Investor Street Smarts - Staying in the Game

Personal_Finance / Learning to Invest Nov 21, 2013 - 03:31 PM GMTBy: Don_Miller

Fifty-eight percent of workers have not even tried to calculate how much they need for retirement, let alone put a plan in place. To stay in the game, you have to get in the game. As a reader of articles like this, you are already past that hurdle.

Fifty-eight percent of workers have not even tried to calculate how much they need for retirement, let alone put a plan in place. To stay in the game, you have to get in the game. As a reader of articles like this, you are already past that hurdle.

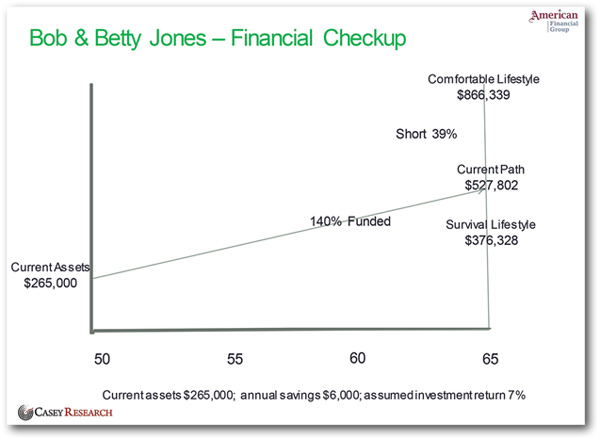

In a recent web event, Jeff White, one of our featured guests, gave an illustration based on two of his real-life clients. “Bob and Betty Jones” were both 50 years old and came in for a financial checkup. Jeff’s team asked them about their lifestyle: how much money did they need, in today’s dollars, to have a “survival lifestyle” or a “comfortable lifestyle?”

Then the team looked at Bob and Betty’s potential retirement income from sources like Social Security, pensions, and savings. They fed all of the data to the computer and determined that Bob and Betty would need a $376,328 portfolio for their survival lifestyle, and an $866,339 portfolio for their comfortable lifestyle—to supplement their Social Security and other income sources.

The next step was to look at how much money they already had, their current savings rate, and projected rate of return. The program used by Jeff’s team then produced a chart like this:

If Bob and Betty continued with business as usual, they would have $527,802 at retirement. That would provide them with a better-than-survival lifestyle, but they would be well short of what they want.

If Bob and Betty’s predicament feels familiar, do not throw up your hands. There are concrete steps you can take to get your retirement on track and keep it there.

Do not confuse facts with assumptions. Bob and Betty have $265,000, and they are saving $6,000 annually. Every other number on the chart is based on an assumption. That includes the numbers they need for both the survival and comfortable lifestyles.

Don’t get discouraged. For Bob and Betty to achieve their desired retirement lifestyle, they need to save an additional $288 per week, or $14,976 annually. That is on top of the $6,000 they are already saving. For most of us, that would be a pretty tall order, particularly if we have house and car payments and/or children in college. But don’t despair: It can be done, and a good counselor can help guide you there.

Get out of debt. Pay yourself first, and learn to live on the rest. For many of us, the first step in accumulating wealth is getting out of debt. Instead of going further into debt, pay those monthly payments to yourself and watch your savings grow.

Use a stairstep approach. Many folks pay off their house as soon as possible and then keep making those payments into their savings—no lifestyle adjustment needed.

Maximize any tax-deferred programs available to you. If your employer has a matching program, take full advantage of it. Currently, the maximum annual contribution for a 401(k) is $17,500 ($23,000 if you are over 50). For a SIMPLE 401(k), the limit is $12,000 ($14,500 if you are over 50). If you have money sitting in cash accounts essentially earning nothing, it may make sense to convert a portion of your assets to after-tax Roth status.

Increase your rate of savings at every opportunity. Remember, most people enjoy their peak earning years in their late 50s. If you get a raise, increase your monthly savings with a portion of it.

My wife Jo and I were in our 60s when our last parent died. What inheritance we received went straight to our retirement account. While no one can ever count on an inheritance, any additional income or bonus is just that—a bonus. Every little bit helps, so sock it away!

Don’t count on the government. As we discussed in our webinar, the promises all levels of government have made are financially impossible to keep. As David Walker, former Comptroller General of the United States, told us: “If you point out our total liabilities and unfunded promises for Medicare, Social Security, and a range of other things, it is actually over $70 trillion now, and growing by about $6 million a minute.”

While Bob and Betty cannot guess what the government will do, it’s time to apply some street smarts. Bob and Betty want to retire in 15 years, and $866,000 is not going to cut it. The government will have little choice but to break its unrealistic promises. Bob and Betty need to plan on saving a lot more. How much more is anyone’s guess, but counting on Social Security is foolhardy. If Bob and Betty drop all government promises from their formula and make up the difference on their own, that would be a good start.

Monitor your progress regularly. Much like a sailor navigating the high seas, we have to monitor many variables. If we have a little extra, great—more provisions for any storm on the horizon.

A successful retirement means retiring on your own terms when you want to. And it all starts with a plan. The journey is rarely a straight line, and your plan will likely need tweaking along the way. But it’s well worth it—retirement can be an awful lot of fun.

I receive a lot of email from my readers asking for advice on what to do. We cover a lot of their concerns in my newsletter, Miller's Money Weekly, and now we're going a step further.

We brought together a blue-ribbon cast of experts to analyze the challenges retirees and soon-to-be retirees face in today's economy and markets. They presented sound financial strategies to make your money last as long as you do that's still as timely and important today.

Our experts included John Stossel, formerly co-anchor on ABC’s 20/20 and now the host of Stossel with Fox Business Network, David Walker, former Comptroller General of the United States, and financial planning expert Jeff White, president of American Financial Group.

There’s no cost to this online strategy session, and you can watch it instantly by going to here.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.