Relentless Stocks Bull Market Continues

Stock-Markets / Stock Markets 2013 Dec 28, 2013 - 03:10 PM GMTBy: Tony_Caldaro

After ending last week near an all time high at SPX 1818, the market gapped up twice this week reaching 1845 on Friday before settling at 1841. For the week the SPX/DOW were +1.45%, the NDX/NAZ were +1.25%, and the DJ World index gained 1.50%. Economic reports for the week were again positive. On the uptick: personal income/spending, PCE prices, durable goods orders, FHFA housing prices, new home sales, and weekly jobless claims improved. On the downtick: the WLEI and the monetary base. Next week, another holiday shortened week, will be highlighted by construction spending, ISM and auto sales.

After ending last week near an all time high at SPX 1818, the market gapped up twice this week reaching 1845 on Friday before settling at 1841. For the week the SPX/DOW were +1.45%, the NDX/NAZ were +1.25%, and the DJ World index gained 1.50%. Economic reports for the week were again positive. On the uptick: personal income/spending, PCE prices, durable goods orders, FHFA housing prices, new home sales, and weekly jobless claims improved. On the downtick: the WLEI and the monetary base. Next week, another holiday shortened week, will be highlighted by construction spending, ISM and auto sales.

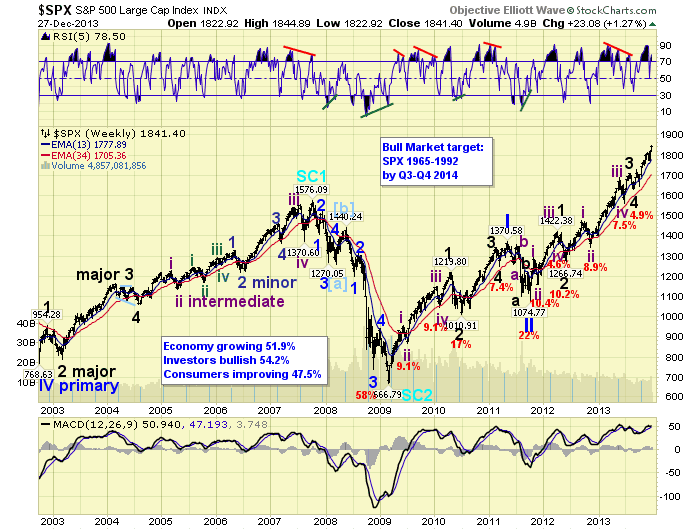

LONG TERM: bull market

After pin-pointing the March 2009 SPX 667 low, nearly to the day, we turned somewhat long term bullish expecting a 50% retracement rally to around SPX 1150. When the market hit that level in January 2010, we noticed the next correction in February to around SPX 1050 was corrective, and not impulsive. This suggested to us we were already in a long term bull market, and not a bear market rally.

Then in mid-2011 we became cautious on the market as it had completed five waves up into SPX 1371. The market then corrected in an elongated flat losing about 20% of its value. Soon after the market started impulsing again as Primary III was underway. The previous five wave advance was Primary I and the steep correction Primary II.

This summer, 2013, we observed a possibility that Primary III could be ending. We expected about a 10% correction. But all we got was 5% and the market moved higher. This fall we observed the same possibility. But this time the market pulled back only about 3% and then turned higher. Primary wave III continues to unfold.

When Primary III does conclude we should see the biggest correction we have seen in over a year for Primary IV. Which may coincide with the four-year presidential cycle low. Then another advance to new highs for Primary V. We had a bull market target of SPX 1779 by Q1 2014 for quite a while. But recently extended it out to Q3/Q4 2014 around the high SPX 1900′s.

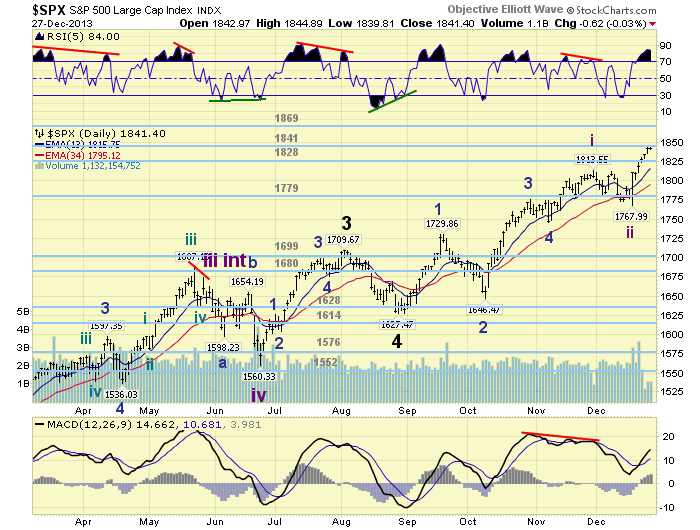

MEDIUM TERM: uptrend

We continue to count this uptrend from the August low, and the DOW October low, as Major wave 5 of Primary wave III. From late-August to late-November, in the SPX, we had a five wave advance: 1627-1814. There was also a five wave advance in the DOW, but of a shorter duration. Heading into December the market corrected only 23.6% of the advance, when the FED projected an end date to QE 3 and started tapering. We counted the first advance as Intermediate wave one of Major wave 5. The pullback Intermediate wave two. And the current rally Intermediate wave three. Both in the SPX and DOW. Possibly the trifurcation of the past few months had ended.

In an October weekend update we offered three potential counts: http://caldaro.wordpress.com/2013/10/12/weekend-update-418/. One was quickly eliminated: the Primary III high. But the other two are still active. We have been tracking the Major 5 underway count on the SPX/DOW charts. And the Minor wave 3 of Int. three of Major 3, bubble-type count, on the NAZ charts. This count we feel is an alternate to more obvious count posted on the SPX/DOW charts.

Last weekend we posted several price projections, resistance pivots, that the market needs to overcome to continue to move higher. SPX 1828 was the first, and the market closed there on Monday. SPX 1841 was next, and the market closed there on Friday. The next resistance pivots are currently SPX: 1869, 1884, 1901, 1955, 1970 and 2070. Should Int. waves three through five equal at least Int. one, then SPX 1955 is achievable before the next significant correction. Medium term support is at the 1841 and 1828 pivots, with resistance at the 1869 and 1884 pivots.

SHORT TERM

Short term support is also at the 1841 and 1828 pivots, with resistance at the 1869 and 1884 pivots. Short term momentum ended the week near neutral. The short term OEW charts remain positive from SPX 1785 with the reversal level now 1830.

The current Int. wave three rally has only advanced three waves thus far from SPX 1768: 1811-1801-1845. Minor wave 1 of Int. wave one, also advanced a similar amount in its first three waves from SPX 1627: 1661-1641-1705. Should the similarity continue we should see a decent pullback soon, then another rally to about the OEW 1884 pivot before even a larger pullback follows. For now, we are assuming the first three waves up of this rally are part of Minor 1 of Int. three. Anticipate, monitor and adjust. Best to your trading!

FOREIGN MARKETS

The Asian markets were all higher on the week for a net gain of 1.2%.

The European markets were also all higher for a gain of 2.0%.

The Commodity equity group were all higher as well for a gain of 0.9%.

The DJ World index is uptrending again gaining 1.5% on the week.

COMMODITIES

Bonds continue to downtrend losing 0.7%, as 10YR yields crossed 3% for the first time in 2.5 years.

Crude continues to uptrend gaining 1.1% on the week.

Gold is trying to uptrend again gaining 0.9% on the week.

The USD is still downtrending and lost 0.3% on the week.

NEXT WEEK

Thursday: weekly Jobless claims, Construction spending, and ISM manufacturing. Friday: Auto sales. The FED gets active again with two speeches on Friday. FED governor Stein at 1:15, then FED chairman Bernanke at 2:30. Best to your weekend and week and Happy New Year!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2013 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.