Stock Market End of Year Musings

Stock-Markets / Stock Markets 2013 Dec 30, 2013 - 12:29 PM GMTBy: PhilStockWorld

Things are indeed getting surreal.

Things are indeed getting surreal.

Appropriately, surrealism began in the 1920s, at the time of another great stock market bubble and was marked by representations of illogical scenes, often pasted together using everyday objects in unusual settings.

As noted by Dave Fry on his NDX chart, who'd have thought we'd be back to those "ridiculous" levels at Nasdaq 4,000 just 13 years after "learning our lesson"? Of course, the Nasdaq marched on to 5,000 before there was any actual lesson to be learned so we need to swallow our pills and go along for the ride if the Fed is intent on dispensing more psychotropics to keep us all tripping in 2014. While we're tripping, by the way, we can relax and get our brains washed by the Mainstream Media:

Do you think this is funny? This isn't funny, folks – this blatant example caught by Conan is, as he says, frightening. These are the kinds of messages that are placed in the media every day that are aimed at our spouses and our children and our parents – who may be a little more sucsceptible to these Corporate Messages. Everyon worries about the NSA LISTENING to them but no one ever worries about what's being SAID to us. This stuff is supposed to be "news"…

The news is nothing more than a script written by the powers that be as we prepare to celebrate New Year's Eve of 1984+30 and, of course, the so-called "Financial Media" is nothing more than a propaganda machine aimed at whipping viewers into a buying frenzy that retailers can only wish for:

The Daily Show

Actually, he thought as he re-adjusted the Ministry of Plenty's figures, it was not even forgery. It was merely the substitution of one piece of nonsense for another. Most of the material that you were dealing with had no connexion with anything in the real world, not even the kind of connexion that is contained in a direct lie. Statistics were just as much a fantasy in their original version as in their rectified version. - 1984

I almost wish I could be like Winston Smith and just tell people what they want to hear – it's much more profitable to do so! No one likes to hear economic warnings in a booming market and I have resolved in 2014 not to be a Chicken Little and worry about whether or not the sky is going to fall – when it does, it does, and we'll deal with it.

What I will do, since it's an introspective morning, is look back at the last time the markets were this disconnected with reality and review a few of the signs I saw at the time. A lot of it may sound familiar, as I've pointed out similar things this time (which may or may not be different):

Sept 18th, 2007: I think CNBC’s Dylan Ratigan summed it up on Monday when he said: “Holy Crap – take a look at BIDU!” “I might get fired but honestly, look at that chart, it’s the appropriate phrase…” That’s pretty much how we all felt about BIDU and the markets in general as they went ballistic today as "Helicopter Ben" rained his special kind of love on the markets, driving us to the best gains since Greenspan’s October surprise of 2002 when he first decided low interest rates would save a faltering economy.

Sept 21st, 2007: Once we get past a retest of 14,000, there is nothing stopping the dollar from slipping to 75, a 5% drop from here, which means we can see Dow 14,500 before the general rally turns back to a stock picker’s market. 14,500 would mean oil at $86, but at that point we’ll be conditioned to be happy it isn’t $90 and our refining cartel is doing their best to keep gas prices low so the people don’t complain while oil prices go through the roof.

Oct 1st, 2007: I’ve been saying for quite some time that the banks need to step into the confessional box and tell us just how much of the $2 Trillion drop in the value of US housing (so far) they are on the hook for. So far we’ve had a Billion here, a Billion there but the big boys have so far had their heads firmly in the sand and that means it’s time for a kick in the ass.

Since ostriches are herd animals, we can expect one admission to follow the others as banks would always prefer to say "Yeah, I lost money too" AFTER someone else admits it. As usual, we have to look to Europe for leadership and we were on top of this story over the weekend (thank you Richard) as ING announced on Saturday that they would take over accounts at NetBank, WHICH WAS SHUT DOWN BY THE US GOVERNMENT FOLLOWING LOSSES ON "SUBPRIME MORTGAGES AND OTHER LOANS." Gee, wouldn’t you think this should be a more prominent story in the US? Once again the sharpies at the WSJ seemed to miss this one.

Oct 8th, 2007: According to Mr. Murdoch’s Journal (and, sadly, I kid you not): "Most shares made strong gains across the Asian-Pacific region. Hong Kong closed slightly lower on profit-taking pressure after tracking record gains in Shanghai as financial firms played catch-up following a week-long holiday." Ah yes, there’s also something about a bridge they want to sell you in Brooklyn…

What are the odds of a financial publication owned by a Billionaire telling you that stocks and other assets (you know, the kind of things theiir net worth is based on) may not be worth what you think they are? If you want reality of Asian market sentiment, check the FXI, not the WSJ!

Oct 15th, 2007: Commercial paper (which is backed by "troubled" assets), sales of which have fallen off a cliff this past quarter. Companies depend on commercial paper to finance day-to-day expenses like payroll and rent. What exactly is off a cliff you may wonder? Well in Q1 of this year, structured investment vehicles (SIVs) were up at $1.2Tn. Last month, just $900Bn worth of notes were left outstanding as investors ran, not walked away from corporate debt. How many months in a row can we be short $300Bn before someone has to cut back their spending (or, even worse, buybacks)?

October 22nd, 2007: Optrader, dead on with shorting bounces – or at least not taking them too seriously. That’s why I’d rather cover the upside with index calls than run out of our puts right away. Remmeber my general rule of thumb, anything less than a 20% recovery (that would be + 90 points, not + 60 points off another 90 point drop!) is nothing more than a small bounce and does not change the trend at all. If the drop lasted a day, the recovery should come in no more than that time. We have a huge 1 day drop from Friday to make up before we even begin to look at what a recovery from last Monday (Dow 14,100 at the open) would require.

Oct 29th, 2007: Nothing matters until tomorrow at 2:15, when we get the real Fed move and the statement and the reaction to the statement. Meanwhile, we’re getting our perfunctory rally but I’m not feeling the giddy heart we had to it before the last Fed meeting when the band was playing "Happy Days Are Here Again" and Cramer was foaming at the mouth for a cut which was very interesting because he points to Bear Stearns as the warning sign the Fed must act on but then tells us NOT to worry about BSC’s problems spilling over – can you really get away with manipulating both the regulators AND your audience with opposite messages in the same week? Apparently you can!

Is Cramer right or is he wrong about the economy, either way he’ll be able to show you the clip where he called it! I’m not here to bash Cramer, he just happens to be recognizable but this is the kind of BS we are getting from the MSM every single day and it’s no wonder our markets fly up and down 100 points a day like it’s nothing, the signals are confusing and dangerous and we’ve been forced to become momentum traders in order to keep our virtual portfolios moving forward. The only thing buy and hold gets you in this market is an ulcer!

It was pretty much all downhill from there but the popular conception is we crashed in 2008 while, to me, it was already over in late 2007, but that didn't stop the Dow from recovering from 11,800 back to 13,000 in Q2 of 2008 and THEN things got very ugly. Bottom line is, we're certainly not going to be surprised by a downturn, these things take months to unfold, even with repeated shocks like China imploding, Bear Stearns, Lehman, Iceland, Countrywide….

So, while I think it's very important to maintain a strong CASH position, that's no reason not to participate in this ridiculous rally for as long as it lasts. In 1999, the ridiculous rally lasted all year long. TWTR went from $40 to $75 (87%) this month! Who wants to miss out on nonsense like that?

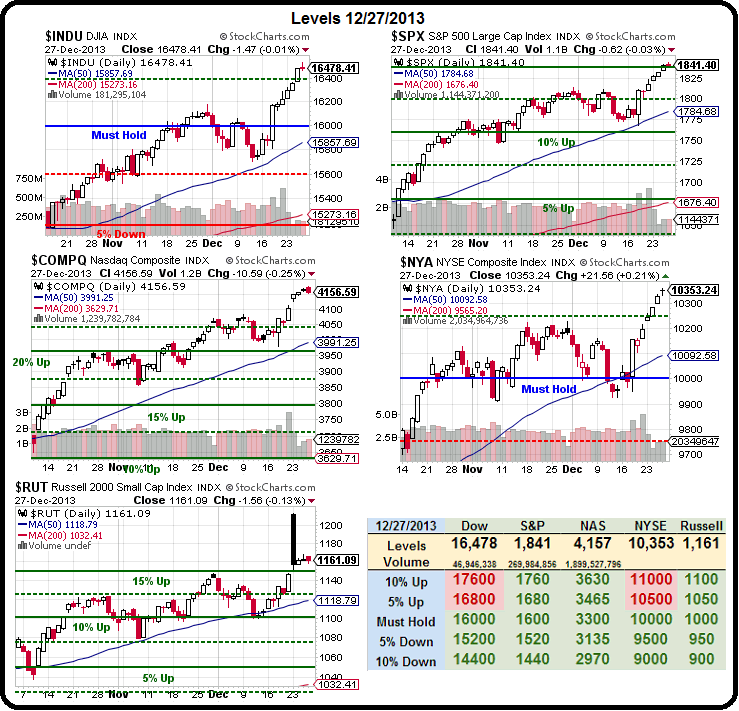

From an index standpoint, we have easy warning lines to watch like Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100 – all very much in the clear now and we'll put new, more aggressive levels on as they move up – so we'll always know when to pull the plug on our long plays.

Should, however, the whole thing fall apart, like it did in 2008 – then that's where we can really shine because, for example, a GOOG June $900 put is only $9 with Google at $1,118. We don't need Google to fall below $891 to make money on that one – a pullback to $1,050 would be enough to double up the put, if it happens by March. If not, of if GOOG goes over $1,200, then we kill it for a 50% loss and maybe we give it another shot for the next 6 months.

That's the way we'll be able to hedge our long plays in 2014, because the mighty now have so far to fall that the rewards for shorting can far outweigh the risks of going long on other hedged positions we may take.

We'll discuss more of this in today's live Webcast at 1pm – Click HERE to register!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.