Stock Market 2014 - Saving You From a Dangerously Popular Delusion

Stock-Markets / Stock Markets 2014 Dec 16, 2013 - 02:26 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: There's a very dangerous meme making the rounds.

Keith Fitz-Gerald writes: There's a very dangerous meme making the rounds.

It goes something like this:

The economy is improving, therefore the Fed's going to taper... and, when it does, the economy is strong enough to endure the withdrawals that will come with it.

Don't fall for it.

Nothing could be farther from the truth. Any amount of stimulus reduction will indeed trigger a "taper tantrum."

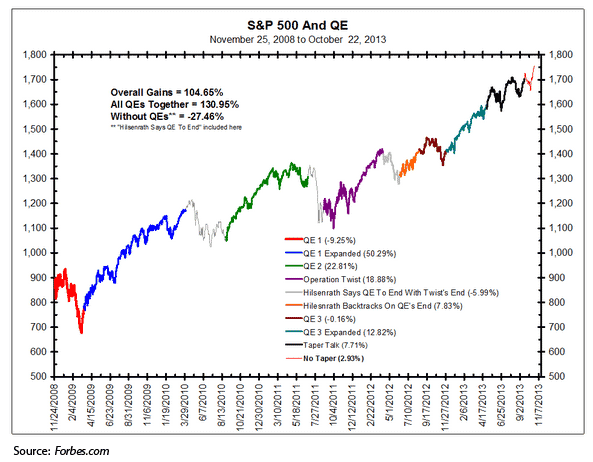

This chart is all the proof we need...

How the Fed Directly Impacts Your Money

The following chart is courtesy of Michael Cembalest, Chairman of Market Strategy and Investment Strategy for JPMorgan Asset Management via Forbes.

You can see as clearly as I can that 100% of equity market gains since January 2009 have taken place during weeks when the Fed has purchased Treasury bonds and mortgages. Conversely, 100% of the declines have been during weeks when the Fed backed off.

Now, I'll parody screen legend Jack Nicholson's iconic line in "A Few Good Men"... some people can't handle the truth. So they argue that this is a short-term phenomenon or just random happenstance.

That's not true either.

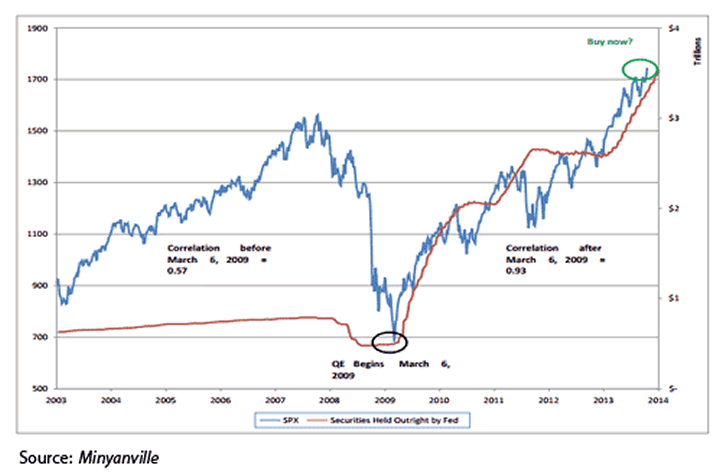

Andreas Calianos, Chief Investment Officer at DomeEquities, did some truly great work in this department that's very similar to my own analysis, which is why I want to share it with you.

Calianos found that the correlation between the S&P 500 and the average weekly dollar value of Fed-held securities from December 2003 to the week ended March 6, 2009, was a low 0.57. That's little better than random.

But from March 2009 onward, the correlation jumped from 0.57 all the way to 0.93 - meaning that there's nearly a 1 to 1 correlation between the weekly average dollar value of securities held by the Fed and equity prices.

If you've forgotten your basic statistics, 1 represents a perfect correlation, whereas a 0 means there's no correlation and the data doesn't seem to be related at all. But, again, we're talking about a correlation coefficient of 0.93, which is nearly perfect.

Ergo... you truly can thank Team Bernanke and the Fed for the $14 trillion 155% rally we've enjoyed for the past 5 years. While correlation isn't causation, you can bet there's linkage in this case thanks to the effect of liquidity that the Fed's buying has created.

So what's next?

That's hard to say, but if you thought 2008 was fun, stay tuned. I don't know when the next shoe will drop, but when it does it's going to be a doozy.

Legendary investor Jim Rogers puts it this way - and I am paraphrasing here - in several recent interviews that the reason why things will get so much worse the next time around is the amount of debt they've put into the system. Central bankers continue to float literally everything in an artificial sea of liquidity.

It's not for nothing that he's quick to remind people that the United States is now the most indebted nation in the history of the world - a point long-time readers know I am prone to hammer on as well because the Fed's activities are magnifying the causes of market instability rather than addressing the fundamental sources of the chaos that created it.

History is filled with examples of false booms where low interest rates create the illusion of savings that doesn't exist and that consumption is healthy when, in fact, it isn't. The Great Depression comes to mind, as does the tulip mania of the 1600s, when European coinage debasement created a continent-wide run on other assets. This should ring some bells if you've ever read Charles Mackay's book, Extraordinary Popular Delusions and the Madness of Crowds. If you haven't, I urge you to read it because it will help put what I am saying into perspective. Bear in mind that it was first published in 1841.

My position is basically this... the notion that our economy is strong enough to support a taper is very, very dangerous.

It's creating a sense of false security amongst market participants who can least afford it while quite literally giving the biggest trading houses yet another "get out of jail free" card for still further derivatives speculation - and yet another chance to fleece the public.

Here's What to Do as We Head into 2014

First, watch the central banks carefully.

People presume that Yellen will telegraph her taper. She doesn't have to do that. In fact, I believe Yellen is the quintessential government banker so she's just as likely to announce a taper one day as she is to change shoes. There may not be any warning whatsoever.

Fed notes reflect growing dissention in the ranks with regard to a taper as well as a lot of head scratching. My guess is that a lot of people inside the Fed know they've boxed themselves into a corner. This makes anything they come up with not only suspect, but also exceptionally risky because they are operating by the seat of their pants.

Second, keep a ready-for-anything plan "top drawer."

By this I mean that you've got to have trailing stops on your stocks. I don't care if they're percentage-based, dollar-based, or even calendar-based. But what I do care about is that you find the exits now... before you need them, and with every single one of your investments.

And if the "taper tantrum" never comes?

Then you keep ratcheting your stops up in concert with the rise to capture even bigger profits.

Now, a lot of investors tell me they don't like trailing stops. That's okay by me... if you've got that covered with put options or inverse funds that rise in the event the markets fall - but running naked without protection against this backdrop is just asking for trouble.

Third, continue buying.

A lot of people can't fathom this because they think of buying and selling as mutually exclusive activities conducted at a specific point in time. In reality, there are all kinds of ways to buy into risky markets over time, many of which result in getting shares you want at a deep discount.

For example, you can do something very simple, like dollar-cost averaging, wherein you spread your money over a period of time and buy in with equal amounts; $1,000 a month for 12 months or some other amount over three months.

Be creative but be disciplined about it. One of the great advantages to dollar-cost averaging is that it forces you to acquire companies when they are on sale and upside potential is greatest, even though your emotions may be telling you to run the other way.

Or, you can sell cash-secured put options at deep discounts and well ahead of time. Then, sit back and relax. If the markets come to you, you're in at the price you want and for exactly what you wanted to pay. Think of it as Vegas in reverse, only this time you're the house.

And, finally, if neither of these alternatives appeals to you, try doing something as simple as throwing a lowball order out there.

For instance, if MCD is trading at $94 but you think it's worth buying 100 shares at $85, then make your play by placing a limit order at $85 and holding that cash in reserve. If the stock drops, then you look like a hero for not paying too much and get the benefit of having gotten a valuable stock at a deep discount to what everybody else paid. If it doesn't you haven't risked a dime and there's nothing stopping you from adjusting your order later.

In closing, opinions are like belly buttons in that everybody has one.

Mine is based on data... there is a direct relationship between Fed buying and equity prices. Which means, by implication, there is also a looming "anti-relationship" that will take hold when they stop.

I want you to be prepared for both alternatives because that's how you profit...

...instead of getting taken to the cleaners.

Source :http://moneymorning.com/2013/12/13/americas-bestselling-ret...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.