Merry Stock Markets – Apple Provides More Lift

Stock-Markets / Stock Markets 2013 Dec 24, 2013 - 09:45 AM GMTBy: PhilStockWorld

AAPL strikes again!

AAPL strikes again!

In last Wednesday's Webcast (Our Top Picks for 2014), I noted that AAPL was once again going to be my pick of the year (it was our top pick for 2013 too) because, once again, not only was it cheap but BECAUSE we could construct a ridiculously cheap option spread for it that can once again deliver a massive return of 500% or more.

Last year's trade idea for AAPL was to buy the Jan 2014 $400/500 bull call spread at $52.50 and sell the 2015 $350 puts for $38.50, for a net $14 entry on the spread. Today that spread is net $91.20, up 551% in less than a year – beating the S&P by 20x!

This year's spread (see Wednesday's post for details) is a bit more ambitious with the 2015 $500/650 bull call spread at $44.30, offset by the sale of the 2016 $400 puts for $30 for a net $13.30 entry on the $150 spread with 949% of potential upside. Well, it's off to a great start as AAPL popped back to $570 this morning (up 4%) as their deal with CHL is finalized. That's getting the Futures very excited as AAPL is 20% of the Nasdaq and the Nasdaq is up 0.75% on the news and the other indexes are lagging a bit, but generally moving higher as well.

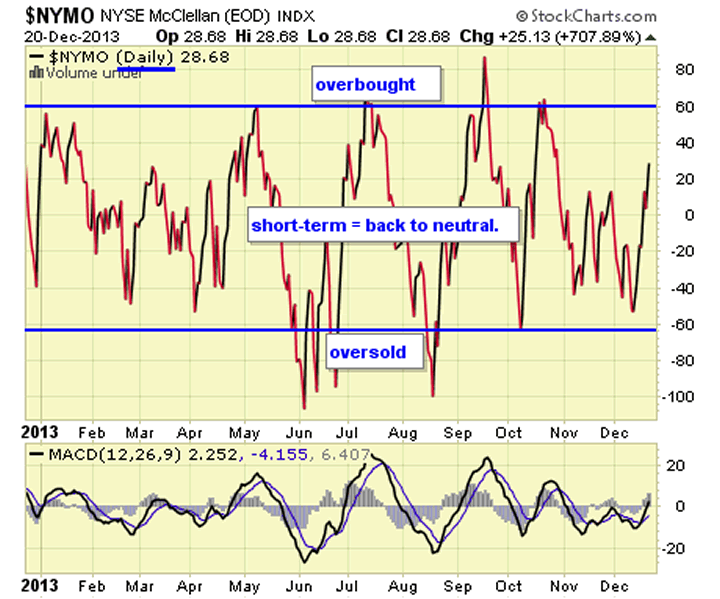

That's going to send our indexes all the way to VERY overbought, if Friday's action on Dave Fry's NYSE McClellan Oscillator is any indication. Even if today adds less than Friday's 25 points, we're still going to be well above that 40 line but, once again, we don't really care – because we are mainly in CASH!!

And why are we in cash in such an exciting market? Here's a sobering snippet from the Consumer Metrics Institute's Analysis of the Economy:

For the past two months we have wondered how the BEA's latest growth estimates might impact the Federal Reserve's stance on monetary policy — and particularly the duration and size of QE.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.