Gold Price Breaking Below $1200, Silver $19

Commodities / Gold and Silver 2013 Dec 20, 2013 - 12:13 PM GMTBy: Alasdair_Macleod

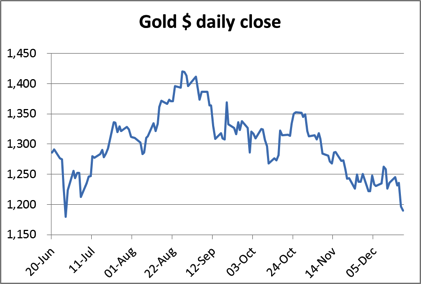

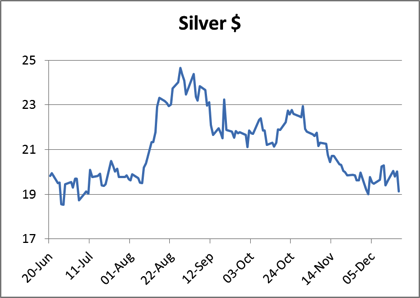

This was the week the Federal Open Market Committee decided to start tapering. The result was gold traded below $1200 yesterday for the first time in nearly six months, and silver pulled back to $19.10.

This was the week the Federal Open Market Committee decided to start tapering. The result was gold traded below $1200 yesterday for the first time in nearly six months, and silver pulled back to $19.10.

The action is shown in the following charts:

Technical analysts see the $1180 level, from which the gold price rallied in late-June, as important; and with the price closing last night only $10 above it we are very close. If it holds, gold will have formed a bullish double bottom; if not technicians will start talking about $1150 as a price target.

The sharp falls in precious metals are not reflected in other risk assets: if anything the opposite is true. Equities soared through or towards all-time highs and bond yields were broadly steady. While the majority of analysts expected the Fed to delay tapering until the New Year, the amount of $10bn was generally discounted by markets, except apparently by gold and silver.

This reaction is mostly a reflection of the extreme bearishness in paper markets for precious metals. There is a tautology here: prices are falling only because they are falling while other investments are rising. Equities, fine art and even diamonds are inflating, but not gold and silver which seem to be locked in a kind of reverse bubble.

This investor psychology is actually typical in the advanced stages of a bear market, and the more irrational it becomes the more dramatic usually the subsequent bull market. The difficulty always is to retain a sense of value against the irrational madness of crowds.

Meanwhile, reflecting Asian values in physical markets demand continues apace as these buyers benefit from lower prices. There is a clip on Bloomberg TV <http://www.bloomberg.com/video/what-s-happening-to-all-the-gold-d33u1c23SDqA0p0e~9_INw.html> which sums up the situation: in a few short years, according to Bloomberg’s Kenneth Hoffman, gold vaults in London that previously were full to the rafters have emptied.

Trade in physical gold in Asia is now so great that joining the Shanghai market in spot trading we may soon be able to add Dubai, Moscow, Bangkok, Singapore and Seoul. These centres either have firm plans to introduce spot contracts based on the 1 kilo bar standard, or are seriously talking about it.

At least in the paper markets, we are coming up to the year end, when fund managers begin to adjust their positions to enhance their mark-to-market profits. It is sometimes hard to know what the net effect will be; but in gold and silver low prices should suit the active traders, who are generally short. This may explain the motivation behind some of the selling. If this is the case, a decent bear squeeze may be postponed until after Christmas. Until then I wish patient bulls an enjoyable and well-earned rest.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2013 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.