The Stock Market Holiday Bulge – Prepare for Selling

Stock-Markets / Stock Markets 2013 Dec 26, 2013 - 06:10 PM GMTBy: Chris_Vermeulen

I would like to start by wishing you a Happy Holidays & New Year!

I would like to start by wishing you a Happy Holidays & New Year!

So far this year (2013) has been a great year for trading and my 2014 forecast looks to be as good if not even better. I do have something exciting to share with you that is going to make 2014 really amazing, but first let me talk about the stock market and what is likely to unfold in the next week or two so you can protect your investments.

As many of you know, I follow and post frequently on StockTwits.com. I like to see what traders and investors are thinking/feeling about the broad market using extreme sentiment readings as a contrarian signal for trade ideas or to protect open positions more by tightening my protective stops and locking partial profits.

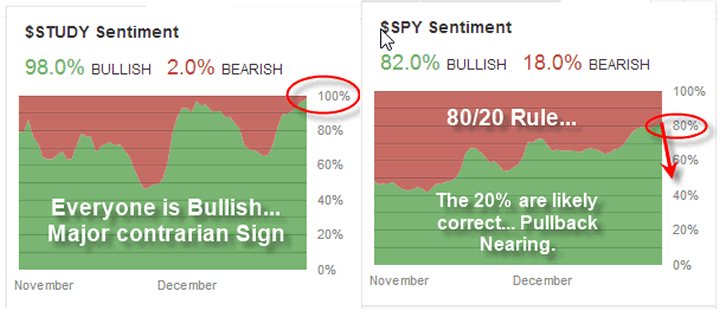

Below I have posted a two charts on sentiment courtesy of StockTwits to show these extreme readings of where the US stock market is trading at. The first chart is of the symbol $STUDY and this sentiment shows us that 98% of trading material is bullish on the stock market right now. My theory is, if everyone is moving in one direction, you better be ready for them to change direction any time. The masses move like a school of fish and one they get spooked they change direction and start selling everything they just bought.

The second sentiment chart is of the SPY exchange traded fund. This mimics the SP500 index and is also a gauge for broad market sentiment. If we think back to the 80/20 rule, we know that 20% of the crowd/clients are correct while 80% tend to be incorrect. With sentiment reaching the highest level in a couple months and with the index making new highs, coupled with the holiday price bulge (holiday rally) logic says a pullback in the near term is very likely an that it could be sharp and it almost like automated trading.

Market Sentiment – Broad Market Contrarians Indicator

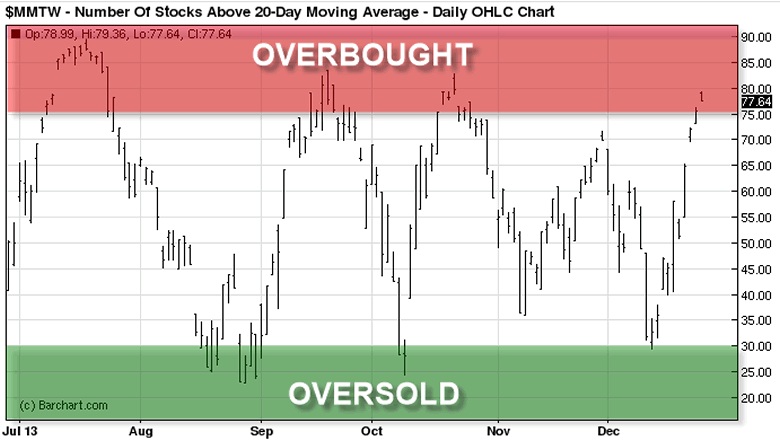

The stock market has wave like patterns that form on a monthly basis that provide us with a steady stream of trading opportunities. One of the best swing trading tools for timing these waves is through the use of this chart below provided by Barchart.com.

The chart below is self explanatory, but let me quickly explain how it works. This chart rises as more and more stocks trade above the 20 day simple moving average. And when the majority of stocks are in a strong uptrend, it’s a lot like humans all trading in the same direction (a school of fish) and the odds favour a change in direction temporarily. These waves are great intermediate trends for swing trading and typically last multiple weeks at a time. This is one of my strategies which I trade with my members at TheGoldAndOilGuy.com alert newsletter. Keep in mind, its not as easy as it looks, because there are more moving parts to this equation but you can see these extreme waves clearly in this chart.

The Holiday Bulge & Amazing Information Conclusion

With the stock market still firmly in an uptrend and firing on all cylinders short term analysis is pointing to a pause or pullback in the next week or two. I did forecast this exact price action several weeks ago and how it could lead to the start of a major market top. If a major top does form early in 2014 then we could make some big money once the down trend starts.

Remember, stocks fall 3-7 times faster than they rise, so once we get short massive gains can be made quickly and while the masses (school of fish) are losing money, we should be on the other side watching our trading account sky rocket!

NOW FOR THE GOOD NEWS!

A few days ago my new book “Technical Trading Mastery – 7 Steps To Win With Logic” became available to my followers and readers with an offer you would cannot refuse. If you buy my book before Jan 1st you get a Lifetime Membership to my new Monthly INNER-Investor Newsletter so you can keep your long term investment capital on the right side of the market forever.

Get the Full Details at: http://www.thegoldandoilguy.com...

JOIN MY FREE ETF TRADING NEWSLETTER!

Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.