The Gold Owner's Price Guide for 2014

Commodities / Gold and Silver 2014 Dec 30, 2013 - 04:05 PM GMT "It's tough to make predictions, especially about the future." - Yogi Berra, baseball philosopher

"It's tough to make predictions, especially about the future." - Yogi Berra, baseball philosopher

Since the beginning of gold's bull market in the early 2000s, we have recommended an unambiguous course of action: Own the physical metal -- fully paid for and stored nearby -- then sit back and watch the show.

Part of watching the show is the forecast and prediction festivities that greet each New Year. This year's entries will be of special interest to gold owners coming off the first down year for gold in the past thirteen. As our good friend, James Turk, says further on: "One losing year after 12 winning years is not that bad."

Overall 2013 was a good year for gold despite the price adjustment. Important trends -- like China's domination of the physical gold supply -- gained depth and substance. Germany's repatriation announcement early in the year added additional character to the demand side of the market, and emboldened private investors the world over added weight to their portfolios as the price corrected. In the United States, silver Eagle demand -- a bellwether for precious metals interest -- set an all-time record.

Overall 2013 was a good year for gold despite the price adjustment. Important trends -- like China's domination of the physical gold supply -- gained depth and substance. Germany's repatriation announcement early in the year added additional character to the demand side of the market, and emboldened private investors the world over added weight to their portfolios as the price corrected. In the United States, silver Eagle demand -- a bellwether for precious metals interest -- set an all-time record.

If I could add a prediction of my own for the New Year, it would be that heavy global demand for gold and silver will remain strong no matter what the price does. At the same time, I believe we are going to get back on the upside track this year. Of all the predictions posted below, Scotia Mocatta's comes closest to my own thinking: "For 2014, a return to $1,435/oz would not be too surprising." The last three years have been corrective. . .I look for the next three to be prescriptive, as the foundational elements just mentioned begin to take precedence over the preoccupation with Fed policy, forward guidance, etc. Early in the year, when Janet Yellen sits down to her broad desk at the Marriner Eccles building, she will be faced with a vexing conundrum: How to keep dollar interest rates down when elemental forces in the rest of the world are pushing them up. Another taper tantrum, for better or worse, has already begun (More below). . .and it will likely test the new Fed chairwoman early in her tenure.

Owning gold and watching the show are two well-advised undertakings. Those two courses of action have paid handsome dividends over the years, both in terms of peace of mind and a healthier balance sheet. In fact, in some quarters, that prescription has created significant wealth. At the very least, it has preserved wealth over the past tumultuous decade while other, more complicated courses of action, have fallen short.

That is why armchair economist-gold owners like Mr. Spot -- pictured above in his study -- remains content, confident and assured this New Year's Eve. He does not own gold simply to make profit. He owns it to protect the wealth he has already garnered. He keeps in mind the historical cycle described by Alexander Tyler, the 18th century historian and jurist:

"A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves money from the public treasury. From that moment on the majority always votes for the candidates promising the most money from the public treasury, with the result that a democracy always collapses over loose fiscal policy followed by a dictatorship. The average age of the world's great civilizations has been two hundred years. These nations have progressed through the following sequence: from bondage to spiritual faith, from spiritual faith to great courage, from courage to liberty, from liberty to abundance, from abundance to selfishness, from selfishness to complacency from complacency to apathy, from apathy to dependency, from dependency back to bondage."

He judges that we are now somewhere between the "selfishness" and "dependency" stages of Tyler's cycle, hopes that things will turn around, but keeps his diversification intact just in case it does not. The politicians, he observes, have not acted well this past year. Washington, he says, seems to be confused and lacking direction and more interested, as Tyler suggests, in getting re-elected than making responsible decisions about the future of the country.

He points to Neil Howe's conclusion, revealed this past year, that the Fourth Turning started with the 2008 financial meltdown and that we are likely to be in a transition period for some time to come. He takes Howe's observation to heart: "You are not just into it and out of it immediately. . .It is a season you have to move through before you are born again, so to speak, as a society, and regain institutional confidence. You have go through the crucible to get there."

(Editor's Note: Those of you who have followed my writings over the years know that I consider “The Fourth Turning” (1997) by William Strauss and Neil Howe one of the most important books published over the past two decades. In that book, eleven years before the 2008 meltdown, the authors made one of the most stunning calls of all-time: “The next Fourth Turning,” they predicted, “is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation, and empire.”)

Ever the amateur historian, Mr. Spot takes special note of the drain of Western gold to the East through the London-Zurich-Hong Kong-Shanghai pipeline -- undoubtedly the seminal gold market event of 2013. (The past year, after all, was China's Year of the Snake.) He is aware that a drain of gold from declining cultures to rising cultures usually accompanies the end phases of Tyler's cycle. Gold, he recalls, fled Rome just before the empire collapsed in the third century A.D. and the British Empire began to lose gold following World War I. Though he does not believe the end is nigh, he does believe that gold movements on this scale proceed for good reason. Many years ago, he tacked a sign on the bulletin board above his desk. It reads: "He who owns the gold makes the rules."

We provided Mr. Spot with an advance copy of The Gold Owner's Guide to 2014. In appreciation he sent over the IPhone snapshot posted above and an encouraging note:

"I wholeheartedly approve!"

And so, dear reader, we send you along to our annual catalog of opinion and predictions posted below with our own fondest wishes for a very happy and prosperous 2014.

We shall start with recent predictions posted by the big global trading banks -- the bulls and bears of gold finance.

The Banker Bears

- Goldman Sachs predicts "significant decline" in gold for 2014 – at least a 15% decline.

- UBS lowers 2014 gold forecast to a $1200 per ounce average. "Our expectation for weaker prices by no means suggests a straight path south. The $1200 average forecast reflects the view that the gold market will fluctuate widely as it faces the crosscurrents of an improving macro backdrop, the changing landscape of physical demand and, ultimately, the implications on mine production."

- Analysts at J.P Morgan Cazenove forecasted average gold prices to drop by 10% to $1,263 an ounce for 2014 and by12% to $1,275 for 2015, according to a research note dated Thursday. The New Year will be characterized by tapering and low U.S. inflation, with the downside exacerbated by the re-emergence of producer-price hedging, the analysts said.

- Credit Suisse: "If the gold price were to continue to retreat along its current trajectory, the metal would be trading close to $900 per ounce by the end of 2014."

- Societe General, a member of the London Gold Fix, predicts an average price of $1050 per ounce in the final three months of 2014: "Regardless of the precise timing underpinning our negative view towards gold is that the ultraloose stance of monetary policy is gradually unwound."

- Morgan Stanley says gold will extend losses into 2014 amid speculations the Federal Reserve will pare stimulus. "We recommend staying away from gold at this point in the cycle."

The Banker Bulls

- Scotia Mocatta, a member of the London Gold Fix, says in its lengthy "Precious Metals Forecast 2014": "Given the funds are still net long, there are still many long term investors in ETFs and investment buying in the East is strong, highlights that the bulk of the market has not turned bearish. The next bullish chapter for Gold we think will involve greater monetization of Gold as confidence in fiat money and government paper deteriorates and when that happens we think central banks and investors will end up chasing prices higher. How high prices end up going is difficult to say. In 2008, the market dropped 33 percent, before rallying 180 percent to the 2011 highs. It would require a 63 percent rally from the $1,180/oz lows to get back to the highs, which seems a tall order in the current climate, but it may not be out of the question at some stage in the years ahead. For 2014, a return to $1,435/oz would not be too surprising, but whether prices could then move up above $1,450/oz might be expecting too much. If they did, it would suggest sentiment is turning more bullish. Whether sentiment turns bullish next year, or further down the road is difficult to call, but at some stage given the debt situation we think it will."

- Merrill Lynch forecasts a $1294 average with a rise to $1350 by year-end. It says gold will under-perform silver, but that gold could trade as high as $2000 per ounce by 2016.

- Germany's Commerzbank says gold "will shake off its current weakness" and end the year around $1400 per ounce. "Speculative financial investors have now largely exited the gold market, as evident from the fact that net-long positions are at a seven-year low," it says. "The negative market sentiment towards gold is also reflected in negative media reports and for the most part pessimistic price forecasts. All of this may indicate a rapid reversal of the trend. After the price has successfully bottomed out, gold ETFs should report inflows again from the second quarter, supporting the price recovery." It also says that a pick-up in economic economy will create "stronger industrial demand in 2014."

- Barclays Bank, another member of the London Gold Fix, says gold will average $1350 in the first quarter of 2014 but track back to $1270 per ounce by year-end.

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you are now reading. It's free of charge and comes by e-mail. You can opt out at any time.

Onward. . . . .

"The World Bank and the International Monetary Fund may have written off gold as an investment option but the yellow metal shows no sign of losing its sheen in India. In 2013 not only did gold prices witness an upward march to touch Rs 34,600 per 10 grams, the demand also remained somewhat intact. Steady demand, despite import restrictions, saw gold prices swaying between Rs 26,440 per 10 grams in April to Rs 34,600 per 10 grams in August. 'Gold will always remain an asset class in India. It will never fetch any negative return. Temporarily, there can be some reverses but in the long term it cannot fade away,' Bachharaj Bamalwa, director of the All India Gems and Jewellery Trade Federation, told the Indo-Asian News Service."

-- IndoAsian News Service

"There are always surprises. You will recall that although she hasn't been confirmed by the Senate, Yellen is to take over as the Chairman of the Fed. And every Fed Chairman, not only the ones that I've known over 50 years but the ones that have been there for the full 100 year history, have been tested in their first year by some market event. For Greenspan it was the Crash of 1987, and for Bernanke it was the Great Recession. I'm going to be very interested because we are seeing one possible impact of that already and that is mortgage rates are creeping up -- therefore, mortgage applications have dropped off. We're back to mortgage applications falling to the level they were when Lehman was being deconstructed.

That is a very, very significant indicator. It is more timely than some of the housing sales and a variety of other things. So if we find that the mortgage rates creep up and the mortgage applications continue to fall, the Fed may have to reverse itself with a 'red face' even before it gets started. I think it would be very significant in that people would begin to wonder, 'Is the Fed in any control at all?' If they had to reverse rather quickly, before they even began the taper, then people would wonder, 'How much in control are these people? How much do they know?'"

-- Art Cashin, UBS

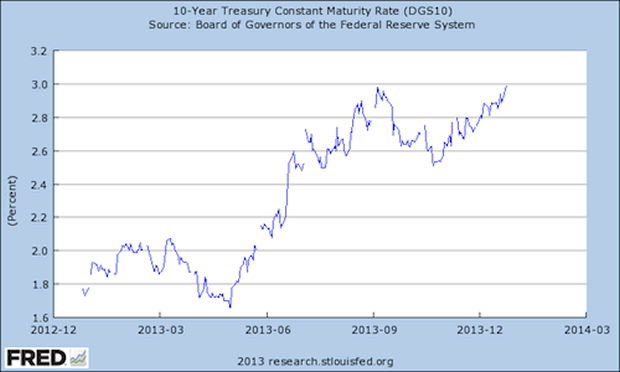

MK Note: Art Cashin raises an important point. The x-factor in Fed policy is the international demand, or lack thereof, for Treasury debt. Alan Greenspan's wanted to raise interest rates and had a difficult time doing it because of foreign purchases of government debt. He called the problem a conundrum. Bernanke, and soon Janet Yellen, want to keep interest rates down, but in the absence of foreign buyers even the hint of reducing Treasury debt purchases sends interest rates hurtling higher as shown below in the ten-year maturity rate chart below -- a bellwether for the bond market. Cashin also has a point when he raises the possiblity that the Fed simply might not understand what is happening in the economy. In a recent Financial Times interview, Alan Greenspan admitted "when I was sitting at the Fed, I would say, 'Does anyone know what is going on?' And the answer was, 'Only in part'. I would ask someone about synthetic derivatives, say, and I would get detailed analysis. But I couldn't tell what was really happening." This is the same Alan Greenspan who said recently that the present stock market is not in a bubble.

Marcus Grubb, Managing Director of Investment at World Gold Council (WGC), stated that gold as an asset class would witness a renaissance in 2014.In his view, ETFs are not always a clear indication of the sentiment and that gold will deliver positive upside surprise in prices next year.

Global gold prices have dropped nearly 30% year-to-date. Exchange Traded Fund (ETF) redemptions during the year stand at nearly 800 tonnes so far this year. However, Grubb argues that it is too easy to bash an asset class when it is battered, but gold will soon shatter the obstacles in its path. Even after the disastrous decline in tonnage in global ETPs, physical ETFs still hold as much as 1,700 tonnes of gold. The Chinese market saw three gold ETFs being launched this year. The trend is likely to continue in 2014 as well.

The net gold purchase by Central banks is likely to reach 400 tonnes by the end of the year, although down when compared to the previous year. According to Marcus, the solitary fact that Central banks continued to remain on buy side in 2013 is a clear indication of their trust in gold's unique value. In fact, all ETF redemptions have been largely absorbed by Central bank demand or strong physical demand from Asian countries.

He further added that gold is a store of wealth that cannot be debased so easily. Right now, the market is getting back to equilibrium. There is potential upside for gold. This could well be a surprise for 2014.

-- Resource Investor

"I believe that coming up we are going to see a fourth devaluation of the dollar against gold. By doing this the US Treasury will overnight have a vastly greater supply of wealth compared with its debt, putting its finances in a much healthier state.

How high might the US re-set the official price of gold? You pick a number -- $5,000, $10,000 or $50,000, but the number should be high enough so that the price of gold won't have to be re-set again in a hurry.

There are two problems with a re-set in the price of gold. (1) The government may decide to confiscate gold from its people. (2) There are arguments regarding how much gold the US Treasury actually owns. There have been no recent audits, and some of our gold may have been loaned out."

-- Richard Russell

MK note: For those concerned with the possibility of a gold confiscation, we recommend that at least 50% of one's gold holdings be in the form of historic, pre-1933 gold coins for reasons outlined here. Rather than numismatic items which trade at very high premiums over the gold price and are not directly correlated to the gold price, we recommend the bullion related category of items which track the price of gold and trade at minimal premiums over their gold content. If you would like to learn more, I recommend you contact your USAGOLD broker. We have detailed information we can pass along.

"When the big bad wolf, also known as the Next Recession or New Depression, hits sometime between 2015 and 2035, these pigs will also be food for the wolf. The third pig builds his house out of tangible assets. These pigs are entrepreneurs and professional investors who study and invest for their own future, investing in real assets, not paper assets. When the big bad wolf comes, in that 20-year window between 2015 and 2035, those who have built houses of "bricks" are likely to get richer. They become richer because they built with bricks, investing in tangible assets such as real estate, gold, silver, oil, food, and businesses they control.

I would definitely avoid paper assets such as stocks, bonds, mutual funds, and ETFs and the reason is these are paper assets, not real assets. Think of the story of the Three Little Pigs: The first pig built his house out of straw, the second pig built his house out of sticks, and the third pig built his house out of bricks. Here's my spin on that story: The first pig represents the poor. Poor people build their house out of paper. They work hard for cash and save cash. Their strategy is to work hard, live below their means, and save money. When the big bad wolf appears, huffing and puffing, these pigs are wolf food. The second pig represents the middle class. They build their houses out of illusions, believing in job security, benefits, owning their home, saving money, and investing in a retirement plan filled with stocks, bonds, mutual funds, and ETFs."

- Richard Kyosaki, Rich Dad, Poor Dad

"There is another reason to look back over the past 13 years, Eric, and view them as one time span: One losing year after 12 winning years is not that bad. Even with 2013 added in, over the last 13 years gold has generated an average annual return greater than 13%. It has been and remains one of the best assets to own, particularly given that neither physical gold nor physical silver has counterparty risk, and just like every other bubble inflated by banks or governments, the 'Money Bubble' will pop too."

-- James Turk, GoldMoney

"I've been to San Francisco with my wife 40 times, and I have never seen the city of San Francisco slower at any time in the past 40 years. I went shopping for Christmas gifts, and normally there would be lines out in the street at some of these places. Instead, I went right in with no wait, made my purchases and went straight to the cashier and paid without waiting.

So there is something strange going on. Everyone is saying the US economy is strengthening, and President Obama was saying today that there could be a real turnaround in 2014. I see all of this as propaganda and outright lies because from what I observed with my own eyes, the bullish talk is patently false.

I don't see the strength in the US economy at all. They just had about the third or fourth upward revision of the 3rd quarter GDP. And now, because the consumer had not been doing well, they cranked up the consumer numbers in the latest adjustment. So I think there is something seriously wrong, and as a result they are falsifying a lot of data in a desperate attempt to try to cover it up. But I strongly believe that the harsh reality will become all too obvious as 2014 unfolds."

-- John Embry, Sprott Asset Management

"There's certainly some Central Bank manipulation. There's some fundamental reasons having to do with what we've been talking about, which is deflation. Gold should go down in a deflation environment initially. But if deflation gets bad enough, the government will make the price of gold go up because they get desperate to create inflation.

If you've tried everything, if you want inflation, and you've tried everything to create it, so you tried money printing, cutting rates, currency wars, Operation Twist, QE, forward guidance, nominal GDP targeting, you've tried everything, you still didn't get the inflation. There's one thing that always works, which is devaluing your currency against gold. So there could come a time when deflation gets so bad that the Fed and the treasury actually raise the price of gold, not to enrich gold investors, but to get close to generalized inflation. Because if gold goes up, silver and oil will go up along with it. It's exactly what happened in 1933. So that's one path. But the other, perhaps more likely path, is that the Fed just keeps printing money and finally succeeds in changing behavior, velocity of the turnover money picks up and inflation goes up on its own. Then gold will race way ahead of that."

-- James Rickards, author, Currency Wars

"The question of Buba's relationship with other central banks still remains open, however one thing we have just learned is the pace at which the German Central Bank has been able to repatriate its gold. It would make a snail proud. Yesterday Buba head Jens Weidmann told Bild that gold valued at €1.1 billion has been repatriated so far. Putting a weight to this number: to date the Bundesbank has received shipments of a paltry 37 tons of gold from its existing storage place in either New York or Paris to Germany: 'The gold reserves of the country will be stored in Frankfurt because it has a special storage with the corresponding equipment,' said Carl-Ludwig Thiele, a Bundesbank board member.

The repatriated amount over the course of all of 2013 represents just over 5% of the total stated target of 700 tons, and is well below the 87.5 tons that the Bundesbank would need to repatriate each year if it were to collected the 700 tons ratably ever year in the 8 year interval between 2013 and 2020.

So the question begs: since the price of gold has tumbled in 2013 (according to many driven in part by the Buba's own demand, which would make procuring gold in the open market for the US and French central banks that much easier for subsequent dispatch to Frankfurt) and one would assume there would be many more sellers than buyers of physical, why would the Bundesbank not be able to obtain a far greater share of the gold? Unless, of course, neither New York nor Paris actually have free, unencumbered physical gold in their possession -with most of it leased out to various even closer 'partners' - and are scrambling to procure as much physical as they can find at the new low, low prices (thank you paper gold ETF dumping).

-- Tyler Durden, ZeroHedge

We see these enormous volumes of gold moving from West to East, sometimes through Switzerland. We saw the disparity in the Bank of England's gold vaulting reports between February and June, where 1,200 tons of gold seemed to disappear. When I asked the Bank of England about that they basically told me to drop dead and they would have no further comment on the matter.

All of this echoes what Kaye [Hong Kong analyst, William Kaye] is saying. We can see these gold outflows from the West, and we can also see the inflows to the East. We don't know exactly when the metal will run out, but we do know we have seen this movie once before. This is exactly what happened when the London Gold Pool was drained. The pool collapsed and there were emergency US Air Force transport flights, according to the Federal Open Market Committee Meeting Minutes, flying gold over from the United States to the Bank of England in 1968. This was at a time when the Bank of England was advancing its own gold into the market on behalf of the United States, in an attempt to hold the gold price at $35 an ounce.

In March of 1968, the outflow of gold had reached hundreds of tons per week. At that point, the nations participating in the London Gold Pool realized they had only a few weeks' worth of gold left at that staggering rate of outflow. So, they closed the London Gold Pool.

The dollar price of gold literally failed at that point. The price of gold was $35 an ounce of gold one day, and the next day there was no price at all because there was no official market. I suspect that either that will happen, and the gold that is available will run out, or more likely the central banks will see what's coming and arrange an international currency revaluation. At that point there will be chaos in the gold and currency markets, but in the end this will mean substantially higher gold after the official reset of the international gold price."

-- Chris Powell, GATA

MK Note: Back in 2008, when the financial system was on the verge of breakdown, Queen Elizabeth asked a now famous question during a visit to the London School of economics: "Why didn't anyone see this coming?"

The answer she got left something to be desired, so apparently she decided to give it another try during a visit this past year to the Bank of England's gold vault. Sujit Kapadia, a member of the BoE's Financial Services Committee, responded by likening the 2008 crisis to an earthquake, saying it was difficult to predict. He also mentioned that "people thought markets were efficient, people thought regulation wasn't necessary." Last, he said, "People didn't realize just how interconnected the banking system had become." "People had got a bit. . .lax, had they?" the Queen asked.

Once again, she had gotten the same standard boilerplate response that was offered up at the time of the 2008 crisis. Perhaps attempting to push for something better and underline the concern expressed by the Queen (and one held by good many others), Prince Philip ventured to ask "Is there another one coming?"

"My sense is that at the present time, the US market is relatively expensive compared to foreign markets, especially to European markets and to emerging markets. On a cyclically-adjusted P/E [price-to-earnings] basis, it is actually going to return very little over the next seven to 10 years. . . 'Given all the money printing that is going on globally – and not just in the US – and given that the total credit as a percent of the advanced economies is now 30% higher than in 2007 before the crisis hit, I think that gold is a good insurance.'"

-- Marc Faber, Gloom, Boom & Doom Report

"First thing you should do is buy some gold coins – or one gold coin I should say – and buy an equal amount of silver coins and that should constitute your financial foundation . . . Bonds remain a triple threat to your capital. With interest rates at all time lows, that means bonds are at all time highs. . .Second thing is that bonds are denominated in paper currencies and those currencies are going to lose value much faster over the next couple of years due to the trillion of units being created by governments," he added. "Third thing is default risk…so bonds are a horrible place for your money, I wouldn't trust them with a 10-foot pole."

-- Doug Casey, Casey Research

"If you're like me, you've bought gold due to the money printing policies of most developed countries and the effect those policies will have on the future purchasing power of our paper money. Probably also because there's no viable way for governments to escape the consequences of all the debt they've piled up. And maybe because politicians can't be trusted to formulate a realistic strategy to avoid any number of monetary, fiscal, or economic crises going forward.

These are valid, core reasons to hold gold in a portfolio at this point in time. But a new trend is under way, and someday soon it will be just as much a driving force for gold prices as anything else: a good old-fashioned supply crunch.

A few metals analysts have mentioned it, but it escapes many and certainly is off the radar of the mainstream financial media. But unless several critical factors reverse course, a supply shortage is on the way with clear implications for the price of gold."

-- Jeff Clark, Casey Research

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.