Start of Stock Market Intermediate Decline, Or...?

Stock-Markets / Stock Markets 2013 Dec 16, 2013 - 06:04 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected (after this bull market is over), there will be another steep decline into late 2014. However, the severe correction of 2007-2009 may have curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - An important top formation may be in the making.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

START OF AN INTERMEDIATE DECLINE, OR...?

Market Overview

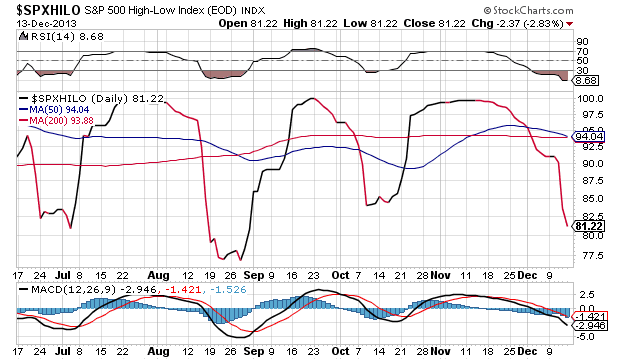

The indicators did not lie! Since the end of December, they have been pointing to the formation of a top. After a 3-day decline of 34 points from 1813, SPX had a rally which stopped just short of producing a new high. Last week, this was followed by another decline of 40 points with the index closing near its low of the move after meeting the 1773 projection target.

In the previous letter, I suggested that, in order to get a confirmed intermediate sell signal, two things needed to happen: 1) SPX needed to close below 1777 and 2) the A/D would need a daily close of at least -1800. Both of these requirements were met on Thursday ... just barely! On Friday, the index could not follow through on the downside, but only traded in a narrow range.

My expectations are that we started a decline which is probably that of primary wave IV, with the correction lasting into February. But I would like the confirmation of an intermediate decline to be just a little more conclusive as there are other factors which contribute to some uncertainty: the 8-week cycle which ostensibly caused the current decline was expected to make its low either Friday or Monday, we are about to enter one of the most bullish periods of the year and, on the Point & Figure chart, it looks very much as if SPX has started to form a base from which to start a rally. So far, that base is not extensive enough to take us to new highs, but if this pattern extends for another day or two, we will have to take another look at such a possibility.

The best way for the uncertainty to resolve itself would be for the decline to continue into next week. This is a possibility since another (but weaker) cycle bottom follows the 8-wk cycle and is due toward the end of next week. If it were to continue pressuring the SPX, it could move it down to the next projection level which is several points lower.

Next week should clear this up.

Chart Analysis

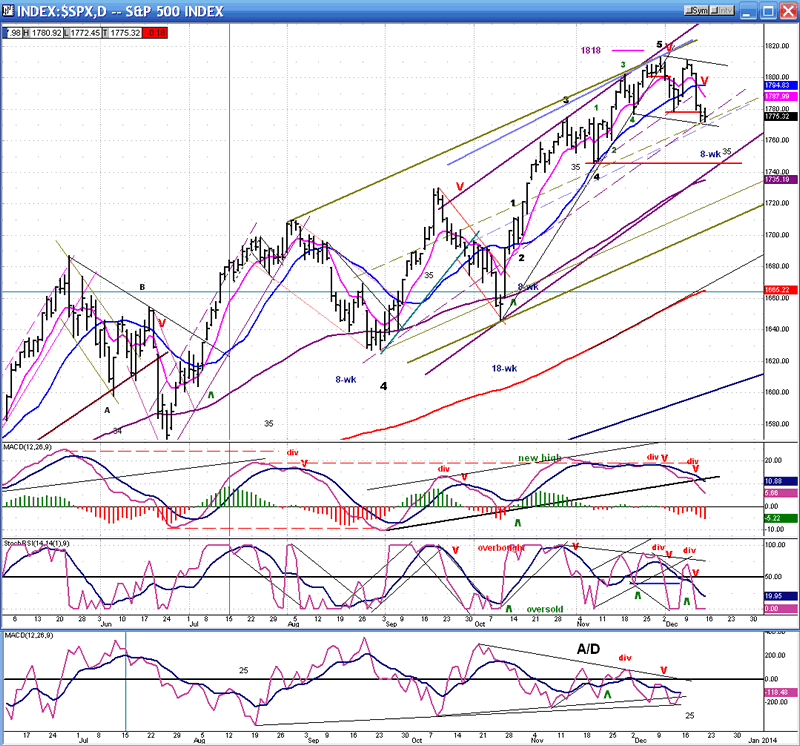

The daily chart (courtesy of QCharts) shows that the SPX stopped its decline at the bottom of a short-term channel and at the intersection of several internal parallels, all of which, together, create enough support to arrest it, at least temporarily. There is also a sizeable congestion level which was formed by the 1775 high which is now acting as support. The current pull-back has come to rest on the very top level. This will make it difficult for the correction to extend beyond this price band right away.

The oscillators are mixed. The MACD is in a decline and has just broken an uptrend line, but it is still positive. SRSI is oversold and flat, and the A/D oscillator has turned up after making a new low, but has not yet made a bullish cross. Collectively, they also reflect a period of hesitation in the downtrend which could quickly evolve into their being in a position to give a buy signal.

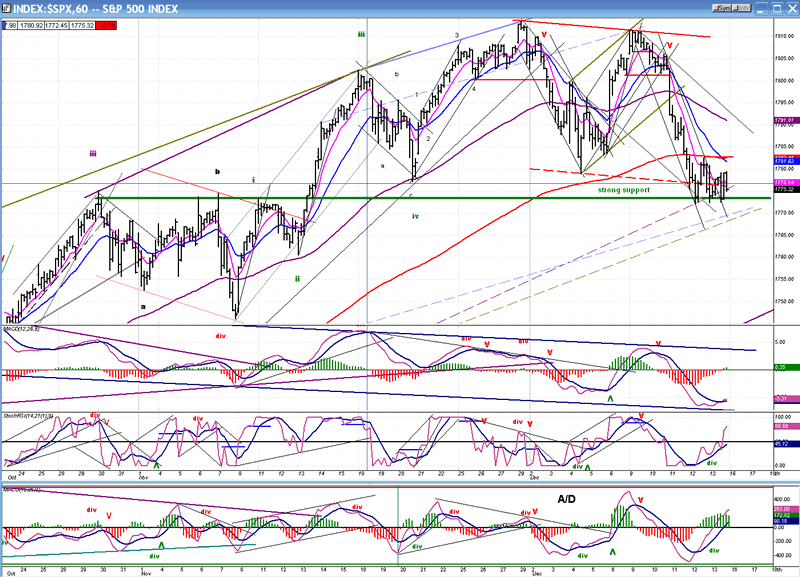

The hourly chart (also courtesy of QCharts) shows that the oscillators have profited from the pause in price to turn up, but they are also mixed. SRSI and A/D are already in uptrends and have turned positive, but MACD is still very oversold and in a longer-term downtrend which may curtail any price rally that may develop from this level.

The chart also shows clearly the support level which coincides with the internal parallel lines around this area. It will take a fair amount of additional weakness to drive prices through all that. Note that SPX has fallen below its 200-hr MA but not far enough so that it cannot be surpassed once again on any attempt at rallying.

The combined daily and hourly charts illustrate the uncertainty about the direction of the next short-term trend and it will take a few more days of trading to sort it out.

Cycles

The downtrend of the 8-wk cycle is just about exhausted and it may even have made a low on Friday. There is another 35-td cycle whose low is due this week which could prolong the decline if it can muster enough downside pressure on the index.

Intermediate cycles which are due in February and long-term cycles due next October could continue to exert downward pressure on the market until both short-term cycles have turned up and can provide a temporary rally.

Breadth

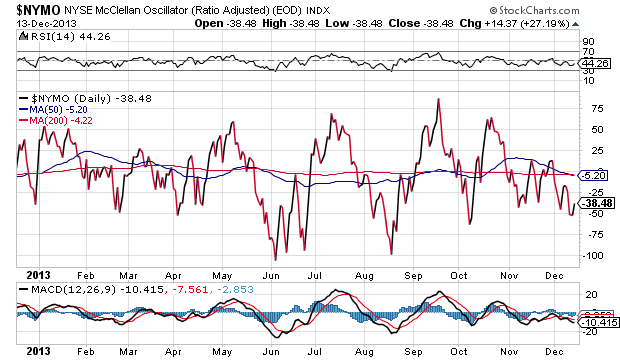

The McClellan Oscillator and Summation Index (courtesy of StockCharts.com) appear below.

The McClellan oscillator has drifted a little lower, but not enough to confirm that an intermediate decline is in progress. If you look back to June and August, the troughs of the indicator are far lower as a result of much more intense selling. Until this occurs, the decline may remain fairly shallow.

NYSI-- which is more reflective of the intermediate term -- on the other hand, has already dropped below its October low and this has produced serious negative divergence in that index. Here, there is less doubt that we have started something more than a short-term decline, but SPX could still generate a rally over the next two or three weeks before dropping lower.

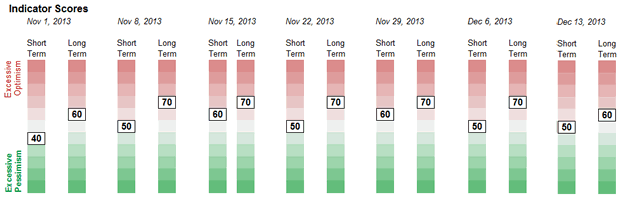

Sentiment Indicators

After several weeks with a reading of 70, the SentimenTrader (courtesy of same) has dropped back to 60. This is still an elevated reading which is by no means suggestive that we should already expect an end to the correction.

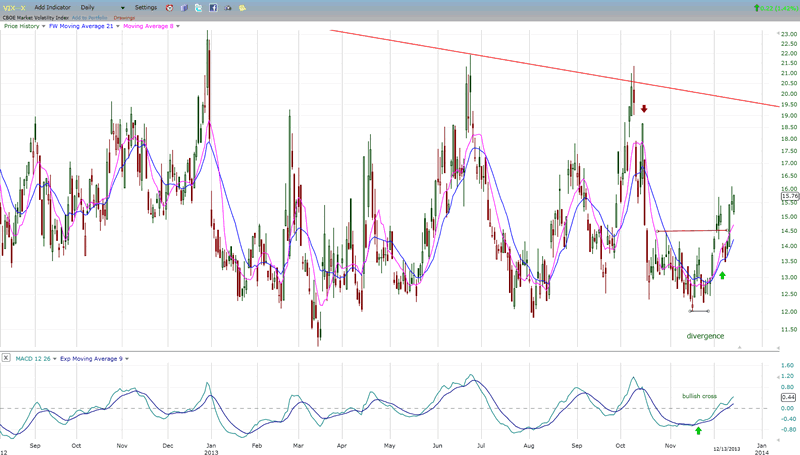

VIX

During the recent decline VIX made the same half-hearted attempt at breaking out that the way it did in the previous one. The pull-back in prices went slightly lower, and VIX went slightly higher. But this only augments the sense of uncertainty about the market's direction. VIX tends to reflect the mood of the market and, at this time, it shows the same degree of complacency which has prevailed for the past six weeks.

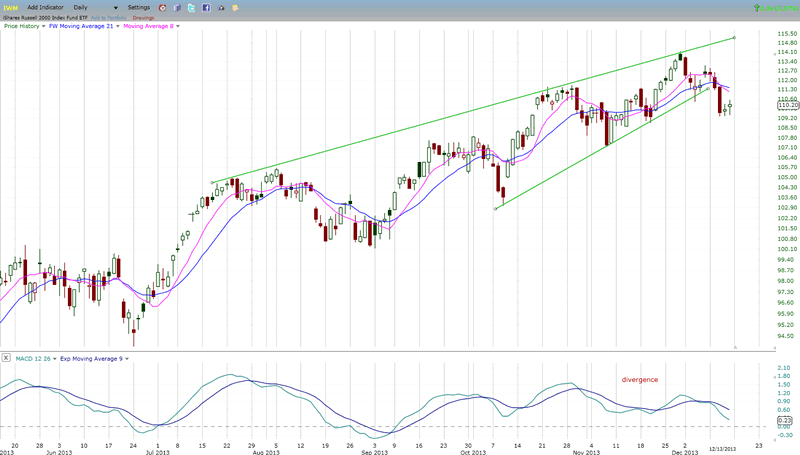

IWM (ETF for Russell 2000)

IWM was making a bearish wedge pattern which has resolved itself to the downside, as it should have. However, the correction is clearly a-b-c and, unless it adds one more down leg, this will turn out to be another short-lived retracement. Hope for more to come resides in the MACD which is still down-trending with no sign of deceleration.

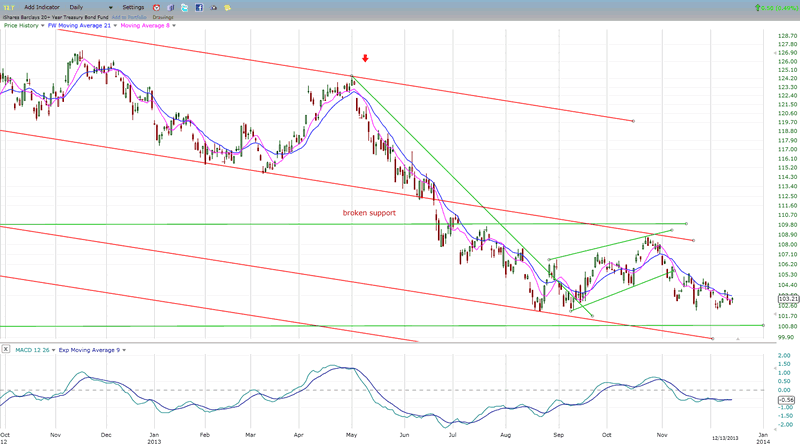

BONDS

As pointed out in the last newsletter, bonds are caught up in a lethargic trend which is going nowhere. The positive divergence which has developed in the MACD is pointing to a potential holding or rallying in the near future. However, the potential for a dynamic reversal of the trend is still nowhere apparent.

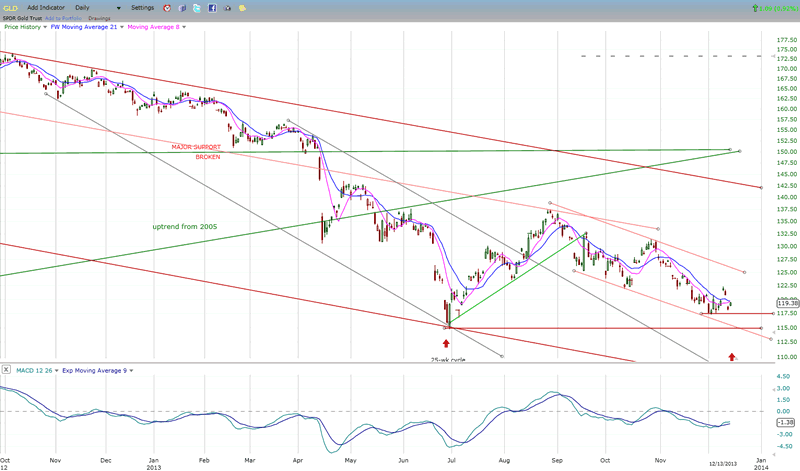

GOLD (ETF for gold)

After a meager attempt at rallying, GLD has quickly moved back down. It is now engaged in finding a price level that will mark the bottoming of its 25-26 day cycle which is scheduled to make its low over the next few days. If GLD manages to hold its former low during this process, it will be in a better position to start a good reversal which could go and challenge the top of its long-term down channel.

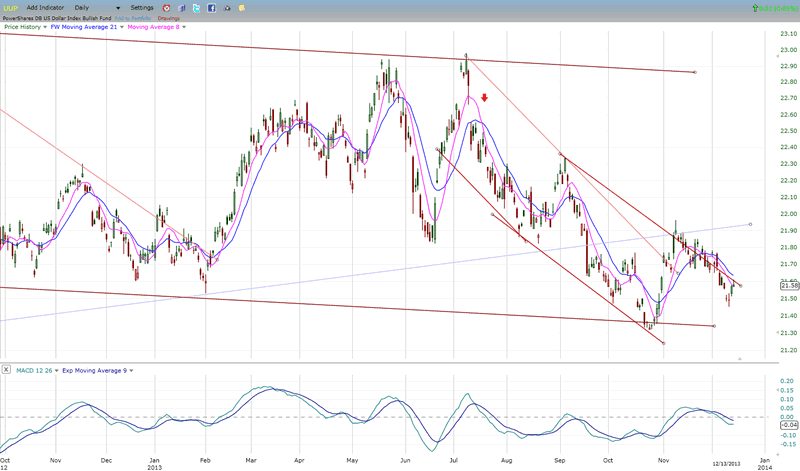

UUP (dollar ETF)

The dollar may have found support at 21.50 and be preparing to turn up from this level. However, the proximity of the 25/26-wk low in gold could affect it adversely, limit its upside potential and cause it to continue its downtrend after only a short rally.

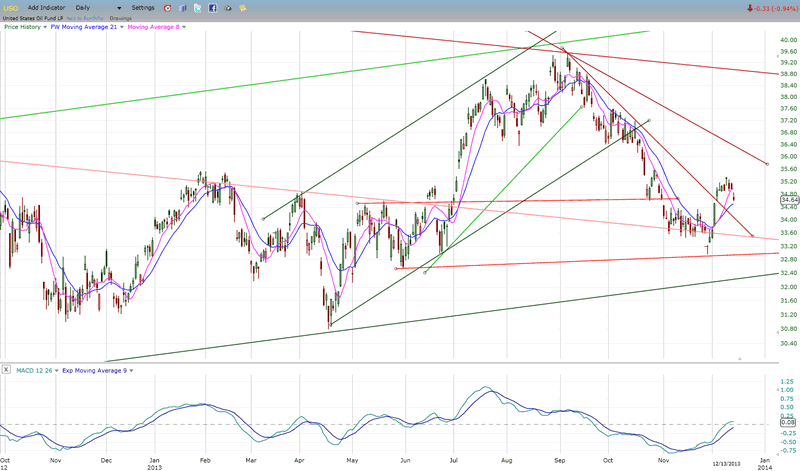

USO (United States Oil Fund)

Last week, I mentioned that USO might have a problem following through on its upward spurt. This has proven to be the case and the index is now engaged in retracing its move. It could lead to more of a rally later on, but the long-term chart argues against anything of substance.

Summary

Perhaps the best way to define SPX's options going forward is to present them in structural terms.

There is a good possibility that primary wave III of the move from 10/11 ended at 1813 and that primary wave IV has started. This is made more probable by the expectation that an intermediate downtrend which will last into the February cycle lows. On the other hand, the current pattern could also be viewed as a large a-b-c correction which ended at 1772.

Confirmation of either possibility will come if the next rally makes a new high, or fails to do so. We are entering what is probably the most bullish period of the year and the hourly chart, particularly, points to the possibility that the decline has been arrested and that the oscillators are gearing up to give a buy signal. The market action into early January will provide more clarity about the overall trend.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.