Death and Taxes: How Inevitable Are They Really?

Politics / Social Issues Dec 31, 2013 - 05:22 PM GMTBy: Don_Miller

With the advent of more and more anti-aging and life-extension R&D in the biotech field—a subject my colleague Alex Daley knows all about—death may not be as inevitable as we think. While I don't believe that I will be among the lucky ones to reach a dainty 200, that feat may very well be achieved within this century. My wife and I have one grandson born in the late 1990s, and his life could span three centuries.

With the advent of more and more anti-aging and life-extension R&D in the biotech field—a subject my colleague Alex Daley knows all about—death may not be as inevitable as we think. While I don't believe that I will be among the lucky ones to reach a dainty 200, that feat may very well be achieved within this century. My wife and I have one grandson born in the late 1990s, and his life could span three centuries.

But I'm not here to talk about death today (though you could view the taxman as another kind of Grim Reaper, reaping what you have sowed).

Taxes clearly are one subject that gets folks' blood pressure up. I got a note from a friend in Canada about a David Letterman top-ten list. This one hits home for a lot of us:

"Only in America ... could the rich people—who pay 86% of all income taxes—be accused of not paying their 'fair share' by people who don't pay any income taxes at all."

What galls many of us is that we're told it is not only our civic duty to pay up—but to pay up with a smile.

A close friend of mine who is a retired federal law enforcement official once clarified the situation this way: he took a sheet of paper, drew a line down the middle, and on the left side put a large capital A, and on the right side a large capital E. (A = Avoidance and E = Evasion.)

"A stands for Avoidance and E for Evasion," he said. "As long as you're on the left side of the page, you're fine."

Considering the trillions of dollars of taxpayer money that Washington and the Fed have generously distributed among their friends and cronies, I think legally minimizing your taxes—and taking advantage of all the avenues available—should be viewed as civic duty too.

Here's my tax tip. When you read it, it sounds kind of "ho hum," but the fact is that only 10% of people with a retirement account take advantage of it.

If it were up to me, I'd make everyone do it, because it can not only make a huge difference in your retirement planning, but also save you a lot in taxes for years to come.

The Easiest Way to Save Taxes

The youngest of the baby boomers are now completing 50 laps around the sun. They are also very aware that the kind of pension plans their parents and grandparents enjoyed are not in their future. In the 1970s, the private sector started to unravel its pension plans and move to a defined contribution plan, which effectively shifts the burden of retirement back to the employee.

Recently, Newsmax ran an article listing the top ten cities with the lowest funding of their pension plans. Government pension plans are soon to follow the path of the private sector; and here, too, the burden of responsibility will rest with the employee. While no one can predict the future 15-20 years down the road, counting on Social Security or a government pension waiting for you in the form it exists in today is a huge risk.

That's why you should take advantage now of the best plans available to save money and taxes. There are different types: IRA, 401(k), 403(b), SEP-IRA—pick your flavor, but the premise is similar for all of them: Save money for your retirement now, and you have a great tax incentive to do so.

Let's look at two of the simple ones. With a traditional IRA, you can contribute $5,500 per year (meaning put the money away and save it). If you're over 50, you can make a catch-up contribution and bump the amount to $6,500. This is assuming you meet the income qualifications and do not have an employer plan. Check with your CPA for the fine print.

If your employer offers a 401(k) plan, you may contribute up to $17,500 per year. Once again, if you're a baby boomer age 50 or older, you can add $5,500 for a maximum contribution of $23,000. Again, check with your CPA for the details.

I'm going to make some conservative assumptions. Tom Smith turned 50 this year and is in the 28% marginal tax bracket. If he has a traditional IRA and maximizes his contribution, he'll save $6,500. That will reduce his 2013 income tax bill by $1,820, so the true out-of-pocket amount is just $4,680. That is less than 5% of his total gross income.

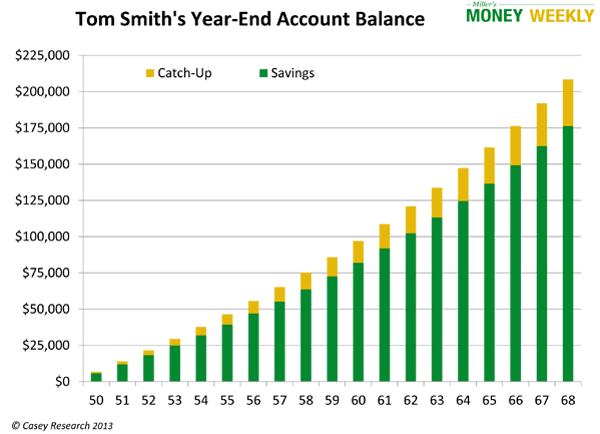

Leaving inflation out of the picture for now, let's assume Tom does this until age 68, investing his money and earning a modest 5%. How much will he accumulate?

His accumulated savings will grow to $176,000, and the catch-up contribution adds an additional $32,000. Tom doesn't have to take money out until he's in his 70s, when he has a required minimum distribution, so he can continue to allow it to compound and grow. At that time, if he's no longer working full time, he hopes to be in a lower tax bracket than he was in his peak earning years.

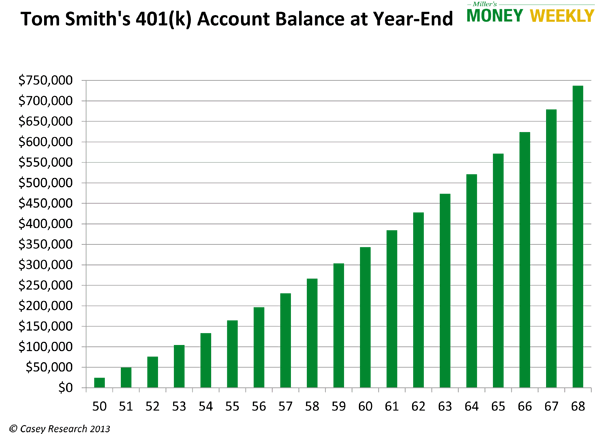

Now let's do the same thing for Tom if he has a 401(k) plan and saves $23,000. He now reduces his 2013 income taxes by $6,440.

Over the 19 years that he'd be putting the money into his 401(k), Tom invests a total of $437,000 that, at a 5% annual interest rate, grows into $738,000 when he turns 68.

If Tom works for the government, he should look into a similar plan for government employees called a "457 plan." The sooner he starts saving, the better.

This is just the foundation. Many companies have some sort of employer-matching provisions. If an employer matches any part of your savings, it's on top of your salary, so it's free money—you just gave yourself a nice raise.

I get many emails from subscribers reminding me that times are tough and they have bills to pay. I understand that fully; the state of the US economy is affecting all of us, regardless of our age. If you can't maximize your contribution today, don't get frustrated: just keep increasing your savings each year, and it will make a world of difference.

Go to the first graph and look at the $1,000 catch-up contribution for Tom this way. If you're in the same situation as Tom, for each additional $1,000 you can save, you'll reduce this year's taxes by $280 and will have an additional $32,000 waiting for you when you're ready to retire and have fun doing the things on your bucket list.

It's your responsibility to save so you can enjoy a good standard of living in your retirement.

What I just described is one easy way that anyone can take advantage of and which helps you accumulate a good-sized nest egg. The more you save, the lower your tax bill.

(If you're among those who think they should not only pay their taxes with a smile but add some extra to help out poor Mr. Obama, there is a website where you can donate to the government—send $5 and sleep tight in the knowledge that you made this country a better place.)

I'm not kidding: According to Yahoo, in 2009 the federal government received over $3 million in voluntary contributions. We know they'll spend it wisely…

Pay the taxes you owe and no more. Don't listen to the "fair share" people who want your hard-earned money; you're part of the working class. When you get to the end of the line, you'll be independent and won't have to worry about being a burden on your family or the government. Everyone wins!

There are a number of ways you can increase the amount you save each year. In the case of a traditional IRA, if it isn't as big as you would like (compared to the total value of all your investments), there is a way to increase its size by it effectively absorbing assets you already own. You can learn how to do just that in our Yield Book special report.

There's much more valuable information for you in The Yield Book, including annuities, how to legally shelter interest income, four things you must look at before buying any dividend-paying stock and much more.

With The Yield Book, you'll be armed with a variety of strategies that will help you make far more yield than you can with typical investments. Click here to download your copy of The Yield Book today.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.