When Saving Interest Rates Go Negative

Interest-Rates / US Interest Rates Dec 04, 2013 - 10:27 AM GMTBy: BATR

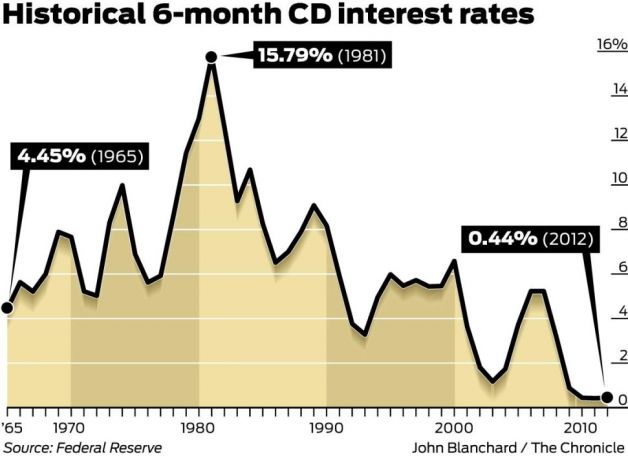

What is more frightening, then the loss of your money. Since most people have, some meager amount held in some form of a financial institution, the prospect of the banksters' cabal placing a charge against your account for the mere privilege of maintaining a deposit, is horrible. The Business Insider warns, In The Future, You May Have To Pay The Bank To Hold Your Money, and raises a very dreadful prospect.

What is more frightening, then the loss of your money. Since most people have, some meager amount held in some form of a financial institution, the prospect of the banksters' cabal placing a charge against your account for the mere privilege of maintaining a deposit, is horrible. The Business Insider warns, In The Future, You May Have To Pay The Bank To Hold Your Money, and raises a very dreadful prospect.

"In recent weeks, economists have discussed the idea of how to implement a negative interest rate while preventing people from hoarding paper currency. Economist Miles Kimball has discussed creating an electronic currency and having an exchange rate between it and dollar bills. Others have discussed going cashless and eliminating paper currency altogether."

Negative interest rates simply mean it will cost you, in fees or service charges, to hold money in banking accounts. Examine Professor Kimball’s ivory tower justification for seizing the value and purchasing power of your savings.

"University of Michigan economist Miles Kimball has developed a theoretical solution to this problem in the form of an electronic currency that would allow the Fed to bring nominal rates below zero to combat recessions. He's been presenting his plan to different economists and central bankers around the world. Kimball has also written repeatedly about it and was recently interviewed by Wonkblog's Dylan Matthews."

Now dig deep into the mind of a mentally ill pseudo intellectual to see just how far from rational money policy such monetary eggheads go to provide cover for the fractional reserve central bankers.

"If we repealed the "zero lower bound" that prevents interest rates from going below zero, there would be no need to rely on the large scale purchases of long-term government debt that are a mainstay of "quantitative easing," the quasi-promises of zero interest rates for years and years that go by the name of "forward guidance," or inflation to make those zero rates more potent."

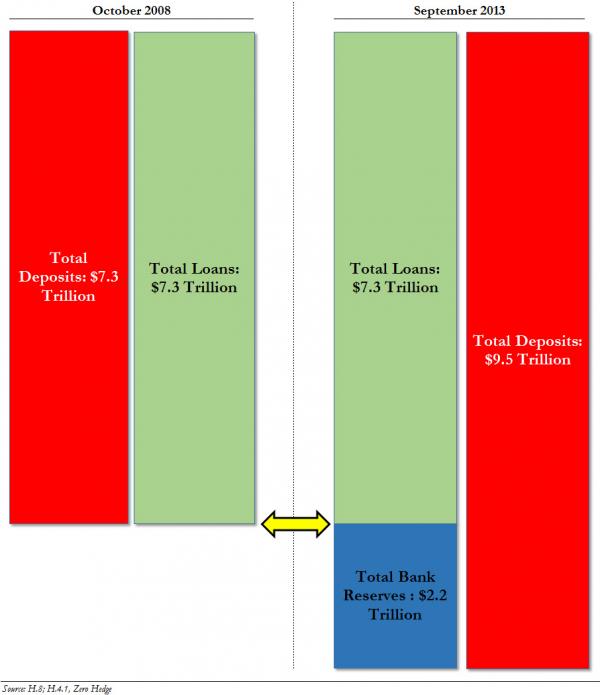

This threat is a continuation from the initial trial balloon that appeared in the Financial Times. A video rant about, Banks to Start Charging You on Deposits, goes ballistic with outrage that the money-centered banks are emboldened as to telegraph their intentions of raiding the nest egg savings of depositors. While the justifiable emotion is understandable for a beleaguered public, the economic aftermaths of interjecting massive QE reserves is explained well by Zerohedge in recent reports with the accompanied chart.

"Furthermore, contrary to what the hypocrite banker said that "the danger is that banks are pushed into riskier assets to find yield", banks are already in the riskiest assets: just look at what JPM was doing with its hundreds of billions in excess deposits, which originated as Fed reserves on its books - we explained the process of how the Fed's reserves are used to push the market higher most recently in "What Shadow Banking Can Tell Us About The Fed's "Exit-Path" Dead End."

What the real danger is, is that once the Fed lowers IOER and there is a massive outflow of deposits, that banks which have used the excess deposits as initial margin and collateral on marginable securities to chase risk to record highs (as JPM's CIO explicitly and undisputedly did) that there would be an avalanche of selling once the negative rate deposit outflow tsunami hit."

With the expectation that bank accounts will actually experience debit fees for parking money will result in a massive outflow of capital. Where will the money go? Will the banks allow the return of your deposits in cash or will they impose significant costs and delay withdrawals?

Consider that under a banking system, which automatically reduces your balances, the acceleration of stripping your net worth goes into high gear. No sane individual would accept this theft willingly. However, the transition to a cashless economy might well inflict a call back of cash (Federal Reserve Notes) in circulation for an enforced substitute legal tender. Or else some variation of the "killer" Kimball electronic compulsory account may be imposed under strict governmental supervision.

Under such a circumstance, the mandatory medium of exchange strips all personal ownership from the individual. Money, in whatever form it takes, no longer will be your own property.

"The problem is not the creation of money! Quite the opposite: it's marvelous that we never need to have a shortage of money. The problem is when the bookkeeper starts raping the debitor with interest for no other reason than the associated minus."

While debt is the central issue in all financial bubbles, the solution is not to destroy wealth creation through capital saving. Until a universal model of wizardry or alchemy is adopted that creates a stable store of value, independent from work, ingenuity or greed; expectations of an interest free currency are pipe dreams.

The benefits from negative interest rates all go to the banksters. The borrower never sees FREE interest loans, nor does the saver earn a fair rate of return. The maxim remains, Those with the Gold, Make the Rules, is no different in the age of the New World Order of central banking. Starving the saver is negative for the rest of us.

James Hall – December 4, 2013

Source : http://www.batr.org/stupid/112513.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.