Bitcoin 2014 Bubble Collapse or Dollar Alternative?

Currencies / Bitcoin Jan 07, 2014 - 05:04 AM GMTBy: Clif_Droke

Is it a bubble or mania destined for collapse? Or can it beat the odds and become a viable alternative to the dollar?

Is it a bubble or mania destined for collapse? Or can it beat the odds and become a viable alternative to the dollar?

That’s what many are wondering about Bitcoin, the electronic currency which has captured the Internet world’s imagination. Many observers have dismissed the e-currency as a passing fad – a flash in the pan destined to suffer the same fate as break dancing and Beanie Babies. This conclusion is far too simplistic, however. Due to the complexities of the new currency the Bitcoin issue demands a deeper analysis.

Looking beyond the rhetoric yields a complex series of possibilities for Bitcoin’s future. Let’s start with the most glaring observation, namely the e-currency’s lofty valuation. At its current level, Bitcoin is unquestionably too pricey to be considered as a legitimate alternative to the dollar. The average American quite simply can’t afford to own Bitcoins, and few are technologically savvy enough to “mine” them. This is one major obstacle standing in the way of Bitcoin’s widespread acceptance.

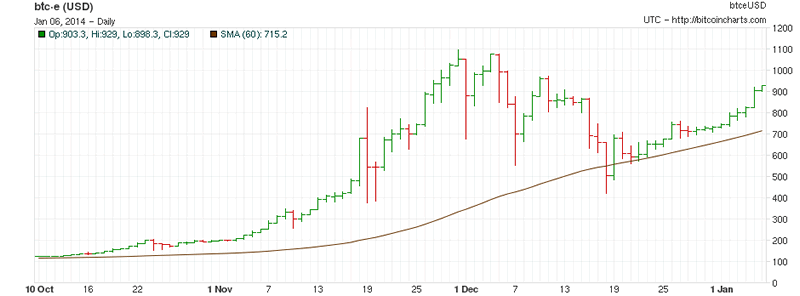

Bitcoin’s ride to stratospheric levels over the past year is reminiscent of the speculative bubble in the gold market – a bubble which eventually imploded and scared away multitudes of investors. Runaway speculation caused its price to soar from $140 to $266 in only four days in April 2013, only to erase most of those gains a few days later. In October and November Bitcoin’s value went parabolic, far exceeding the April run-up. This in turn was followed by a sharp decline in December, followed by another recovery rally (see chart below). Most recently one Bitcoin was quoted as being worth $842.

It stands to reason that any commodity (or potential currency) which is subject to excessive speculation and wild volatility will never succeed in supplanting the dollar as a primary medium of exchange. There must be relative stability before buyers and sellers will consider using Bitcoin as an everyday method of payment. To that end a collapse in Bitcoin’s value would go a long way in paving the way toward this end. But a deflation in Bitcoin’s value alone won’t secure its future as a viable currency. Once Bitcoin has returned to a reasonable level the speculative element must be largely – if not entirely – eliminated to ensure that it doesn’t suffer a similar fate in the future.

“For all its weird politics and bad press,” writes David Wolman in the November issue of Wired, “Bitcoin may just be the most ingenious system ever created for settling online transactions. Done right, it could put small ecommerce sites on a level playing field with the likes of Amazon and Apple.” He urges us to “commandeer it from the radicals and make it work for the rest of us.”

To circumvent the volatility factor, Wolman proposes that individuals make it a habit to not hold Bitcoins very long and to convert them only when making an online transaction. To this end, a San Francisco-based startup called Coinbase is offering merchants free conversion from Bitcoin into other currencies. This allows vendors to accept Bitcoins as payment without having to maintain a cash register full of them.

Admittedly any proposal based on self-restraint is likely to fall far short of taming Bitcoin’s extreme volatility. To that end, more extreme measures have been proposed to decrease volatility and thereby make the e-currency more attractive as a mainstream medium of exchange. A group called the Digital Asset Transfer Authority is trying to establish guidelines for digital currencies such as Bitcoin. E-currency advocates have even suggested the creation of a central authority to intervene when price fluctuations become too extreme. Much of Bitcoin’s wild volatility is undoubtedly due to the fact that it hasn’t yet achieved the critical mass of widespread acceptance. Venture capitalist Chris Dixon believes that everyday mainstream use of Bitcoin would help diminish the price oscillations.

“This currency, like all currencies,” concludes Wolman, “needs to inspire trust to succeed.” He suggests that centralization is required to tamp down on Bitcoin’s volatility problem, a suggestion that will no doubt rankle the die-hard members of the e-currency community.

For owners of Bitcoin concerned with a possible loss of value, a more practical safeguard is in order. Consider using a basic “stop loss” exit system based on a retro-fitted moving average. An example would be the simple 60-day moving average, which has captured most of Bitcoin’s intermediate-term turning points over the years of its existence. A 2-day close below the 60-day MA is a good rule of thumb for exiting Bitcoin in anticipation of additional volatility. As long as Bitcoin stays above the rising 60-day MA, however, its dominant interim trend should be considered up.

As I concluded in my Dec. 18 commentary on Bitcoin, chart pattern analysis suggests there is more upside in the coin’s future before the bull market in its value comes to an end. The breakout to new highs in Bitcoin’s price which occurred in November was preceded by six months of base-building. In classical chart analysis this is normally a good indication of additional upside ahead.

Beyond the near-term outlook is anyone’s guess. Bitcoin will likely suffer the same fate as every speculative craze, namely eventual price deflation culminating in a crash in value. The suspicion is that this will occur sometime before the end of 2014 while the long-term Kress cycles are bottoming. The true test to the new coin’s value will in fact occur after a cataclysmic setback, for that will determine whether the public is willing to embrace a currency subject to extreme fluctuations. It will also determine if the public is willing to risk capital in what may or may not be a safe store of value relative to the dollar.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.