Three U.S. Economic Charts Obama Hopes You'll Never See

Economics / US Economy Dec 05, 2013 - 03:24 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Today I'm going to show you three charts Obama hoped you'd never see.

Keith Fitz-Gerald writes: Today I'm going to show you three charts Obama hoped you'd never see.

Brace yourself.

You're about to get a very different view of the "recovery" picture that the administration keeps painting for us.

This one, for starters, is accurate.

It also explains why incoming Fed Chair Janet Yellen can't cut stimulus, which is one of the reasons you have an opportunity to make some money here... especially if you follow my "mid-December plan." More on that in a minute.

Let's start with the charts...

The White House positively hates this first one...

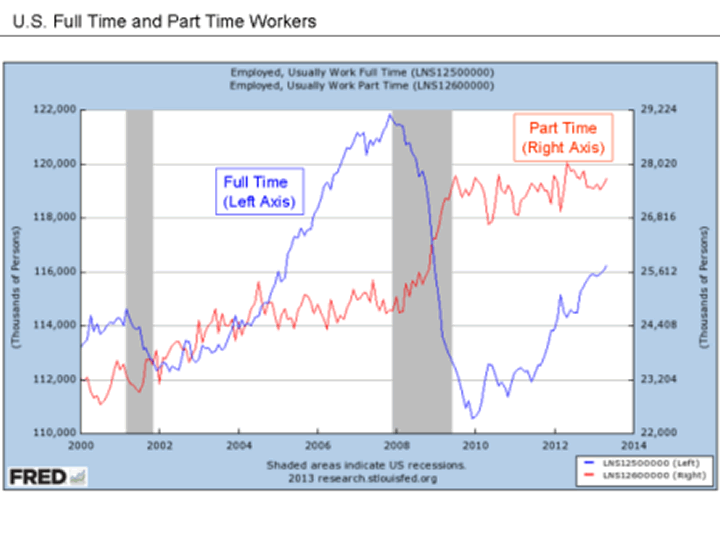

Charted Truth No. 1

U.S. payrolls are 1.5 million jobs short of where they were in 2008, and the "partimeification" of America continues unabated.

Yes, the White House hates this chart, because it shows - in excruciating detail - that the recovery they keep trying to convince the rest of us is happening is little more than a complete evisceration of our labor base.

At a time when we should be seeing robust growth, what we're seeing is a huge percentage of productive workers shunted to the sidelines. Actual unemployment is more likely 14% to 17% if you factor in the under-employed and those who have given up looking for work.

Yellen's already tipped her hand in this department, incidentally, noting that "below average" employment is reason enough to prevent her from raising interest rates - and, presumably, from tanking the stock markets.

Given that the Fed's current two-pronged mandate emphasizes employment over inflation, she'll hammer on this notion until the numbers either move the way she wants or somebody can manipulate them to match reality.

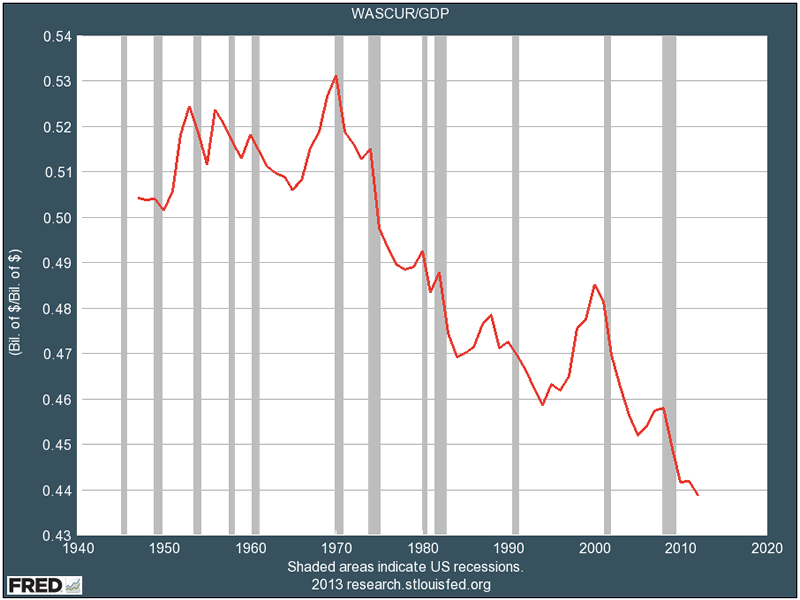

Charted Truth No. 2

Employee compensation as a percent of GDP is down to the lowest levels ever recorded.

This is another chart that fairy-dusted federal policy makers don't want made widespread knowledge.

The White House is trying desperately to convince the American public that things are improving, as are politicians from both parties who are anxious not to lose their seats at a time when trust in their abilities has dropped to all-time lows.

Despite having spent trillions on liquidity injections, average workers are getting squeezed harder than ever before. So while profitability is now at record levels - with the average S&P 500 company generating 9.9 cents per sales dollar, according to Bloomberg - compensation is headed for the basement.

Decades of shoddy economic policy are coming home to roost, and there's not a damn thing they've done about it except serve up their own self-interested legislation while selling mainstream America down the river.

Not only are huge swaths of workers being "partimeified" in an effort to further boost margins, but wages are falling well behind GDP growth. According to the Bureau of Economic Analysis, as reported by Bloomberg, the ratio of U.S. wages to earnings is a mere 3.2 as of Q2 2013... and falling. By comparison, that same figure averaged 4.7 from 1947 until the beginning of the financial crisis, so we're talking about a 31.9% decrease.

Individual company data is even more graphic - pun absolutely intended.

Disney boosted operating margins from 13% in 2005 to 21% while terminating loads of workers and closing offices. Defense contractor Northrop Grumman has bluntly raised expectations by cutting jobs to boost net income. Its profit margin rose 56%, from 5% in 2009 to 7.8% in 2012, as noted by Bloomberg.

This isn't just a U.S. problem.

In Japan, for example, Toyota, Mazda, and Panasonic have all cut tens of thousands of jobs and closed once thriving production lines while offshoring remaining production.

Even Europe, with its comparatively inflexible labor laws, is feeling the bite despite being the slowest to cut labor and, as a result, boost profits. Italian labor unions, for instance, are trying desperately to hold on to nearly 200,000 jobs split amongst 150 companies looking to cut them. France, Germany, Spain, and England are in the same boat, with companies struggling to make a go of it.

Unfortunately, the issue may be moot.

Big American companies like Ford, Whirlpool, and GE are simply selling off European operations - or closing them entirely - to save their bottom lines from the hassle, not to mention the earnings impact. Asian firms like Sony and Fujitsu are rumored to be interested in dumping European facilities, too, and for the same reasons.

I believe incoming Fed Chair Janet Yellen is keenly aware of the international implications of cheap capital and expanding margins. So she'll do everything she can to boost both, knowing that an estimated 40% to 60% of S&P 500 revenues come from overseas operations.

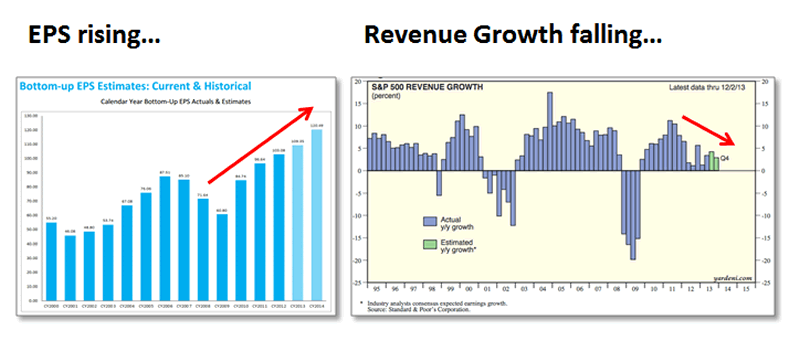

Charted Truth No. 3

Earnings have doubled since October 2009, while sales growth is slowing.

Source: FactSet Earnings Insight, Standard & Poor's Corporation, via Yardini.com

Under normal market conditions, slowing revenue growth and record-high profit margins are not a recipe for continued growth unless earnings can support the equation.

This time around, they are.

That's because companies are willing to invest in potential productivity growth as long as the Fed provides the cheap capital needed to fuel it. By the way, this is what people mean when they talk about what was the "Greenspan put," which became the "Bernanke put," which is now set to become the "Yellen put."

Normally, companies would be bracing for slowing activity. But this time around, they're looking for additional earnings expansion using a trifecta of exceptionally low wage rate pressure, historically low debt service costs, and share buybacks that could boost year-over-year EPS growth by upwards of 1.5% to as much as 2%.

Yellen won't risk upsetting this delicate balance if for no other reason than to serve Washington's interests. I can't imagine the pressure she's under.

You Can Take Advantage of This Situation

The $14 trillion we've seen created out of thin air via a five-year rally that began 165.35% ago in March 2009 is just getting warmed up.

As long as money remains cheap and companies can cut costs further while also overtly resisting new full-time hiring, profit margins will continue to increase.

Bloomberg and S&P data pin bottom-line growth next year at approximately 10%. My own expectations are a little more aggressive.

I believe 11%-12% bottom line growth is more likely, as long as Yellen keeps her foot on the gas. I say that if for no other reason than the markets have perpetually underestimated how adept corporate America is when it comes to squeezing profits out of thin air. So rising equity prices are a means of catching up.

And the key to capturing that?

With very few exceptions, I think that "glocals" are the place to be for the next 12 months. That's what I call companies like ABB, Raytheon, and AFLAC - firms with globally recognized brands, internationally diversified sales, strong balance sheets, and disciplined management. I'm game for small caps, too, but more as "spice" than "sauce," so to speak. (If you follow Sid's Small Cap Rocket Alert recommendations, you know a dash of the right "spice" can go a long, long way.)

Dividends are exceptionally important right now and should be a source of renewed emphasis for every investor, because they offer cold hard cash as compensation for the ownership risk you take when you buy them.

I'm also increasingly a fan of bottom fishing into 2014, because I think very aggressive tax harvesting will put the best companies in several key sectors on sale. If you're not familiar with the term, that's what people call selling big winners to harvest losses that offset the capital gains normally incurred with big winners.

My favorites at the moment include Chinese industrial fabricators, resource plays, and even REITS that have been trashed to the tune of 40%, 50%, or even more.

But act quickly - tax-loss sales have historically peaked in mid-December, which sets up a "recovery rally" of sorts into 2014.

And you just know the White House would love to tout that "it" made that happen come mid-term elections.

Source :http://moneymorning.com/2013/12/05/three-charts-obama-hopes-youll-never-see/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.