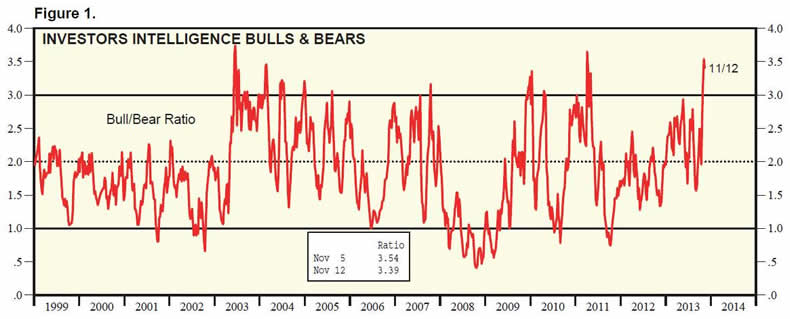

Finally, below is a chart of the Investors Intelligence Bulls/Bears Ratio. Note that it once again approaching an all time high. (source: http://www.yardeni.com/pub/stmktbullbear.pdf )

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Links to Amazon reader reviews of Brian Bloom's fact-based novels: The Last Finesse, Beyond Neanderthal

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.